The price of natural gas is determined by several supply and demand factors.

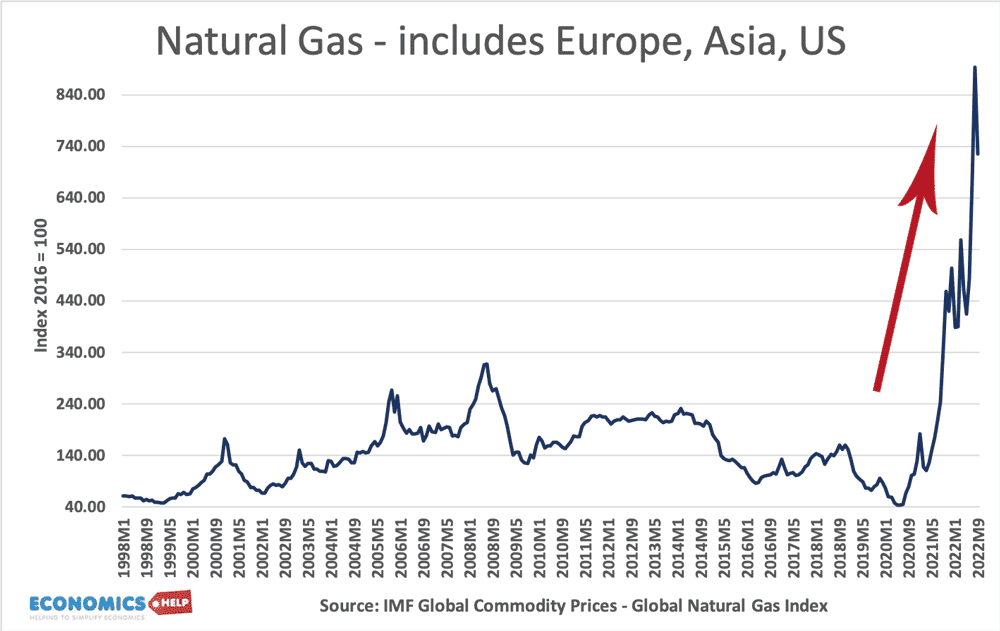

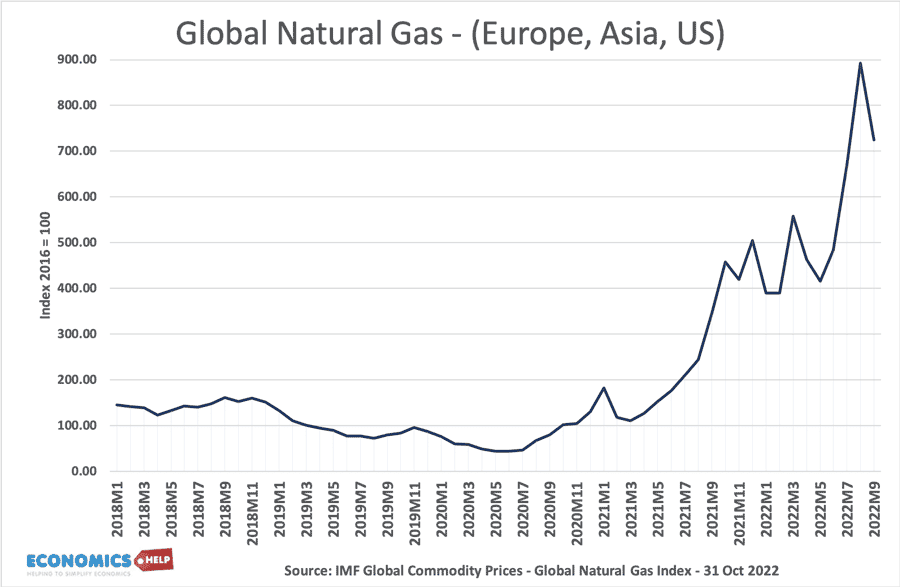

- Source: IMF Commodity prices (look for left column – excel database)

