In theory, there is a strong link between the money supply and inflation. If the money supply rises faster than real output, then prices will usually rise. This means if a Central Bank prints more money, we will often (though not always!) get higher inflation.

Explanation of why increased money supply causes inflation

- The money supply is the amount of money in circulation. This includes notes and coins and bank deposits.

- If the government printed more money, then there would be an increase in cash in the economy. Households would have more money and so their demand for goods and services would rise. With more cash, we wish to buy more goods.

- However, if the amount of goods for sale, remained the same, then firms would see a big rise in demand for this limited supply and so would respond to the higher demand by increasing prices.

- Therefore, increasing the money supply faster than the growth in real output will cause inflation. The reason is that there is more money chasing the same number of goods. Therefore, the increase in monetary demand causes firms to put up prices.

Video explanation

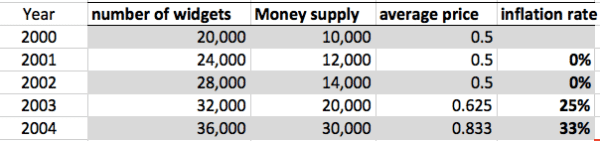

Example of money supply and inflation

- In 2001, the output of widgets increases 20%. The money supply increases by 20%. Therefore, the average price of a widget stays at £0.50 (zero inflation)

- In 2002, the output of widgets increases 16.6% and money supply also increases 16.6%. Prices stay the same and the inflation rate is 0%

- However, in 2003, the output of widgets increased 14% but the money supply increased 42%. With the money supply increasing faster than output, there is a rise in nominal demand. In response to this rise in demand, firms put up prices and we get inflation.

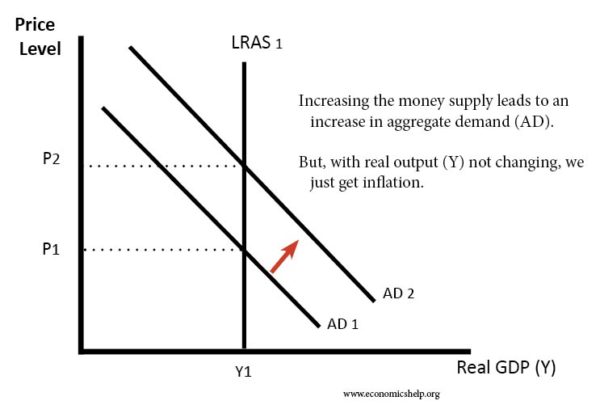

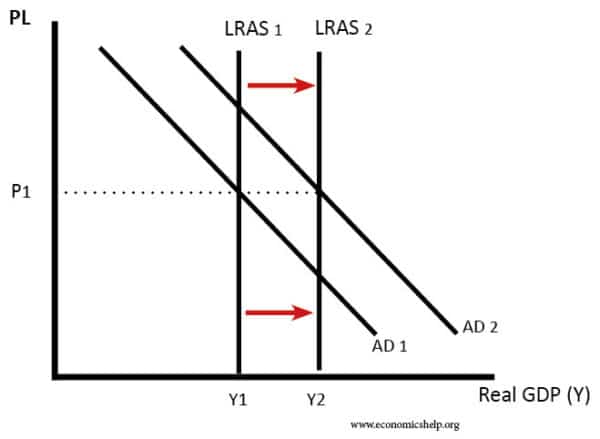

Diagram showing effect of increased money supply

- An increase in the money supply causes higher aggregate demand (AD) and this leads to an increase in the price level.

Historical Examples of increased money supply causing inflation

This link between the money supply and inflation can be seen in many historical cases.

US Confederacy 1862-65. During the Civil war, the Confederacy of southern states found itself short of finance (it could only raise 46% of the cost of war from taxes and bonds) so it increased the printing of money to pay for materials and soldiers. However, with economic output falling, this caused inflation of 700% in the first two years of the war and reached a peak of over 5000% by the end of the war.

