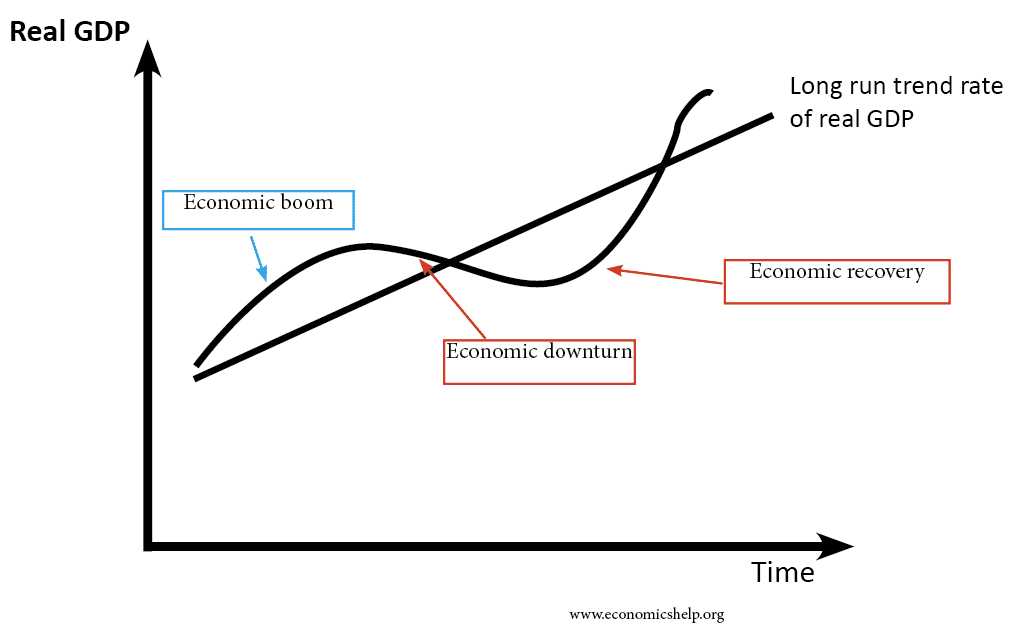

The economic trade cycle shows how economic growth can fluctuate within different phases, for example:

- Boom (which is a period of high economic growth possibly causing inflation)

- Peak (top of trade cycle, where growth rates may start to fall)

- Economic downturn/Recession ( where the growth rate falls and may become negative – leading to a fall in national output)

- Economic recovery (economic growth becomes positive and growth rates pick up.)