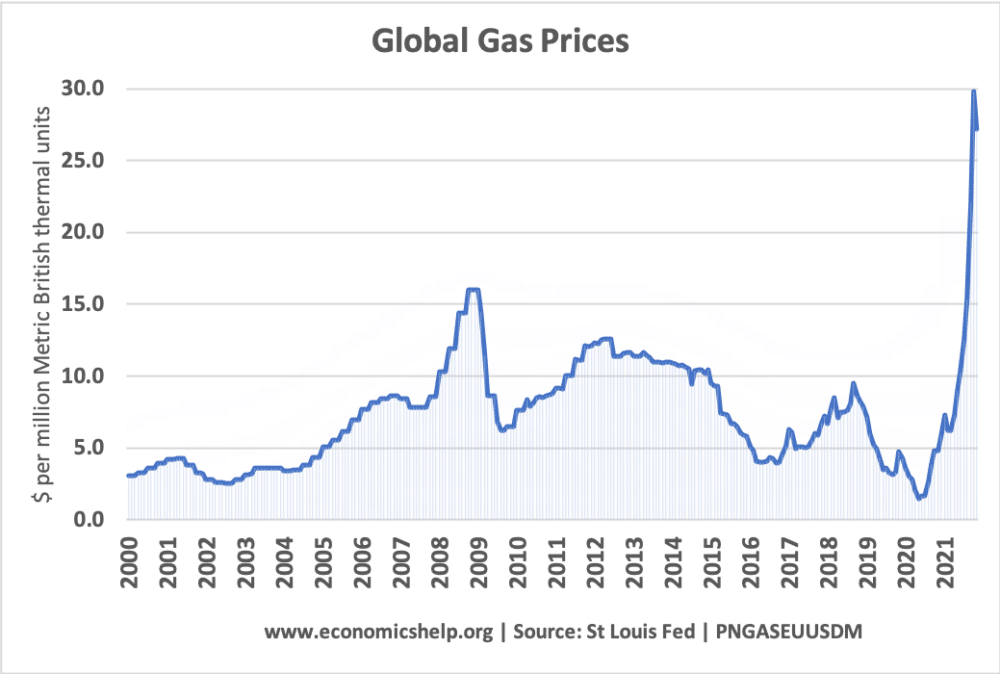

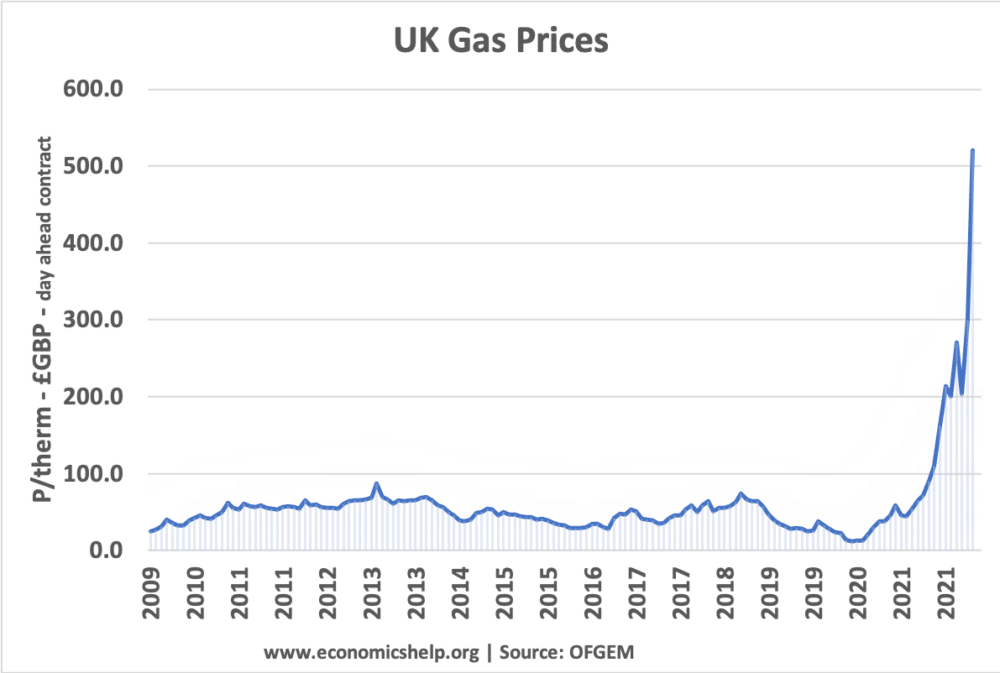

The sharp increase in the price of natural gas in 2021/22 reflects concerns over the availability of supply from Russia and the economic recovery which has led to greater demand.

