The UK recession of 1991 was primarily caused by high-interest rates, falling house prices and an overvalued exchange rate. Membership of the Exchange Rate Mechanism (1990-1992) was a key factor in keeping interest rates higher than desirable.

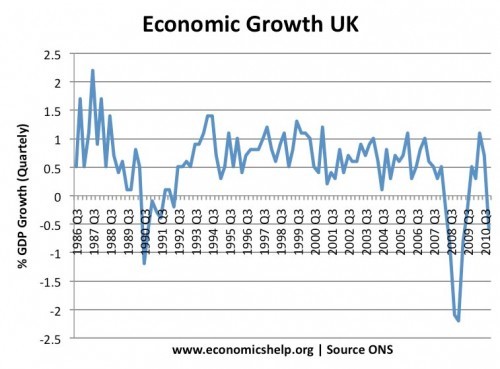

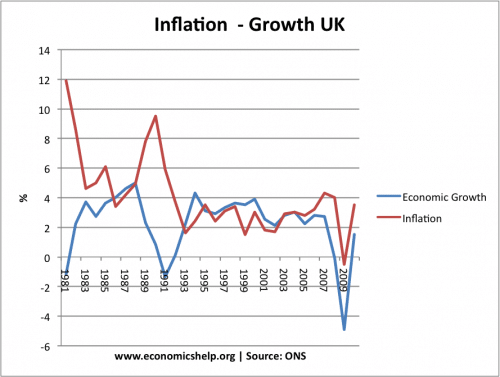

The recession also came after the late 1980s economic boom – a period of high economic growth and rising inflation.

The Lawson Boom – Background to Recession

During the 1980s the government allowed the economy to expand at a significantly higher rate than its long-run trend growth rate. This was because they felt there had been a “supply side miracle”. They argued that its supply-side policies enabled the economy to grow at a faster rate than before.

During the 1980s, the government kept interest rates low and cut income tax, especially for high earners. This helped increase consumer spending. Also, during the 1980s, there was a boom in the housing market. The rapid increase in house prices led to an increase in consumer wealth and consumer spending. There was a big increase in consumer confidence.

Unfortunately, it proved over-optimistic that the economy experienced a supply side miracle; most of the economic growth was caused by consumer borrowing and spending. This was reflected in a large current account deficit and growing inflation.

The effect of growth above the long run trend rate was to cause inflation and a large current account deficit.

