A reader on twitter asked – How has government borrowing helped me recently?

I’m tempted to paraphrase as – What has borrowing ever done for me? – just so that I can make a reference to Monty Python and the Life of Brian? – And what have the Romans ever done for us? – apart from education, sewers, wine, roads, peace, law and order … (youtube)

I’ve answered this question several times before:

But, I frequently get asked it, so here’s a few more ideas.

Why do we need to be in debt at all?

Surely all the money in interest (some £50bn pa?) would be better spent on ourselves as a country?

It is true that the government spends around £50bn a year on interest payments. (and forecast to rise) But, those interest payments enable higher government spending now.

We could reduce the amount of interest payments by raising taxes / cutting spending. But, it wouldn’t make us better off. It would just change how we finance current spending.

Also, who do those interest payments go to – primarily UK individuals/UK pension funds. You can think of it as a transfer payment to people within a country.

You could argue that it is a transfer payment from the average taxpayer to people with pension funds / city financiers – who are likely to be better off. But, more people with private pensions may benefit from government interest payments than they realise.

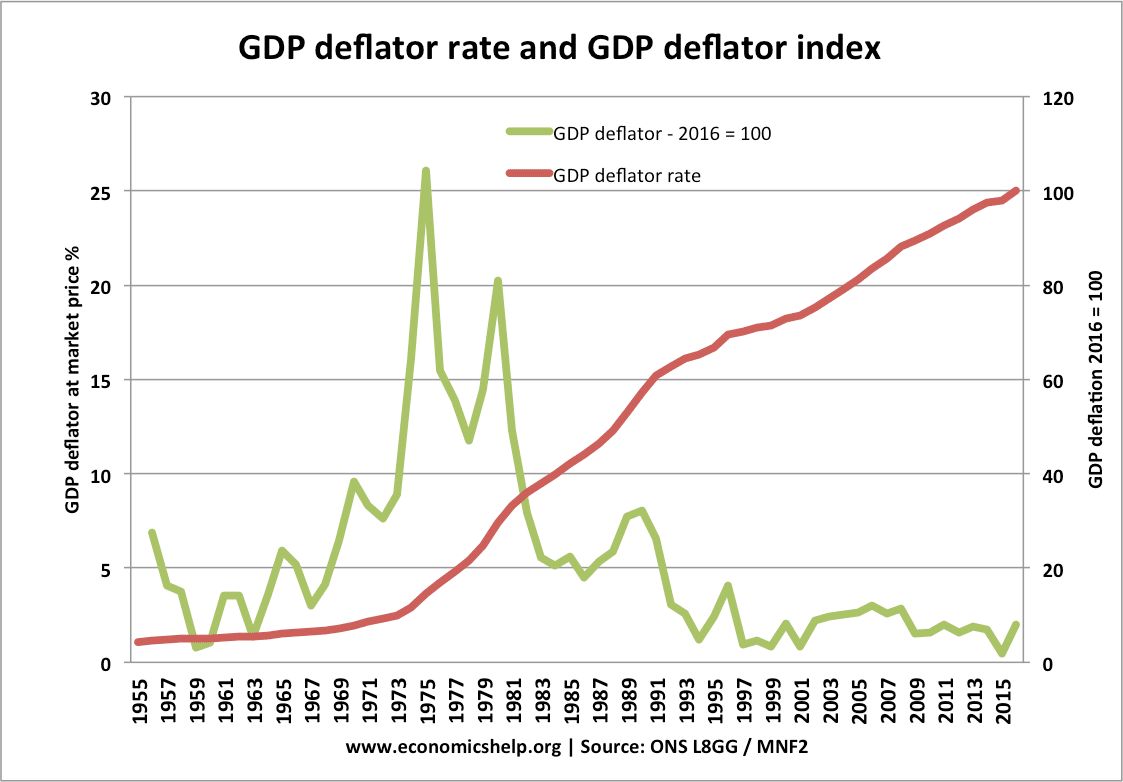

Interest rates are also very low, which means interest payments on government debt are quite a small percentage of GDP. (3%)

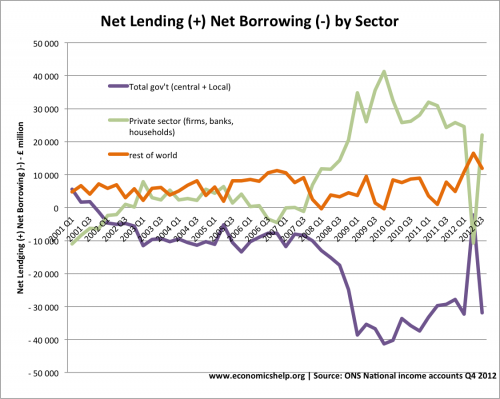

Use of private sector saving

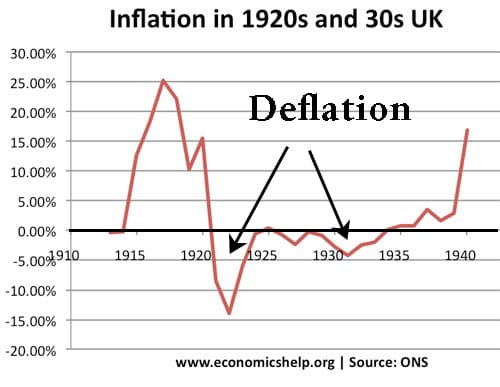

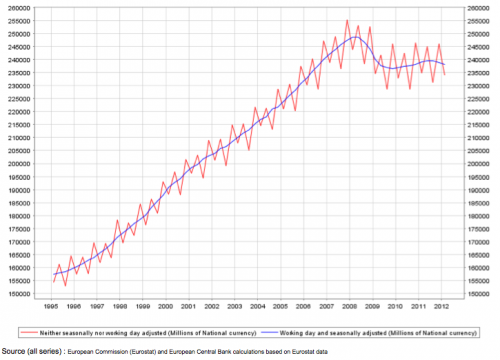

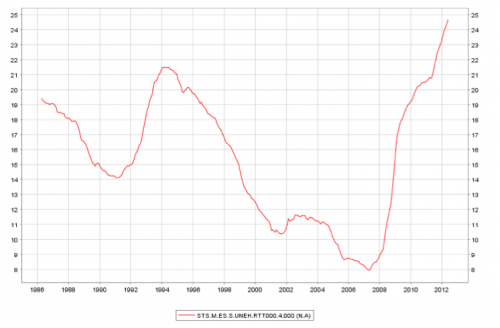

In the great recession, there was a rapid rise in private sector saving. This was money not used, but just saved and unproductive.

If the government borrowed nothing, these resources would remain idle, aggregate demand would be lower and the recession deeper. Through government borrowing, we made use of this surplus savings and helped to stabilise the economy. (recession not as deep)