German Hyperinflation 1923. In the aftermath of the First World War, Germany faced high reparation payments. To meet these demands, the government started printing more money – so that firms could continue to pay workers. This led to an explosion in the inflation rate. By the end of 1923, printing money had got out of hand, and the economy experienced hyperinflation.

Zimbabwe 2008. Zimbabwe found itself in a similar situation. High government debt, falling output and a need to print money to stave off a short-term crisis. This printing of money led to hyperinflation of an estimated 79,600,000,000% in Nov 2008. A daily inflation rate of 98%

US economy 2020/21

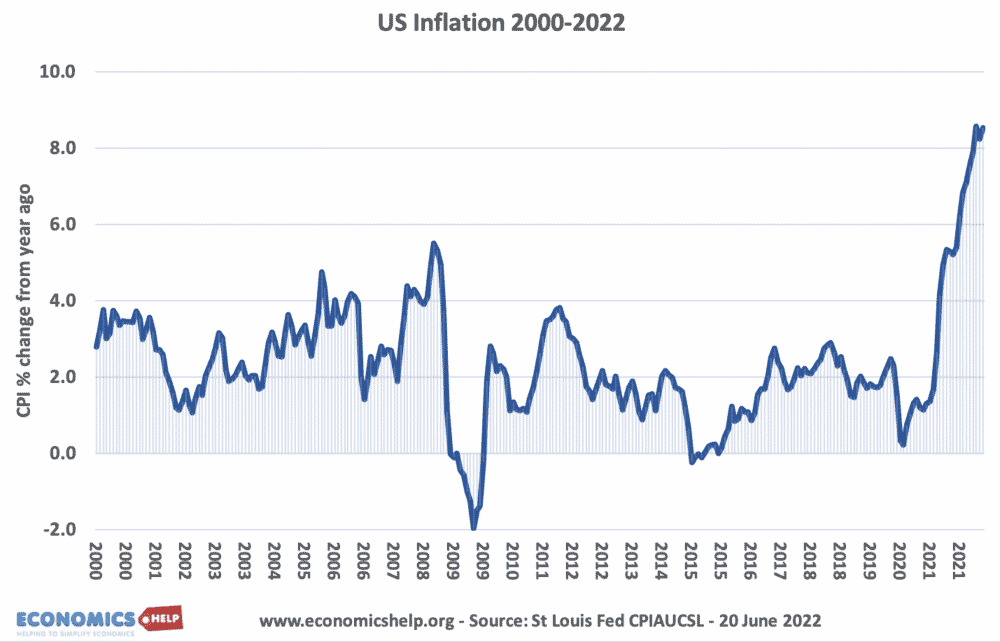

In the Covid Pandemic of 2020, there was a sharp fall in economic activity. The Federal Reserve responded by creating more money electronically. 12-24 months later this led to higher inflation. (Though, it is important to note, that some of this inflation was also caused by other factors such as rising oil prices, and supply chain issues.)

Why increasing the money supply does not always cause inflation

It is possible to increase the money supply without causing inflation. There are a few possible reasons.

1. The growth of real output is the same as the growth of the money supply

Suppose the money supply increased by 4%. In a simplified model, this would lead to an increase in Aggregate Demand (AD) of 4%. If AS (productive capacity of the economy) also increased by 4%, then the price level would be unaffected. In other words, the growth of the money supply is absorbed in the increase in real output.