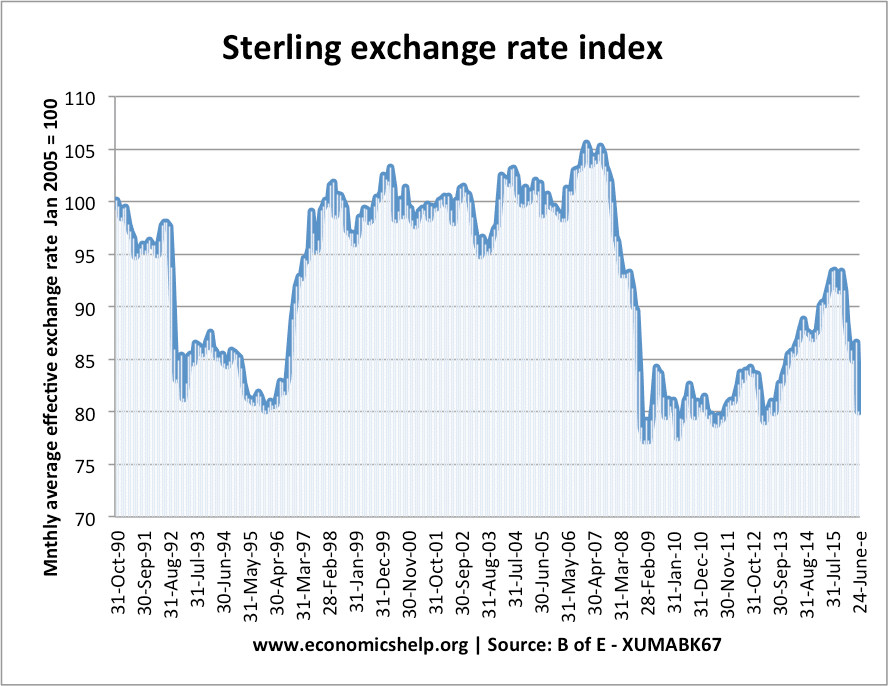

Exchange Rate Mechanism 1990-92

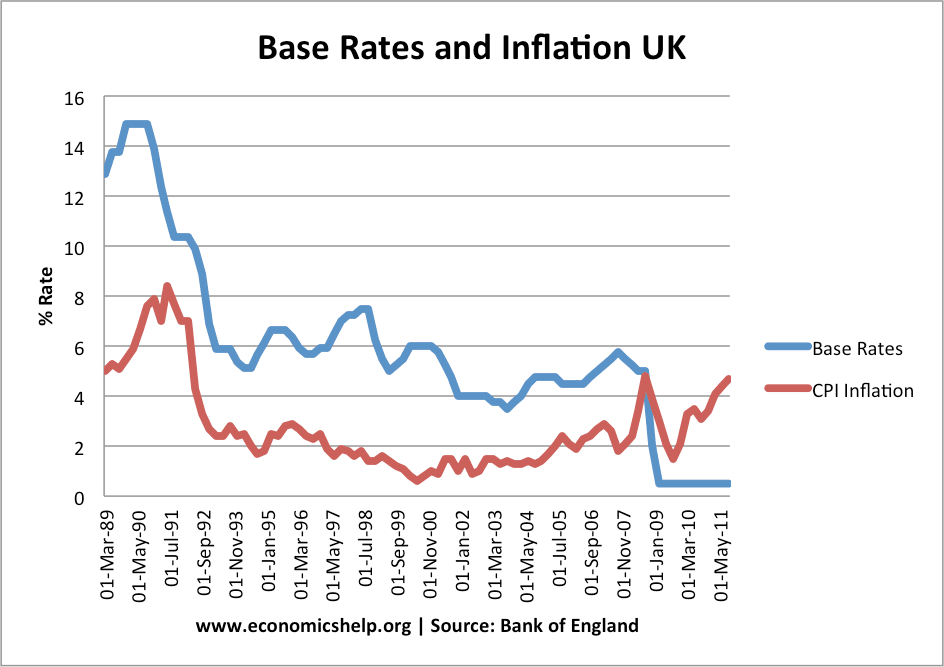

To reduce the high inflation, the government joined the Exchange Rate Mechanism in 1990, it was felt that by joining, inflation would be brought under control.

However, as the UK joined the ERM, the economy began to slow down, and it soon became difficult to keep the value of the Pound at its exchange rate target against the DM.

To maintain the value of Sterling the government had to:

- Use its foreign currency reserves to buy sterling (the UK lost an estimated £3.5 – £21bn in the ERM)

- Increase interest rates. In September 1992, interest rates were 10%, despite the economy being in recession. The government even increased rates further to 12% and even temporarily 15% in an effort to protect the value of Sterling.

- But, investors correctly predicted that these interest rates were unsustainable. The high-interest rates made mortgage payments very expensive, and many homeowners saw a fall in disposable income, leading to lower spending.

Despite these measures to prop up Sterling, the speculators were stronger than the government and the UK was forced to leave the ERM and devalue. After Black Wednesday on 16th September 1992, the UK government finally left the ERM and the Pound devalued 20% – indicating how much it was overvalued.

High Interest Rates Major Cause of Recession

High interest rates in 1991-92:

- Caused a rise in borrowing costs, and a rise in mortgage interest payments. This reduced consumer disposable income leading to spending and a fall in aggregate demand.

- Caused a fall in house prices as many people couldn’t afford their mortgage payments. This fall in house prices reduced household wealth and AD further.

- Many people who had borrowed money in the 1980s now faced very high interest rates

- Confidence fell sharply.

One consequence of this recession was to eventually give the MPC of the Bank of England control over setting interest rates. The hope was that an independent Bank of England would prove more adept at avoiding boom and bust economic cycles.

