How will UK house prices be affected by Brexit – in both the short term and long-term?

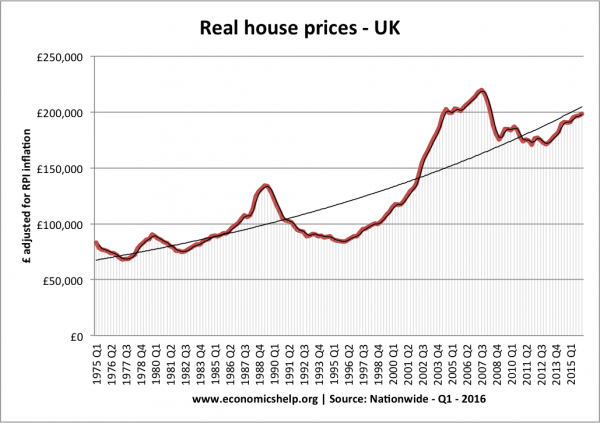

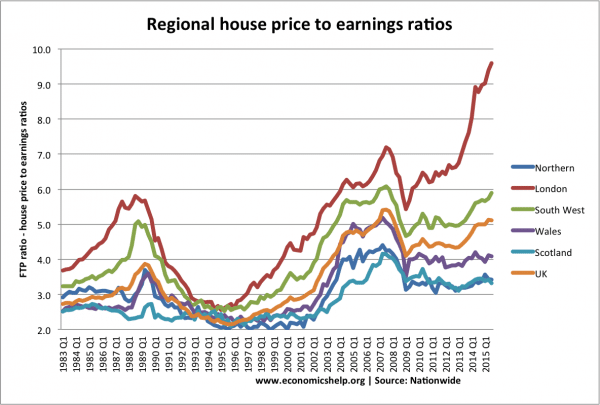

In the past few decades, the UK property market has been characterised by a long-term rise in real house prices. UK house prices have risen faster than inflation – especially in London and South. In fact, we could really talk about two separate housing markets – London and the rest of the UK.

Summary

It is not clear whether Brexit will really change the fundamental disparity between supply and demand which has led to expensive house prices. But, if anything, it will moderate the rise in house prices.

House prices and voting choices

In the EU referendum the towns with biggest leave vote (e.g. Burnley) saw the biggest drop in house prices last year. The place with strongest Remain vote had the biggest price rises. A reflection of Leave voters being concentrated in poorer areas. But, if there is a shock to house prices it is likely to be felt most strongly in the over-heated areas of London and the south.

Short term falls

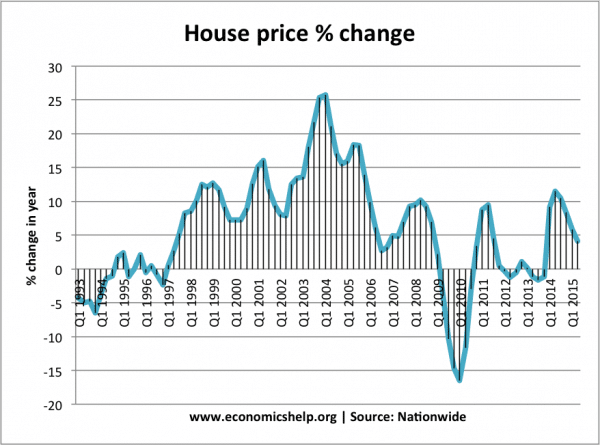

In the short term there is a good case for house prices to fall.

- The strong decline in consumer confidence, will most likely filter through into housing market, with people delaying purchases.

- With consumption and investment slowing due to uncertainty, there will be some kind of economic slowdown, which will also hit the housing market. It remains to be seen if there will be any significant upturn in unemployment as a result of a post-Brexit recession. At the moment, it is hard to see any kind of upsurge in unemployment (like 1991 and 2008 recession) though if global conditions deteriorate this may change.

- Commercial retail property trusts have also been hit with investors seeking to take their money out, in anticipation of more vacancies in London property market. This has led to property trusts being suspended, though this is not as dramatic as it sounds. There is no liquidity shortage in the trusts, and suspending access during periods of turmoil, is part of the contract of these trusts.

- There is still an uncertainty about how much the City of London will be affected by the UK leaving the EU, with the degree of access to Single Market still to be worked out. It is possible, financial firms could relocate to other European capitals; in this case, the UK would see less demand for property and office space and prices would fall.

- Decline in number of first time buyers able to afford deposit. In recent years, the rise in property values has priced out an increasing number of young people from the property market. It is an unbalanced market, relying on thin volumes to push prices higher. With a shock to demand, these recent price rises could be reversed.