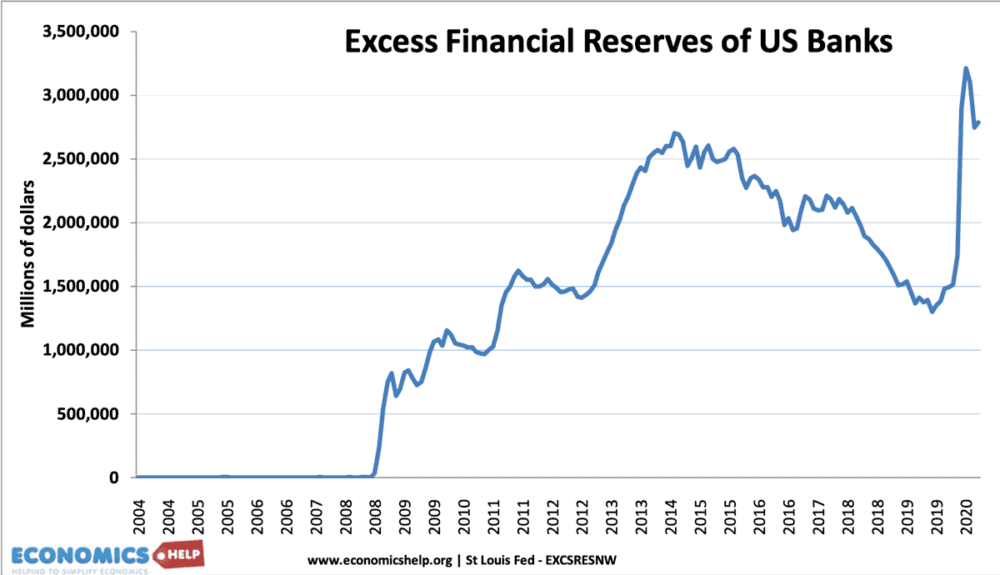

2. Increase in bank reserve ratios

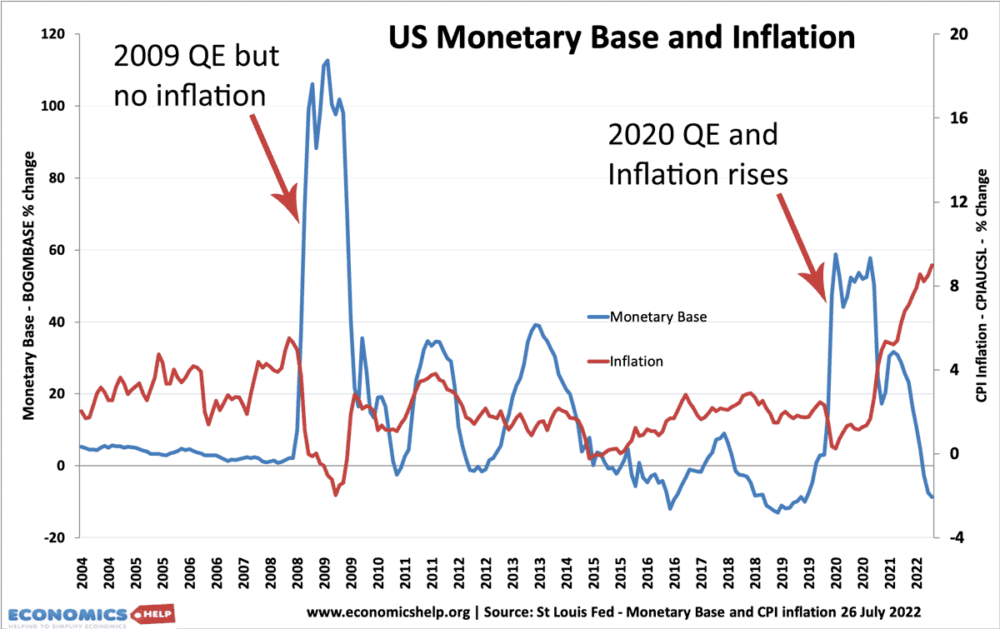

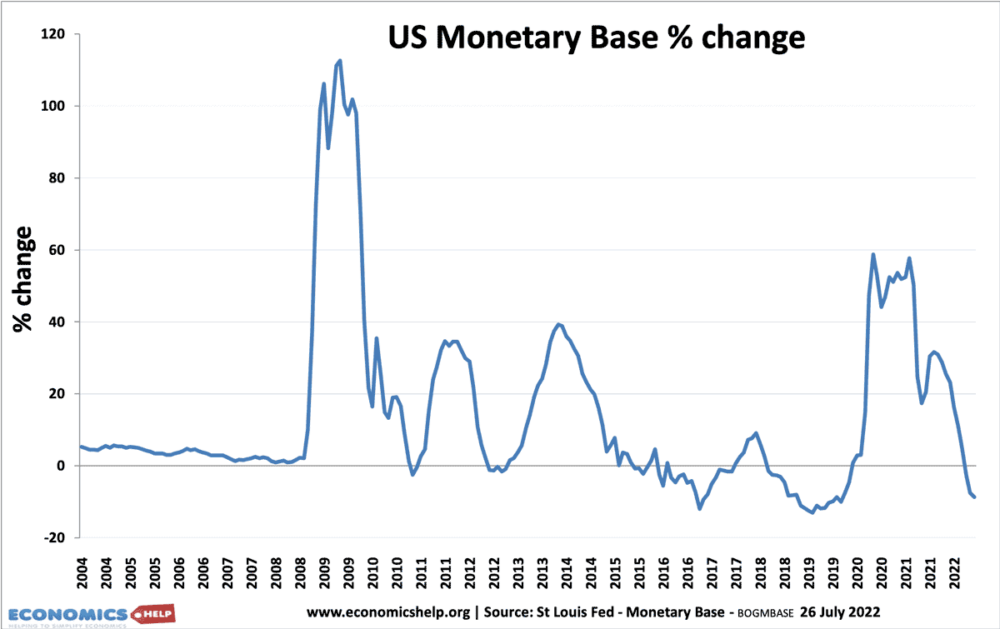

In 2008/09 the Federal Reserve increased the money supply (monetary base) by over 120%. But, this did not cause inflation. In fact, the US experienced temporary deflation. The main reason is that banks increased their reserve ratio. Essentially banks received extra money from Federal Reserve, but did not want to lend it to ordinary firms and households. Therefore, the extra money supply did not reach the wider economy and there was no inflationary impact.

3. Hard to Measure Money Supply

Sometimes the money supply is hard to calculate and is constantly changing. Large increases in the money supply are often just due to changes in the way people hold money. For example, an increase in credit card use may cause an increase in the broad money supply M4.

4. Changes in velocity of Circulation

The quantity theory of money equation MV=PY assumes that an increase in M causes an increase in P. However, this assumes that V(velocity of circulation) is constant and Y is constant. However, in practice, it is not as simple as this equation assumes. There are often variations in the velocity of circulation.

