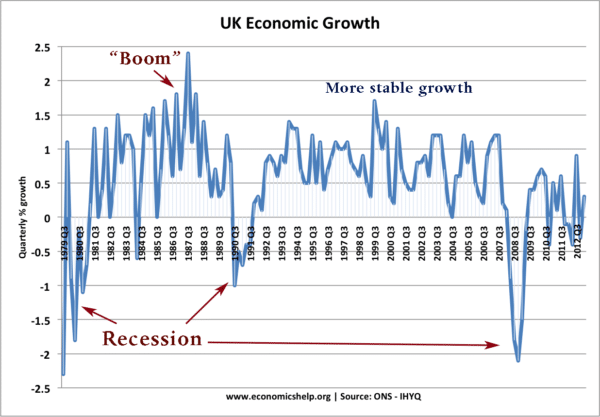

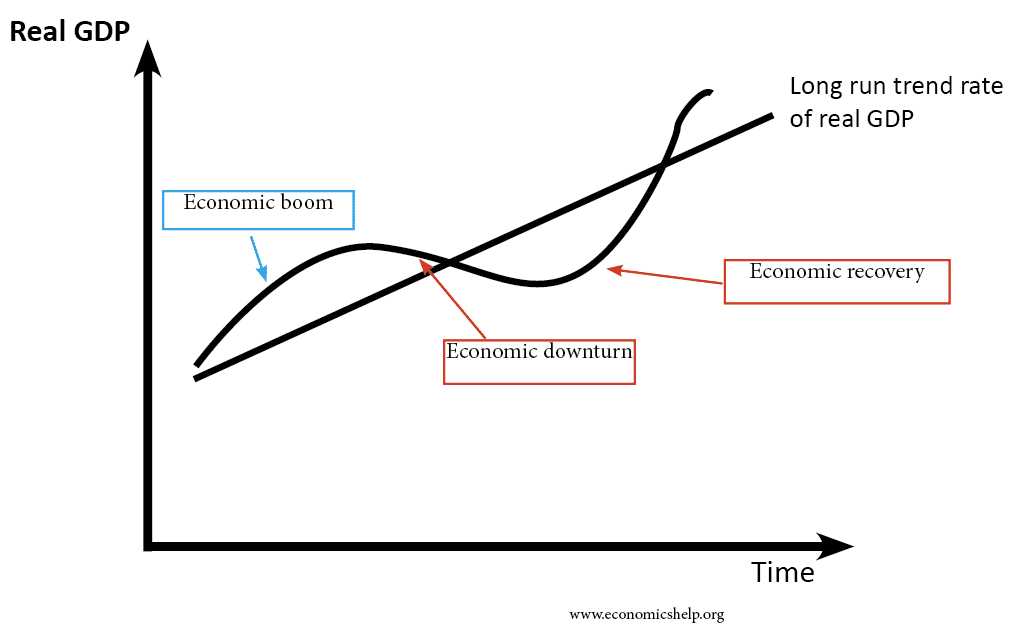

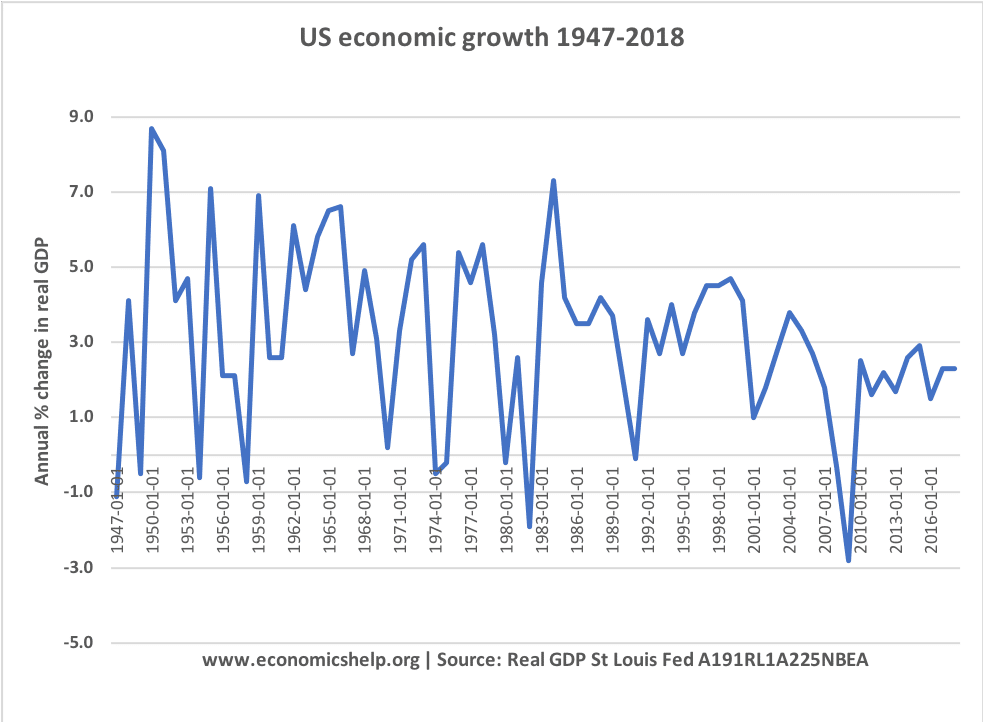

The economic trade cycle shows how economic growth can fluctuate within different phases, for example:

- Boom (A period of high economic growth usually causing inflation)

- Peak (top of the trade cycle, where growth rates may start to fall)

- Economic downturn/recession (where the growth rate falls and may become negative – leading to a fall in national output)

- Economic recovery (economic growth becomes positive and growth rates pick up.)

The economic cycle can also be referred to as the ‘trade cycle’ or ‘business cycle’

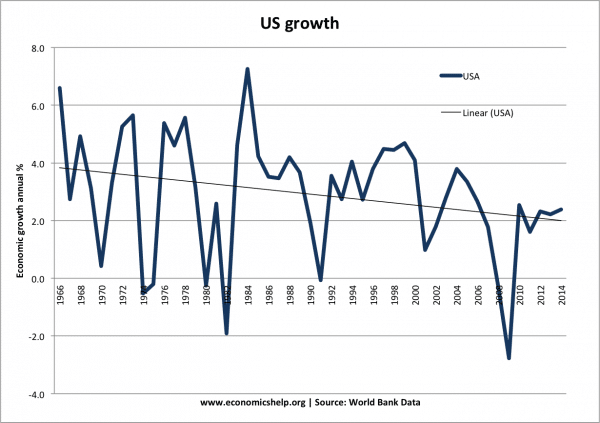

How long do these economic cycles last?

In the US, according to the National Bureau of Economic Research (NBER) (MSNBC)

- Since 1854, the economic cycle has averaged 38.7 months

- Since 1945, the economic cycle has averaged 58.4 months.