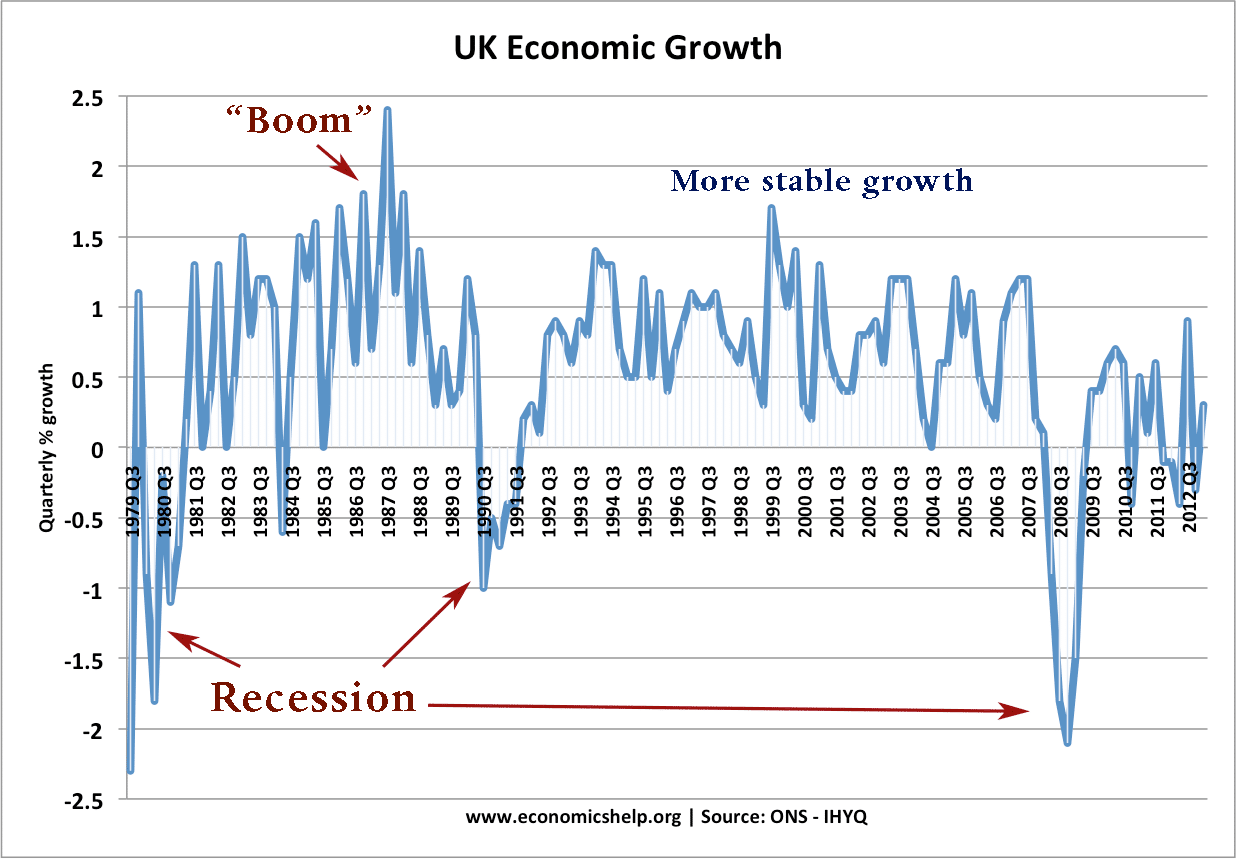

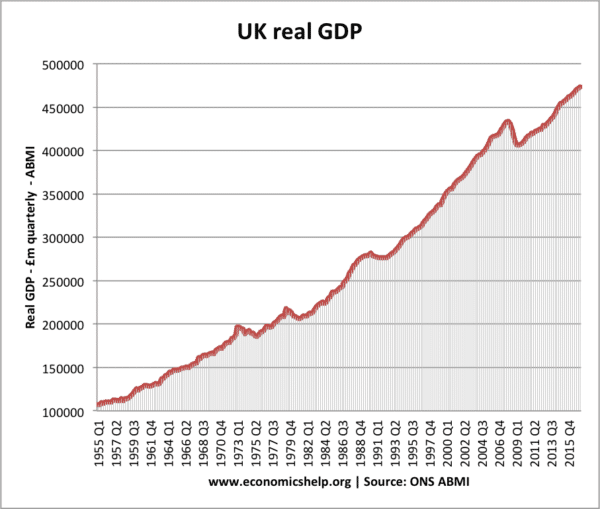

Quarterly Economic Growth in the UK

The late 1980s saw an economic boom, with quarterly growth reaching over 2%. This was followed by recession of 1990-91

Causes of economic trade cycle

- Momentum effect. When there is positive economic growth, this tends to cause:

- A rise in consumer and business confidence

- With economic growth, banks are more willing to lend, increasing investment.

- Rising asset prices such as houses; this causes a rise in wealth and consumer spending. The higher economic growth increases incomes and causes more demand for housing

- Accelerator theory of investment. This suggests investment depends on the rate of change of economic growth. An improved growth rate leads to higher investment.

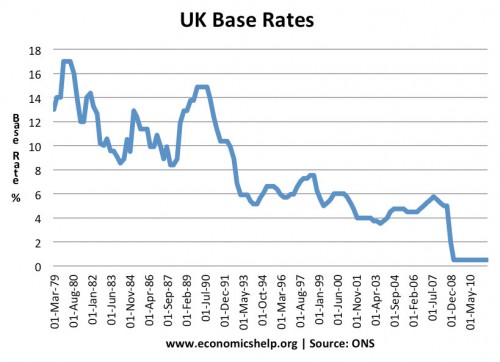

UK base rates increased in 1989/90 caused the economic slowdown.

UK base rates increased in 1989/90 caused the economic slowdown.

- Interest rate changes. When there is higher economic growth, inflation tends to rise. In response, Central Banks tend to increase interest rates to reduce growth and inflation. High-interest rates in 1990-92 were an important cause of bringing the economic downturn. High-interest rates made mortgages expensive, reducing disposable income and causing a rise in home-repossession rates.

- Technology. Improvements in technology may cause a boost in economic growth. A lull in technological innovation may cause slower growth.

- Political Business cycle. Some economists suggest that there is a political business cycle. This is when politicians try to have a boom (high economic growth) before an election to help win the election. Since 1997, UK monetary policy has been given to the independent Bank of England with a remit of keeping inflation at 2%

- Global Trade Cycle. A global economic downturn will tend to affect individual economies. The recession of 2008/09 occurred in all major global economies.