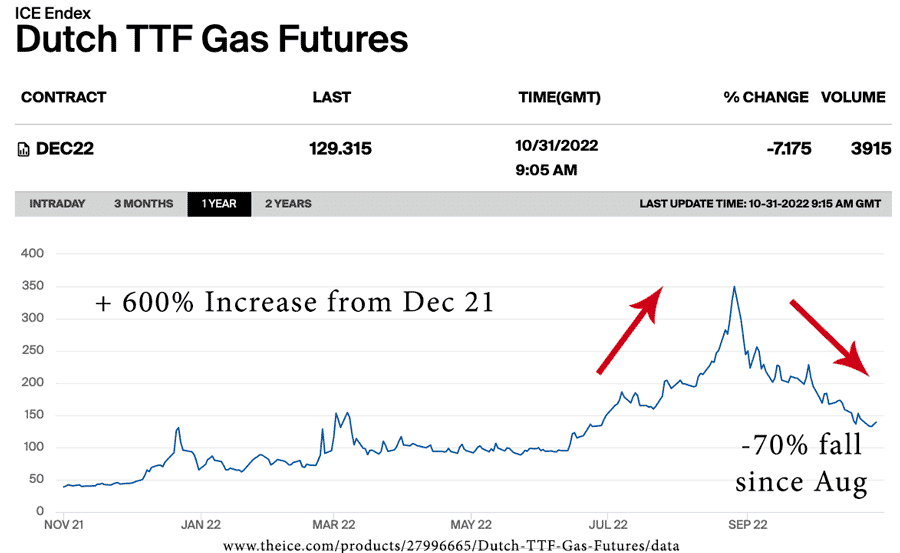

Since August, future prices for gas have started to fall.

Futures reflect day to day conditions in the market and were a response to higher supply of LNG and mild winter reducing demand.

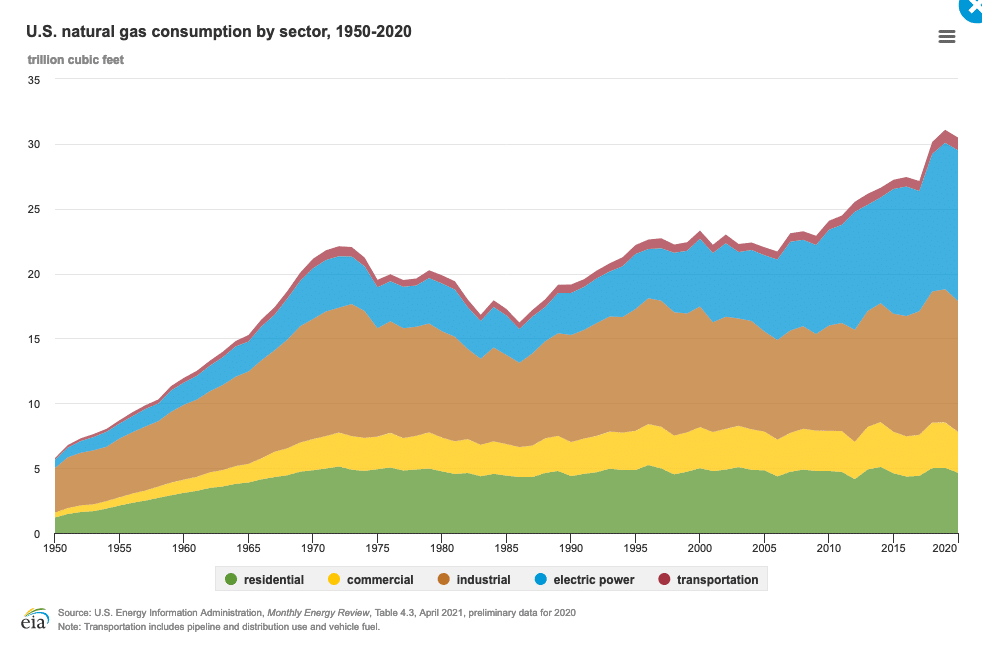

Natural gas is used for

- Power generation – burning gas to create electricity

- Heating homes

- Heating hot water- Gas central heating

- Cooking.

- Air conditioning

- Transportation – liquid gas is used in approximately 4% of US transport.

Factors affecting supply

- Pipeline capacity. The majority of natural gas comes from fixed pipelines from natural gas production to homes and businesses. If access is restricted, supply will fall. For example, the Russian/Ukrainian conflict has led to reduced supply pushing prices up quite dramatically.

- An alternative source of natural gas is to buy liquid natural gas which can be transported in containers (liquified form takes up to 600 times less space than the gas) However this is generally a more expensive method than pipelines.