- The current economic cycle which began in March 2009, has now been going for over nine years (110 months).

- This makes it one of the longest lasting periods of economic growth on record. The current record is 120 months 1991-2001.

- The third longest was the period 1961-1969 (which lasted 106 months)

Is the economic cycle getting longer?

This data suggests that the economic cycle is getting longer. By historical trends alone, he US economic expansion is set to end. But, will it?

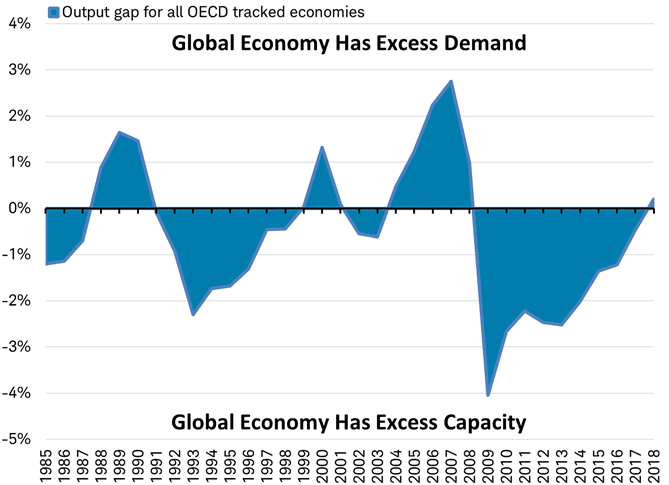

Economic growth in the period 2009-2018 has been relatively muted. There was no rapid recovery like previous recessions. This means it has taken a lot longer for the economy to close the negative output gap. Wage growth has remained low and as result inflation has remained low. As a result, interest rates have stayed at historic lows and only in recent years have their been modest increases in interest rates.