Impact of the trade cycle

Fluctuations in economic growth have an important influence on other macroeconomic variables.

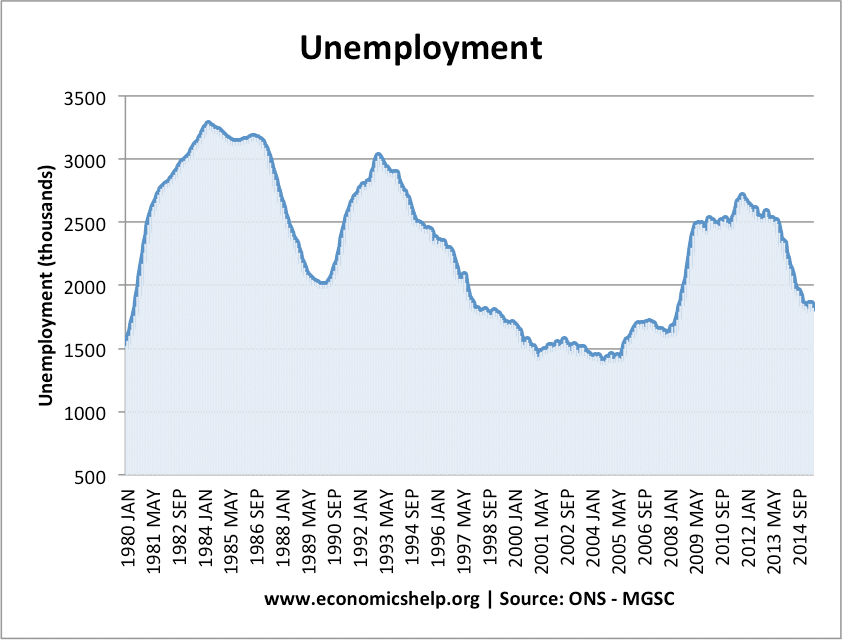

Unemployment –

In recession (1981,1991, 2009), we see a sharp rise in demand-deficient unemployment

Inflation

– In a recession, the inflation rate tends to fall. With rapid economic growth, we tend to get demand-pull inflation

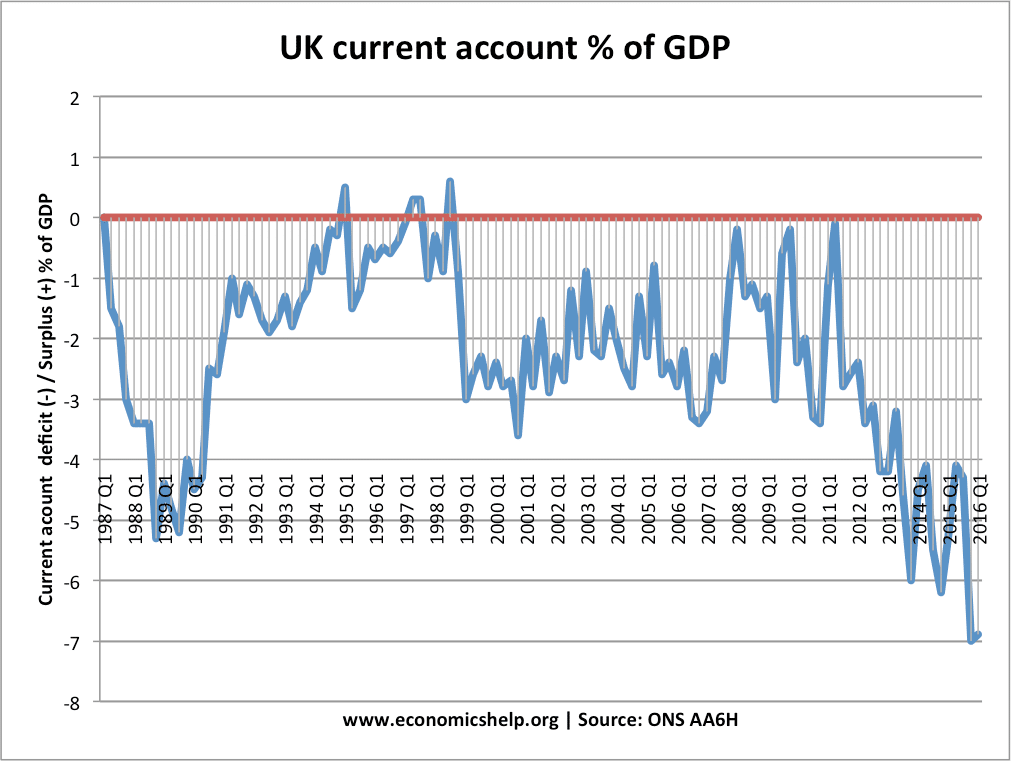

Current account on balance of payments

– In a period of rapid economic growth and rising consumer spending, we tend to get a rise in imports which causes a deterioration in the current account.

