In recent years, many advanced (high-income) economies have seen a marked fall in unemployment but only very slow or even negative real wage growth. This phenomenon of slow wage growth, despite falling unemployment, is marked in countries such as the UK, Japan and the US. Reasons to explain this slow growth of wages include

- Low productivity growth

- Hidden slack in the labour market

- Uncertain economic outlook

- A decline in union bargaining power

- Growth of monopsony power of employers

- Change in labour market with more part-time, temporary and zero hour contracts.

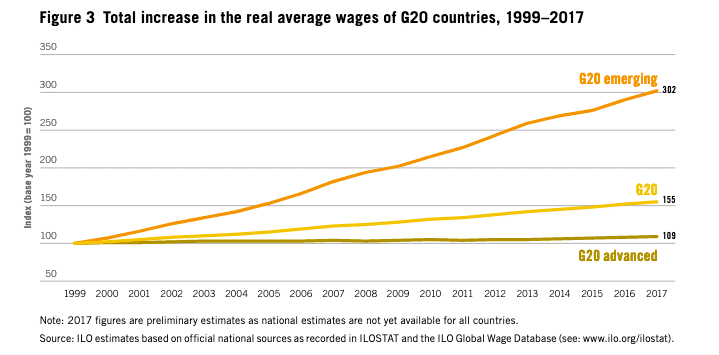

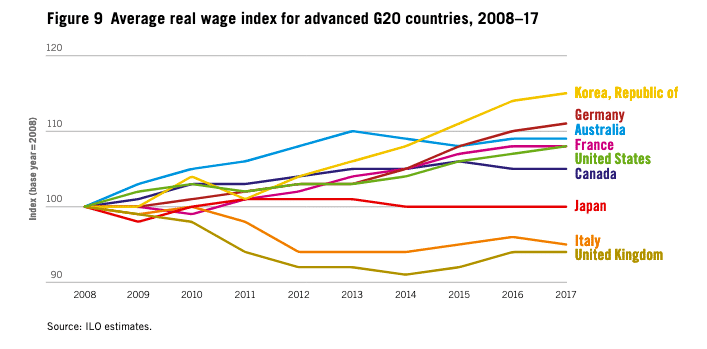

Low wage growth in advanced G20 Countries

This shows that wage growth in the most advanced G20 economies is notably lower than for emerging economies, like China, Taiwan, Korea

Italy and the UK have seen negative real wage growth. With the US, Canada and Japan experiencing much lower than usual wage growth.

Potential reasons for low wage growth

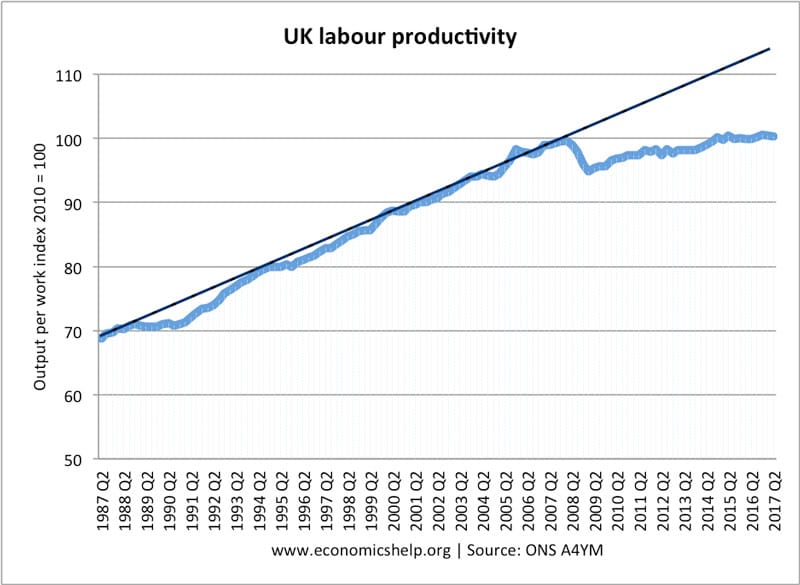

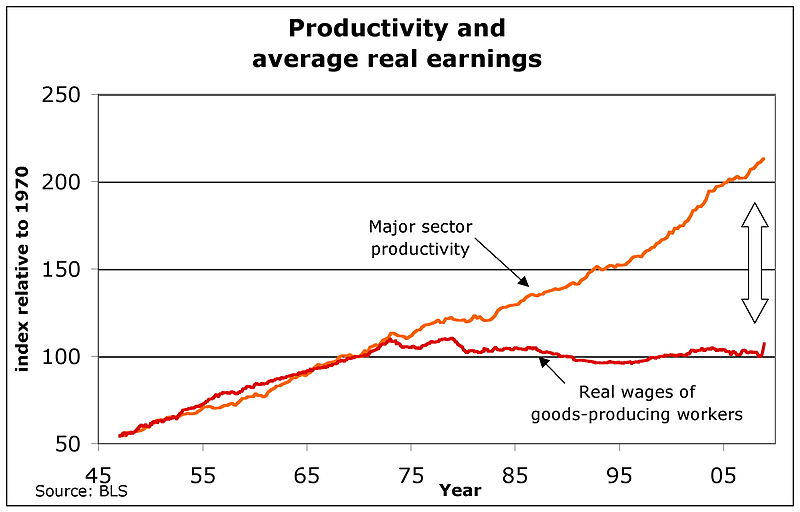

Productivity

Labour productivity is a key determinant of wages. If the output per worker is stagnant, then, ceteris paribus, the firm cannot afford to increase wages. In periods of high productivity growth, wage growth tends to match the growth in productivity.