A good example is in a recession, the stock of money may rise 5%, however, people will be making fewer transactions and therefore the velocity of circulation will fall. This is one reason why quantitative easing (increasing the money supply) did not cause inflation between 2009 and 2016.

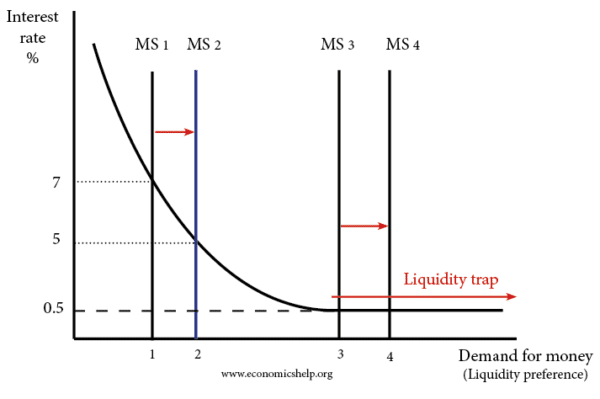

5. Keynesian view – Liquidity Trap

In a recession, there is spare capacity in the economy. Therefore, an increase in the money supply, merely helps to get unemployed resources used in the general economy. Therefore, in the case of a recession, an increased money supply is unlikely to cause inflation.

In a liquidity trap, interest rates fall to zero but this doesn’t prevent people saving. In this situation, there is a fall in the velocity of circulation and this can cause deflation. In this situation, increasing the money supply will not necessarily cause inflation.

For a start, increasing the money supply doesn’t reduce interest rates any further.