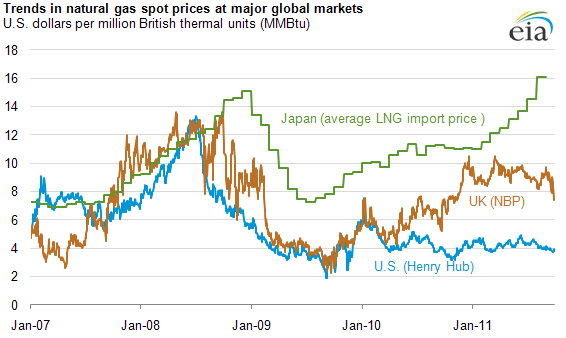

- New gas supplies. For example, recently, US has increased the supply of gas from controversial fracking methods. This has led US gas price to become lower than Japan and UK. The UK and Europe have been more reluctant to use fracking sources.

- Storage. Natural gas can be stored in physical locations. A large store, will help keep prices low, but when stocks run low, this can push up prices. Before, the invasion of Ukraine, Russia’s largest gas producers reduced stocks in Europe, giving them less spare capacity and time to find alternatives.

- Weather. Hurricane Katrina (2005) led to a temporary halt of gas production in areas affected in the US.

- Regional variations. Unlike oil, gas can be more difficult to transport, therefore, we can see bigger regional variations. Oil prices tend to converge around the world because transport costs are low. But most gas suppliers rely on fixed infrastructure. For example, Europe is reliant to a large extent on gas pipelines from Russia. It is more difficult to switch to supplies from another continent. (though some liquid gas can be imported)

Regional variations in gas prices

Demand

- Weather. A major use of natural gas is in heating – both in households, commercial and industrial sectors. In cold weather and the winter months, demand for natural gas rises rapidly.

- Power. Another major use of natural gas is to use in power generation. Gas can be burned to create electricity. This is why higher gas prices, will lead to higher electricity prices too.

- Economic growth. Higher economic growth will increase demand for natural gas as consumers can afford to have a warmer home in winter. Also, economic growth will increase industrial use as production increases.

- Speculation. Natural gas is an important commodity and traders will look at future expectations in determining what they buy in advance. If stocks are low, then this is a signal that price is likely to rise as investors seek to buy future contracts. The rapid rise in prices in March 2022, reflect fears supplies from Russia could be cut off due to sanctions.

- Alternative energy sources. In the long-term, the demand for natural gas is related to the price of alternatives. For example, a rise in the price of natural gas could encourage consumers and firms to switch to electricity generated from renewable energy sources.

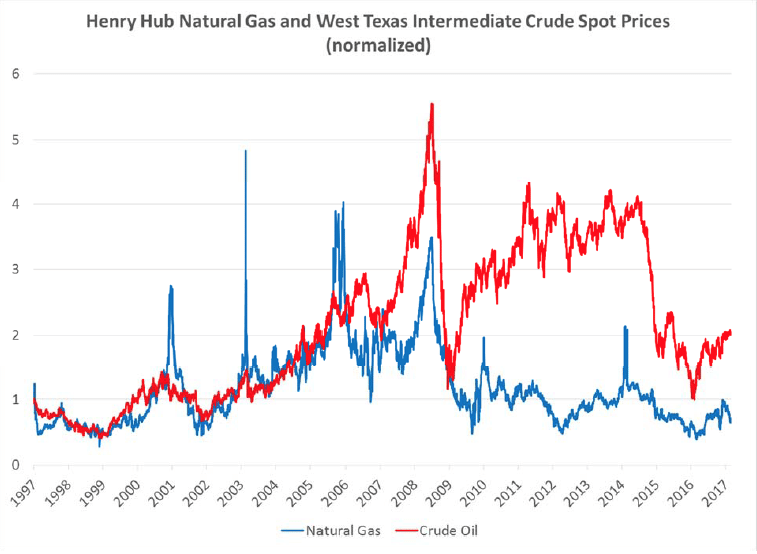

The link between Gas and oil prices

Before the production of shale gas, there was a strong correlation between the price of natural gas and crude oil. This is because

- Gas and oil were substitutes. Higher oil prices would lead to a higher demand for natural gas as an alternative to generating power from petroleum products.

Decoupling of link between gas prices and oil

- However, with the development of fracking and shale oil (wet gas – which refers to natural gas mixed with oil). Drilling for crude oil could lead to new supplies of natural gas as a by-product of production. Higher oil prices spur more drilling for oil, which also leads to an increase in the supply of natural gas. Therefore, high prices of oil helped to reduce prices of gas due to the increase in supply. Therefore, in the early 2000s, natural gas supplies stayed low, whilst oil prices were high.

The link between gas prices and electricity

- Rising gas prices usually lead to higher electricity prices. In the UK 42% of electricity is generated from burning natural gas (2016). Therefore, if natural gas is more expensive, then electricity will rise in price too.

UK Gas prices 2022

- Gas prices Ofgem

Global Gas prices