Definition of devaluation and depreciation

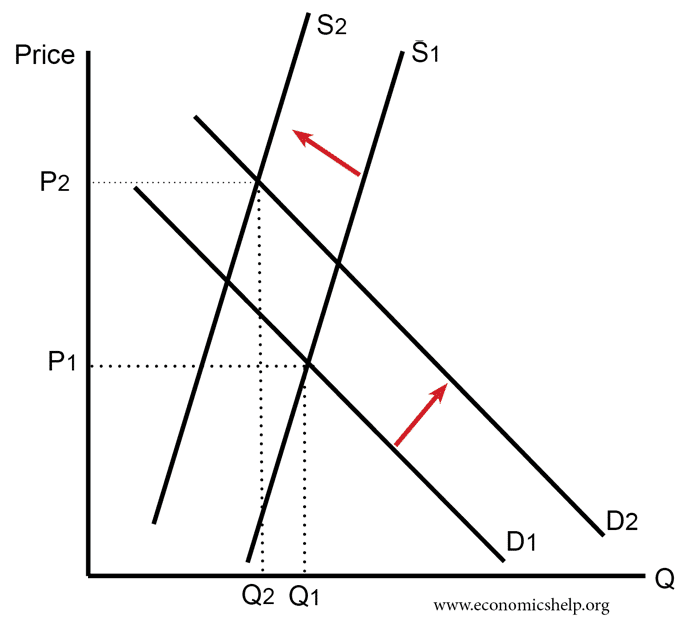

- A devaluation occurs when a country makes a conscious decision to lower its exchange rate in a fixed or semi-fixed exchange rate.

- A depreciation is when there is a fall in the value of a currency in a floating exchange rate.

In general, everyday use, devaluation and depreciation are often used interchangeably. They both have the same effect – a fall in the value of the currency which makes imports more expensive, and exports more competitive.