The UK is a good example of an economy that has seen very poor productivity growth in recent years.

Since the Great Recession of 2008, UK productivity has stagnated, causing at least part of the stagnation in wages.

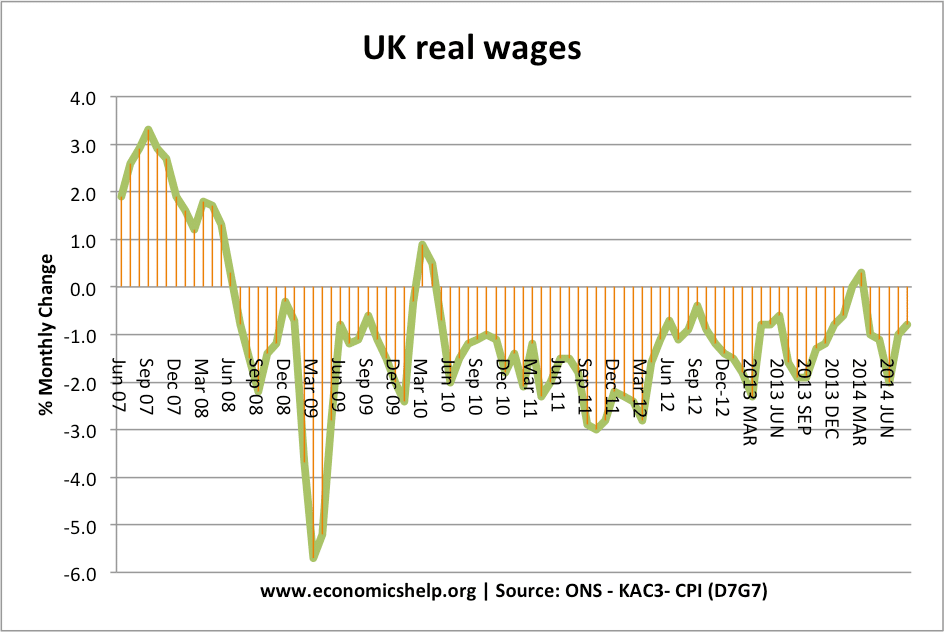

UK Real wage growth stagnates after 2008.

This raises the question of why is labour productivity growth slowing?

- A slowdown in major technological advances (AI and internet not giving as many gains as hoped)

- In the Great Recession, firms hung on to workers but resisted wage cuts (due to the negative impact of cutting nominal wages on workers motivation), So in the recovery, firms are not raising wages but recouping previous trends.

- Low wage growth is in turn leading to less investment and lower productivity as firms find it cheaper to employ low-wage workers rather than invest in capital.

- Uncertainty in the global economy is discouraging investment.

- Low wage growth is causing low productivity with low wages and firms not investing when labour is cheaper.

However, productivity only partially to blame

In the US, wages for manual workers have started to lag productivity.

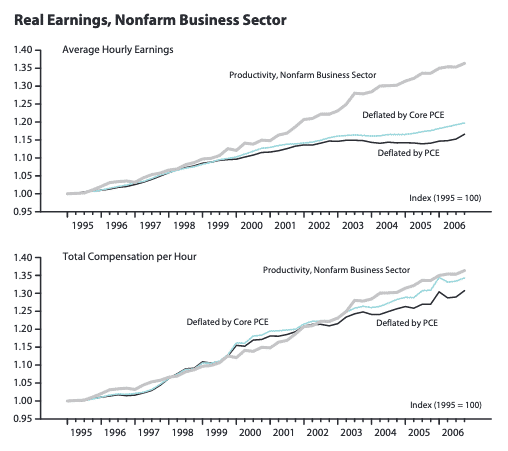

However, on further investigation, the link between productivity and pay is closer if we use total compensation per worker (which includes bonuses, and end of year pay)

Source: St Louis Fed (Wages and productivity)

This shows that using total compensation per hour; there is still good link between productivity and wages.