Summary of Link Between Money Supply and Inflation

- In normal economic circumstances, if the money supply grows faster than real output, it will cause inflation.

- In a depressed economy (liquidity trap) this correlation breaks down because of a fall in the velocity of circulation and banks wishing to hold more reserves. This occurred in the US and UK between 2008-14

- However, when the economy recovers and the velocity of circulation rises, increased money supply is likely to cause inflation.

Quantitative Easing and Inflation

Quantitative easing was a policy by Central Banks to increase the money supply.

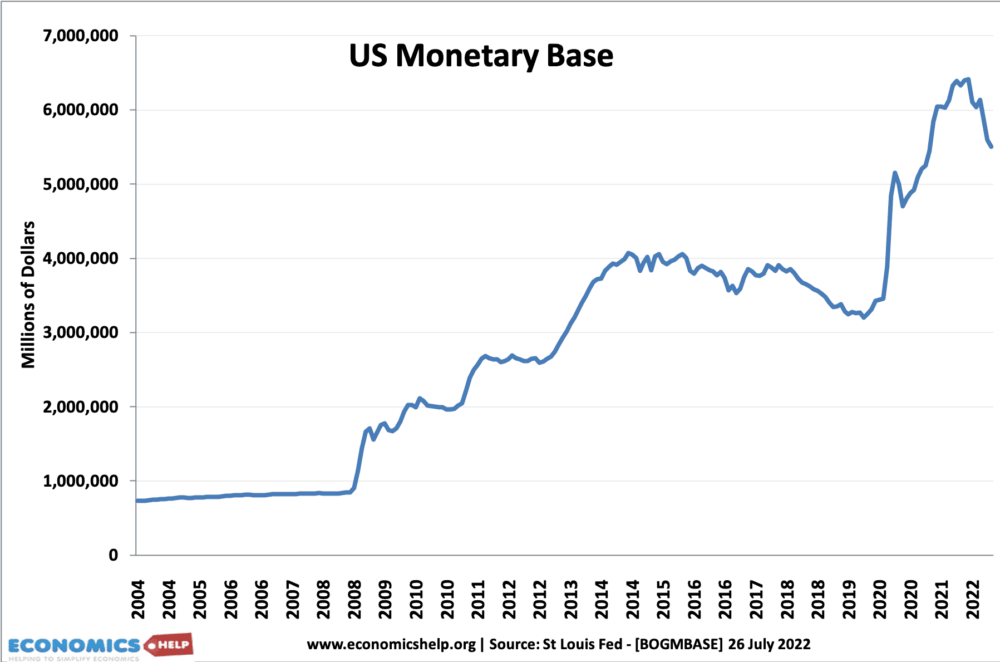

Quantitative easing in 2008/09 led to a big increase in the monetary base (a form of the money supply)

The Federal Reserve created money to buy bonds from commercial banks. Banks saw a rise in their reserves.