Inflation prospects? Unemployment in the US has fallen to 4.1%, and there are signs that the negative output gap has finally been closed. For the first time in the economic cycle, the US could be moving into a positive output gap.

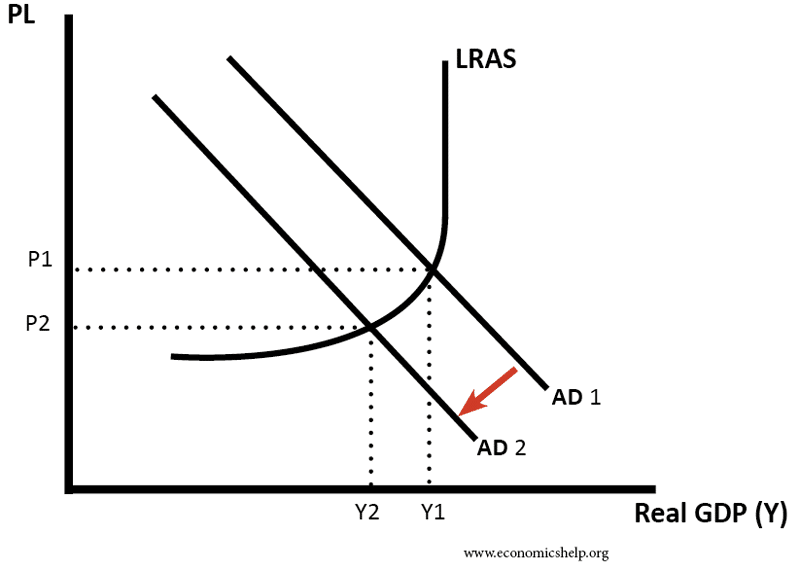

With the recent fiscal expansion (tax cuts), this could provide a further boost to aggregate demand and the Federal Reserve may respond with higher interest rates. Even a modest rise in interest rates could cause a demand-side shock which leads to an economic downturn (Why do higher interest rates cause lower economic growth?)

Trade war. There are concerns that an escalating trade war between the US and the rest of the world could be the trigger for a negative demand-side shock – leading to a fall in exports and fall in confidence.

The end of the business cycle?

There have been previous times when people have questioned whether the business/trade cycle is over. For example, in 2007, after the great moderation (Long period of economic expansion and low inflation) many wondered if the business cycle had ended. In that case, growth was brought crashing to a halt by an unexpected source – the global credit crisis. This shows it is not just the typical measures of inflation/interest rates that can cause the business cycle to end, but unexpected sources.

What could cause the current economic expansion to end?

Positive output gap – inflation – interest rates. The most common route for an economic cycle to end is an economic boom with growth above the trend rate causing the monetary authorities to respond to higher inflation by raising interest rates. This higher interest rate causes a fall in demand, a negative multiplier effect and an economic downturn.

Secular stagnation. Another theory is that due to factors such as demographics, the western world is heading towards a period of secular stagnation (effectively weak growth) – recent growth has been artificially maintained by very loose monetary policy – but with an ageing population, there usual patterns of demand are not there, and there could be a fall in demand. See more at: Secular stagnation

Real business cycle theories. Another perspective is that there are supply side causes to economic cycles. Technological innovation can go in cycles and if there is a lull in productivitiy and investment – this causes an economic downturn. However, a feature of this recent period of economic growth has been relatively poor productivity growth. See: Real business cycle models

Financial disruption. Like in 2008, if investors and banks become over-extended, then they may cut back on lending and this can cause the demand side shock.

Trade war. It is not impossible that a trade war and retaliatory tariffs could cause a fall in demand.

Commodity prices. A surge in oil prices could cause higher costs – stagflation and lower demand. Higher oil prices were a contributory factor in the 2008 recession. Though it is hard to see a rapid rise in oil prices.

Related

it’s good books