Hidden slack in the labour market

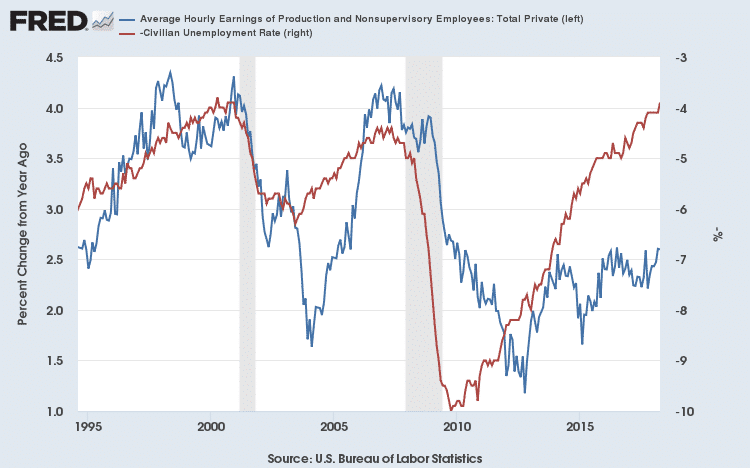

Headline unemployment rates have fallen in the UK and US to near record levels. Usually, as the unemployment rate approaches 4%, we see a tightening of the labour market and rising wages and firms compete for workers.

However, since 2008, falling unemployment has not led to wage growth

This suggests that labour markets may not be as tight as unemployment stats suggest. For example, a better guide to labour market tightness is the employment rate and participation rate. In the US, there has been a fall in labour market participation – especially amongst men. This could be discouragement, education, early retirement or sickness and disability. For example, employment rates for men workers in the US was 89% in 2000. This fell to 81% in 2010 and in 2018 close to the peak of the economic cycle, 86%. Perhaps evidence of a small long-term decline in productivity.

Decline in union bargaining power and rise in monopsony

Across the western world, there has been a decline in membership of trade unions and the collective bargaining power of workers. Without unions to push for higher wages, workers are not getting the same wage increases. This decline in union power is being complemented by a rise in monopsony power of employers. This is the market power employers have in hiring workers. With monopsony power, firms can pay wages lower than competitive markets and resist the pressure to raise wages.

“We have shown that concentration is high, and increasing concentration is associated with lower wages. Our results suggest that the anti-competitive effects of concentration on the labor market could be important.” Labor market concentration José Azar, Ioana Marinescu, and Marshall I. Steinbaum, NBER 2019

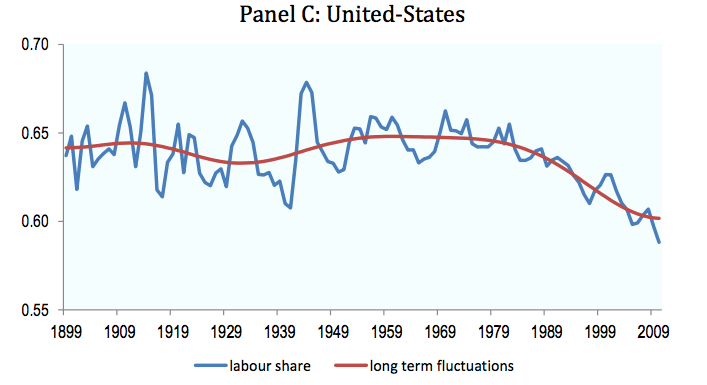

Falling labour share of income

Source: OECD – Labour share in G20 (2015) (See more on labour share of GDP)

This suggests low wage growth is due to rising inequality – corporate profit taking a bigger share of GDP than income. This would support the hypothesis of weaker trade unions and more powerful monopsonies.

Changing nature of labour markets

New growth in the labour market is coming from service sector jobs, which are often part-time, temporary work, zero-hour contracts. New jobs have greater insecurity and uncertainty. Workers are more likely to be self-employed and have limited bargaining power.

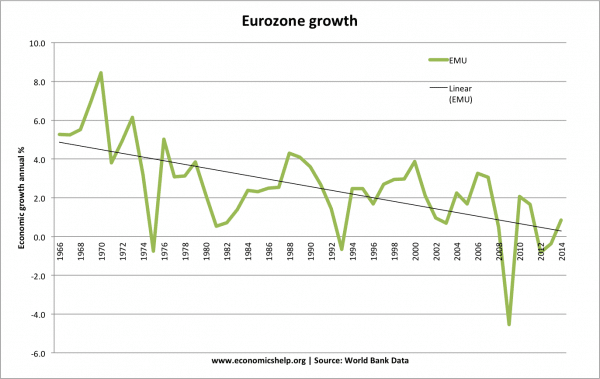

Uncertain economic outlook

The recovery from the 2008 recession has been slower than previous recessions. Economic growth is weaker and this is limiting investment and strong economic growth. It continues a long-term trend of falling rates of economic growth – causing some economists to talk of ‘secular stagnation‘

Other possible reasons for low wage growth

- Demographics – ageing populations, means economies are less dynamic. However, low wage growth is seen across the age spectrum

- Inequality. Slow wage growth has occurred in a period of rising wealth inequality and rising wages of the top 1% of income earners.

Related

Dear Tejvan, many thanks for your quick and comprehensive response to my question. As a follow up one, what problems do you see in the medium to longer term with companies not investing in new technology or in upskilling their staff but rather using cheap wages as a competitive tool?

Thanks.

To what extent does the trade war between USA and China actually impact on the economies of other nations? Could the U.K. Provide China with goods that the USA provides, but without having a tariff imposed? Would this not be beneficial to the U.K. Economy?