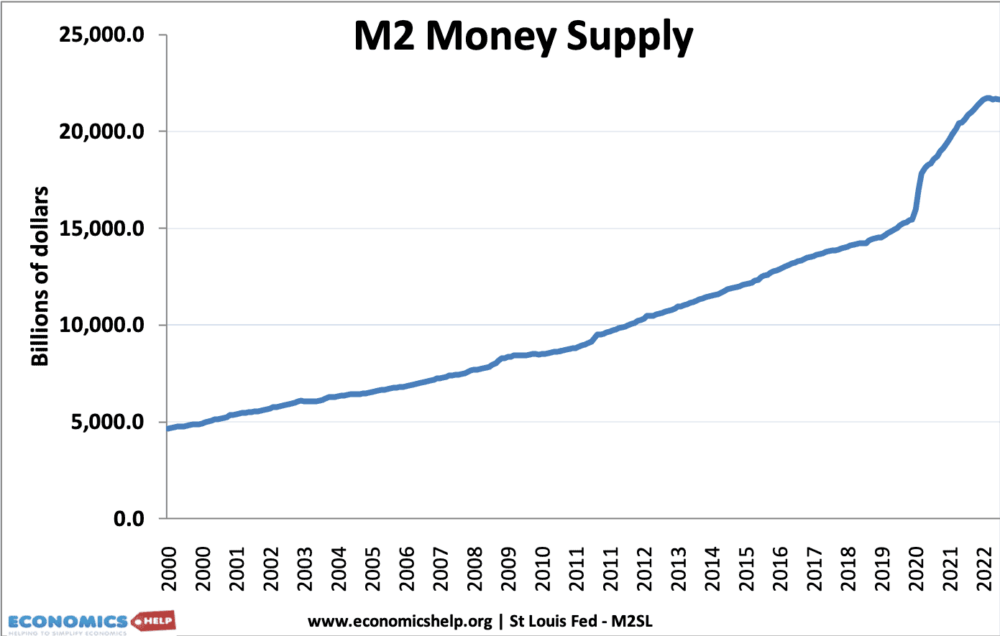

However, commercial banks didn’t lend this money out. Therefore the growth of the broader money supply (M2) didn’t change much.

What happened is that from 2009-2015, commercial banks didn’t want to lend this extra money. They wanted to increase their cash reserves. Many banks had lost money in the credit crunch and needed to take in more cash to improve their balance sheet. Their confidence was also very low.

The US inflation rate was largely unaffected by this increase in the monetary base. Stripping out volatile cost-push factors (food and fuel), core inflation remained below the 2% inflation target.

It was only in 2022, that the US started to see inflation. This 2022 inflation was due to a few factors:

- Increase in money supply in 2020.

- Expansionary fiscal policy and strong recovery from 2021 Covid slowdown

- Rise in oil prices

Further reading

I would like to know if any country has a policy of strictly limiting the growth of the money supply to the total wealth of the nation.

They would never increase the money supply in order to “stimulate” the economy

can inflation exist without an increase in money supply?

I would like to know the estimation model used to test if an increase in money supply causes inflation, and the test hypothesis

How is inflation and deflation to money supply?

Link between Money Supply and inflation How is inflation and deflation to money supply?

If the fed has issued $100, while holding assets worth a total of 100 oz. of silver, then each dollar will be worth 1 oz. If the Fed then issues another $200, which it uses to buy a bond worth 200 oz. of silver, then the Fed now has $300 laying claim to 300 oz. worth of assets, so the dollar remains worth 1 oz., and there is no inflation. This is according to the Backing Theory of money.

The Quantity Theory of money says that the Fed’s assets are irrelevant to the value of the dollar, and instead attributes inflation to changes in M, V, and Y. The Quantity Theory, unfortunately, is the only theory that gets any attention in the macro textbooks.

If printing more money is the solution, why don’t every other country just print money. I don’t understand this, how can a Govt of a country print money out of the thin air, how are it’s value based in accordance to other countries? How can China sells goods to the USA, if it’s printing money out of thin air? Isn’t the goods gonna cost more? or are the Chinese stupid? How can the Feds print money and expect it’s value to remain the same? The more you print, the less value it has? If not, than it’s a con game, the money’s got no value. Help me out folks, I am deeply confused. Thanks

How, increasing the money supply is not necessarily inflation?

Perhaps the best definition of inflation is that inflation is an increase in the money supply. If the U.S. increased the money supply by 5% today, your prices at the stores would not take an immediate leap of 5%. It would take a while for you to notice the inflation, but it happened immediately.

This is not a good definition of inflation. Inflation is an increase in the general price level. In the real world, the link between the money supply and inflation is uncertain.

I have never seen a case that if the money supply went up, inflation went up. In looking at the extreme increase in the money supply recently, I think we have created a real serious problem .

Expansion of the money supply is inflation. The political implications of Central Bank (Federal Reserve) policy decisions prevent honest discussion of the issue. The manipulation of the money supply and its affect on a country’s citizens is obvious; yet, while prices increase a legion of academicians come forth to say it ain’t so.