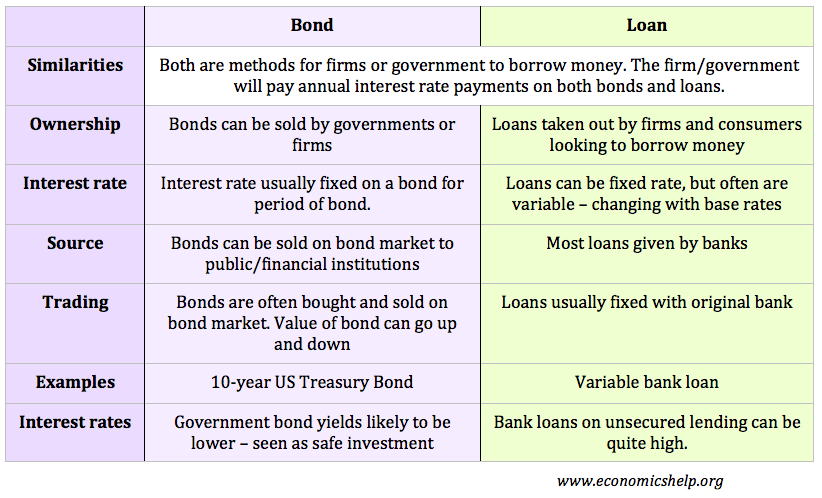

- A bond is a type of debt instrument. It is a way for a company or government to raise money by selling, in effect, IOUs – with annual interest payments.

- A loan is also a debt instrument, usually provided by a private bank with a variable interest rate.

They are both methods of borrowing money, but with some differences.

Bonds work by firms selling a bond for say £1,000. In return, the firm agrees to pay back the bond in 10, 20 or 30 years time. In the meantime, the government/firm will pay interest on this bond of say 5%. The purchaser of the bond gives the firm £1,000 and in return gets interest payments for the duration of the bond term.

Tradable nature

The main difference between a bond and loan is that a bond is highly tradeable. If you buy a bond, there is usually a market where you can trade bonds. This means you can sell the bond, rather than wait until the end of the 30 year period. In practice, people buy bonds when they wish to increase their portfolio in that way. Loans tend to be agreements between banks and customers. Loans are usually non-tradeable, and the bank is obliged to see out the term of the loan.

Interest rates

Interest rates on government bonds are usually lower. US and UK Government bonds are seen as low-risk. Private loans on unsecured debt are likely to attract higher interest. Corporate bonds are usually somewhere in between – depending on the reputation of the firm.

Repayment

Bonds tend to be only repaid in full at the end of the period – e.g. 10, 20 or 30 years. Banks may expect repayment of both interest and principal during the repayment period.

Related

Re Tradable nature: It should be noted that most large commercial loans are not fixed with the original lender, but are syndicated to several other banks at after initial arrangement in order to reduce exposure.

The loan is often further traded on the secondary market to banks, funds, and other institutional investors, in what is a $600bn volume market.

Corporate Loans are rarely bilateral as stated in the article – the risk exposure is often too great for one bank to hold. As Loan Trader states above, most are syndicated, and exposure further managed on the active secondary market. Distressed loans are also traded, restructured, and sold off or go to claims.

The main difference between loans and bonds is the flexibility that loans offer the issuer.