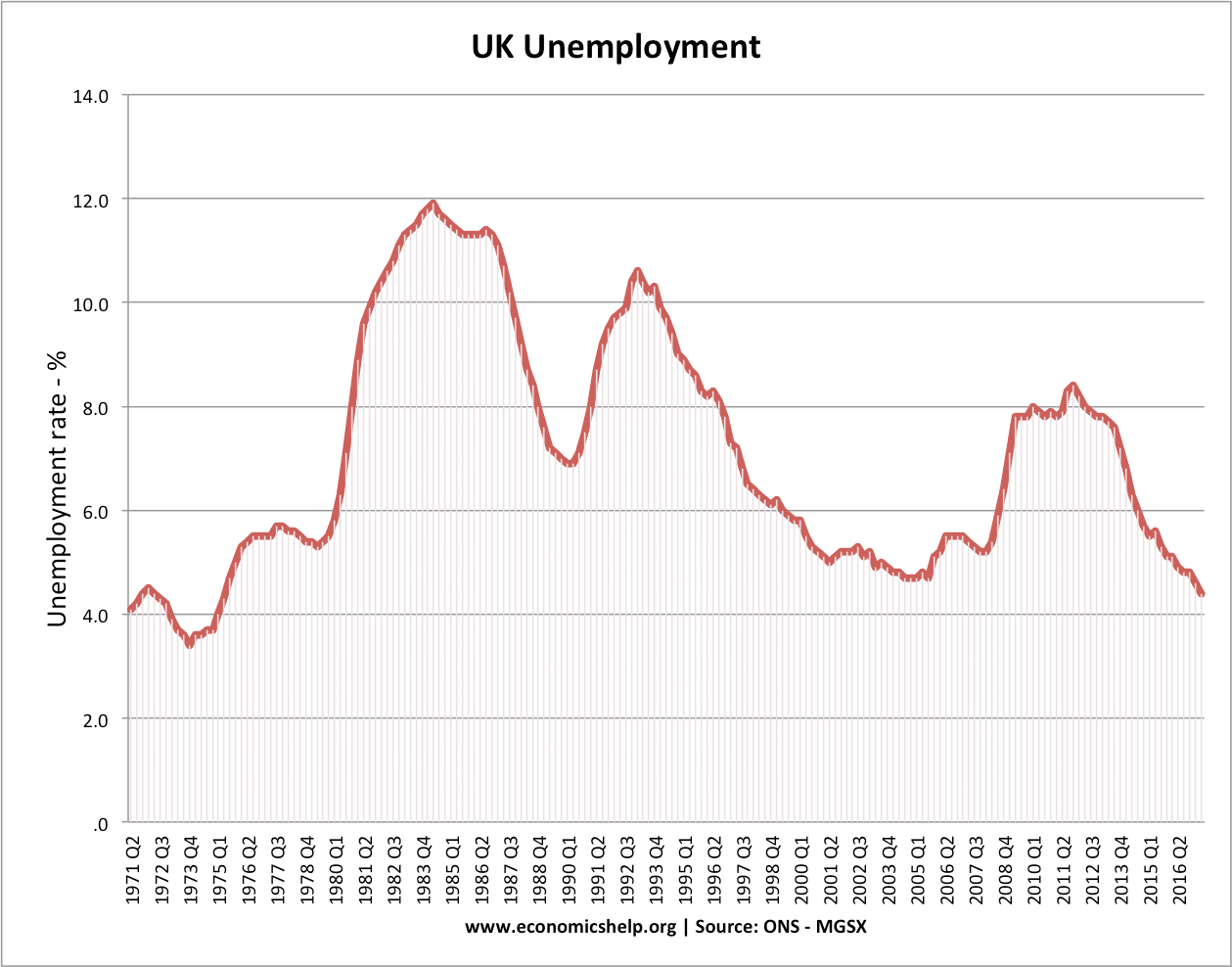

Unemployment in 1992 recession

Unemployment rose to over 10% in 1992

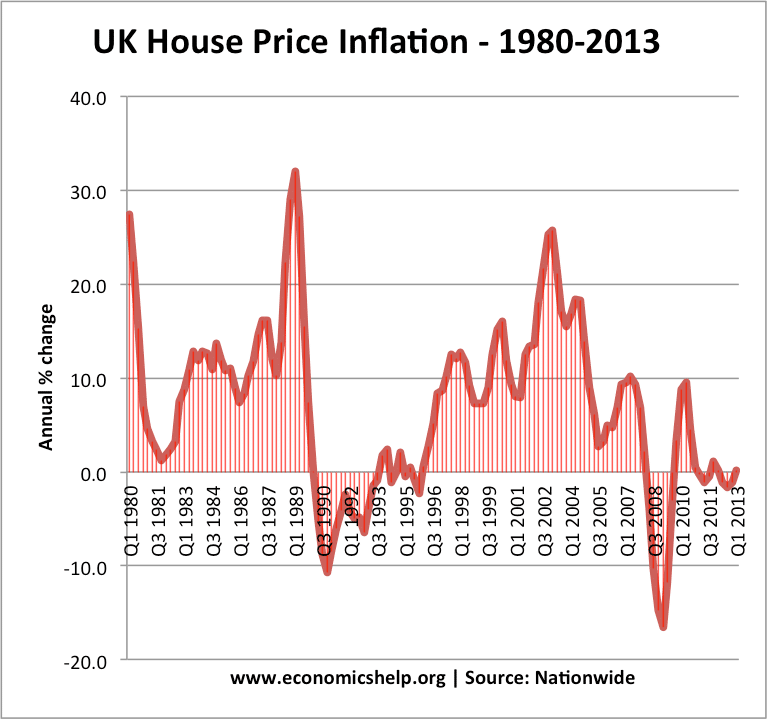

House prices in 1991 recession

In the late 1980s, the housing market was surging – especially in London and the South East. However, the high-interest rates and fall in confidence caused a significant fall in house prices. In 1990, house prices were falling by 10% as home repossession rates rose.

This caused a negative wealth effect and a fall in consumer spending, which added to the deflationary impact.

Related

1 thought on “UK Recession of 1991-92”

Comments are closed.