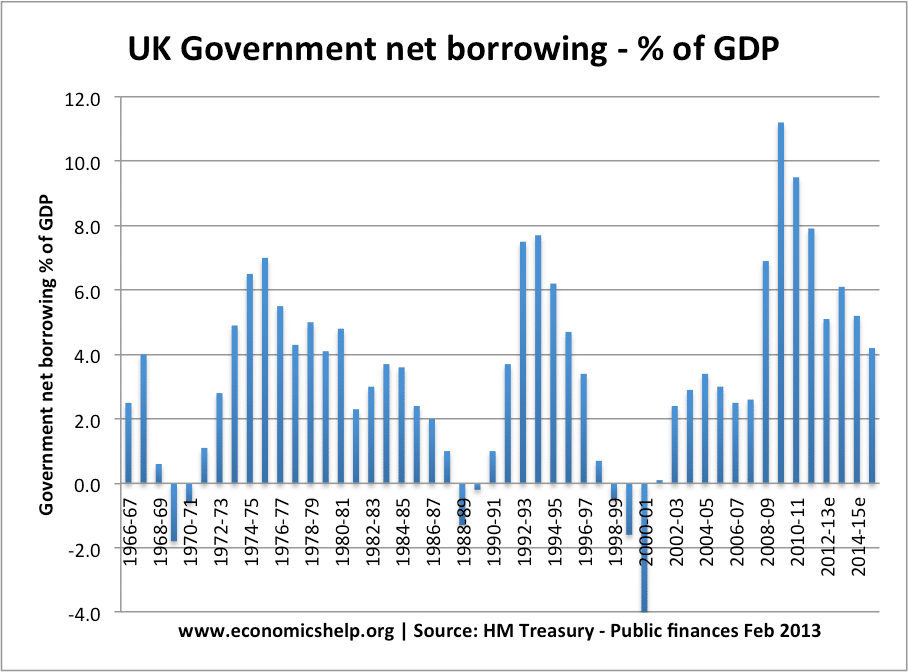

Government finances

In a recession, government finances tend to deteriorate leading to a larger budget deficit.

This is because in a recession:

- Tax revenues fall. Less spending – less VAT. Lower incomes – lower income tax.

- Higher welfare spending, e.g. unemployment benefits.

Influencing the Trade Cycle

Some economists feel that there is an inevitability of a trade cycle and the government cannot influence and prevent recessions. However, other economists (such as Keynesians) argue that government intervention can help overcome recessions.

For example, in an economic downturn, the government can pursue

- Expansionary fiscal policy – Higher government spending and/or lower taxes financed by borrowing. This should provide an economic stimulus.

- Also, the Central Bank can provide monetary easing – lower interest rates and/or increasing the money supply.

Between 1997 and 2007 the trade cycle was more stable in the UK. However, the global financial crisis pushed the UK economy into recession during 2008/09.

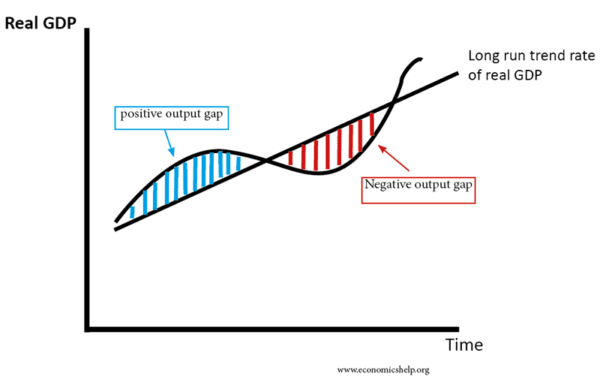

Output Gap

- If economic growth is slow and actual output grows slower than potential – there will be an increase in spare capacity. This will cause a negative output gap.

- With fast economic growth and increases in AD then the output gap gets smaller and can become a positive output gap.

The Long Run Trend Rate of Economic Growth

The long-run trend rate refers to the average sustainable rate of economic growth in an economy. For example, in the UK this is about 2.5%. This depends on the growth of AS and productive capacity.

Related