Short-term factors propping up prices

- The drop in the value of Sterling is making the UK an attractive place for foreign investors. There has been renewed interest in London property market from overseas buyers, looking to profit from the 10% fall in Sterling. If Sterling heads even lower, this will make it more attractive for investors to buy into the UK property market – primarily London.

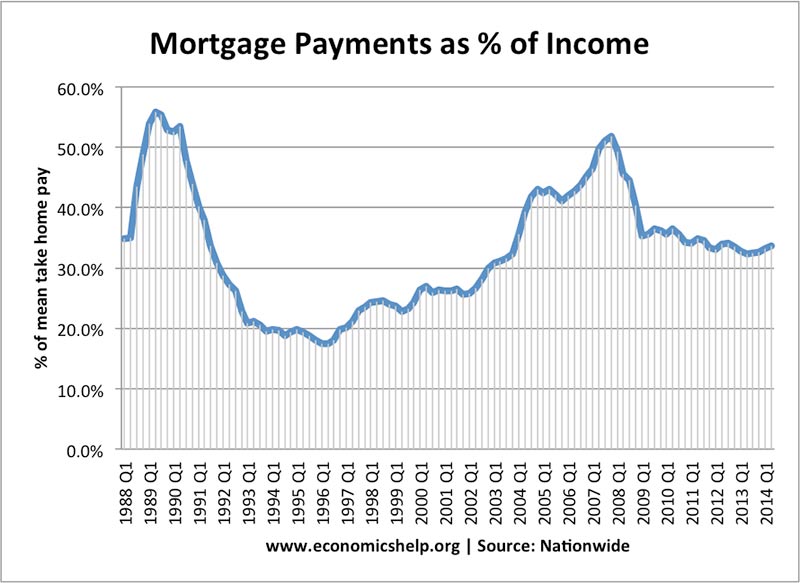

- Interest rate cut. The Bank of England is likely to cut interest rates to zero – giving even more good news for mortgage owners, who find mortgage payments as a percentage of income are relatively low, compared to previous periods of housing turmoil.

Affordability of Mortgage Payments

Long-term Prices

Will Brexit affect long-term house prices?

This is a different issue. Will Brexit pop the UK property bubble and will we see a fundamental fall in house price to income ratios?

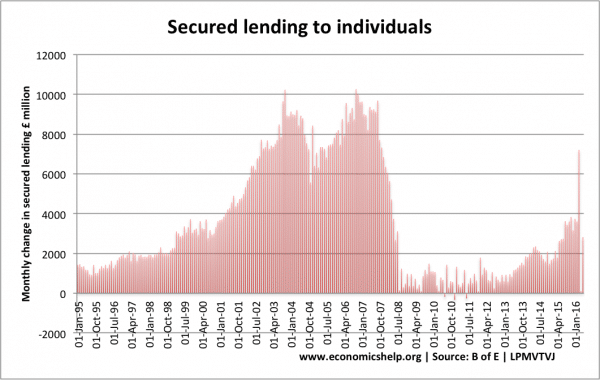

Supply and demand. The fundamental driver of UK house prices is the growth in number of households outstripping the supply of housing. This is why property prices are over-valued – despite a low volume of transactions and mortgage lending. London prices have also been rising due to additional overseas demand.

This graph shows how mortgage lending has collapsed post 2008 credit crunch. But, prices still rose on limited mortgage lending – showing that the UK growth in house prices wasn’t due to rise in mortgage lending, but shortages of available stock.

Immigration and number of households. A Brexit with controls on immigration could start to cut net migration levels, and lead to slower population growth. However, UK population growth is not just coming from net migration from Eastern Europe, but migration elsewhere, and the face people are living longer. It would take a considerable change in social and migration policies, for the UK’s population trend to stabilise – let alone fall.

UK population projections at BBC. The trend of UK population growth will have one of the biggest impacts on long-term house prices.

Ceteris paribus, strict immigration controls, will limit the growth in the number of households and this may limit the growth in long-term house prices.

Long-term economic growth. Many economists suggest UK real GDP could be 2-3% permanently lower due to leaving Single Market, this would have some effect in reducing real incomes, but might only have limited impact on UK housing market.

Related

The other major factor in house price rises is due to our planning system. If you look at countries where planning is easier and not so restrictive, property prices do not increase at the same rate because land prices are lower due to a greater supply available. In the UK the land values to build cost is far greater than most countries due to the planning restrictions. Simply supply and demand at the land end drives up the property value – build cost stays in line with inflation wherever it is in the UK.

Another factor is the stamp duty making it prohibitive to move regularly and hard for first time buyers. This removes liquidity from the market at certain price points