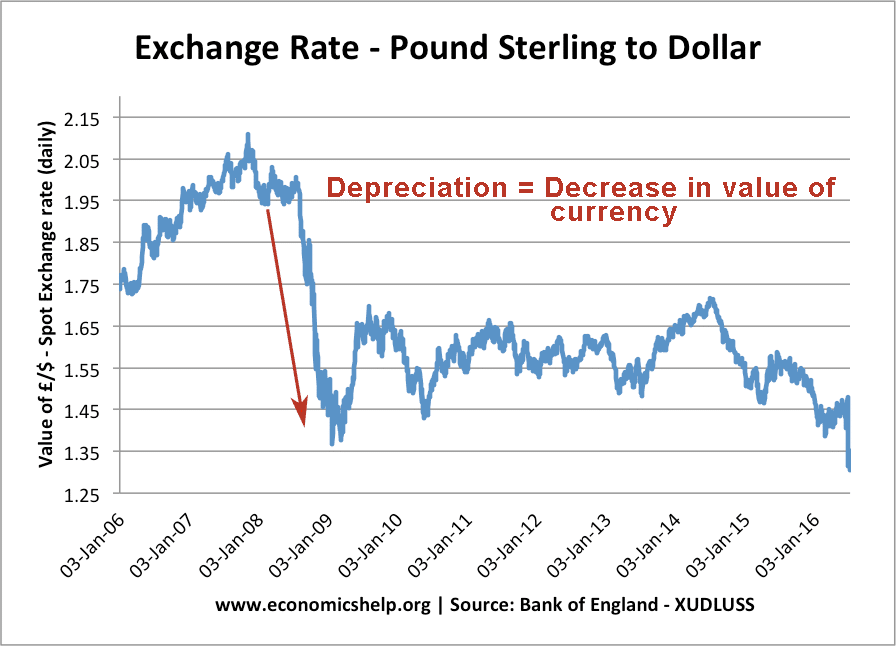

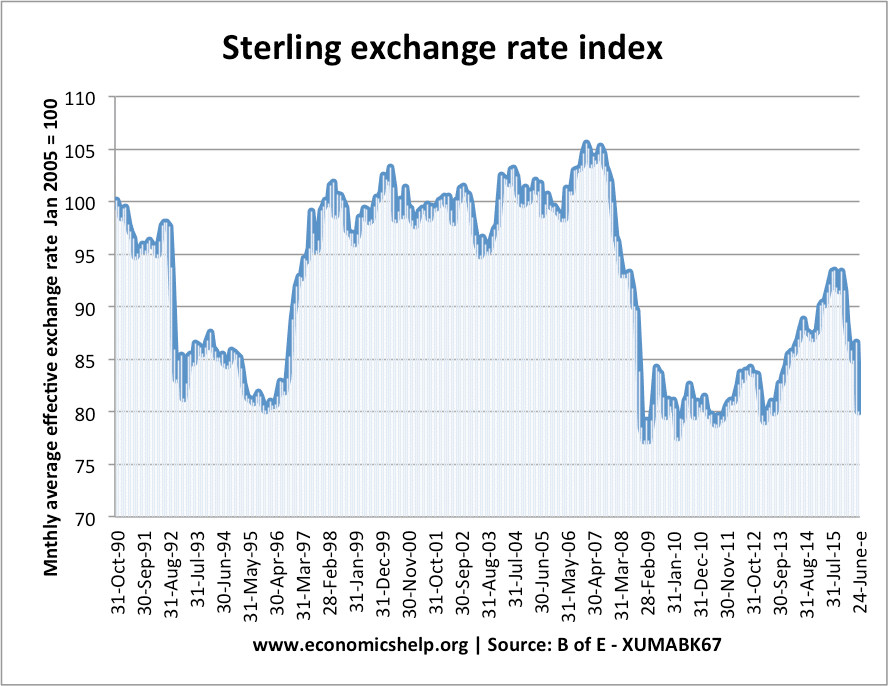

In 2008, the Pound Sterling fell in value by 30%. The correct term is a depreciation because the Pound Sterling was a floating currency. (no fixed exchange rate.)

- For A-Level economics, it is not absolutely essential to distinguish between the two, but there is a distinct technical difference and using them correctly is good practice.

- Essentially devaluation is changing the value of a currency in a fixed exchange rate. A depreciation is reducing the value in a floating exchange rate.

Definition of Devaluation

A devaluation is when a country makes a conscious decision to lower its exchange rate in a fixed or semi-fixed exchange rate. Therefore, technically a devaluation is only possible if a country is a member of some fixed exchange rate policy.

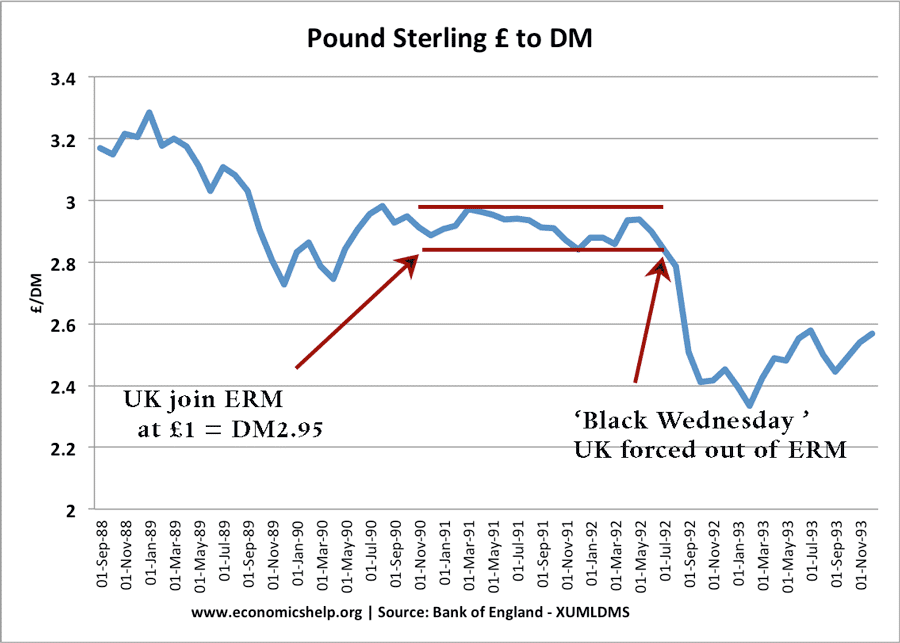

- For example in the late 1980s, the UK joined the Exchange Rate Mechanism ERM. Initially, the value of the Pound was set between say 3DM and 3.2DM.

- However, if the government thought that was too high, they could make the decision to devalue and change the target exchange rate to 2.7DM and 2.9DM. In 1992, they left ERM as they couldn’t maintain the value of Pound.