Currency wars are said to occur when countries seek to devalue their currency to gain a competitive advantage. However, if one country seeks to become more competitive through devaluation, it means other countries become less competitive. Therefore, they may respond by weakening their currency too. Thus, we may get a situation of competitive devaluation where each country seeks to reduce the value of a currency. This can lead to instability.

Why do countries want a weaker currency?

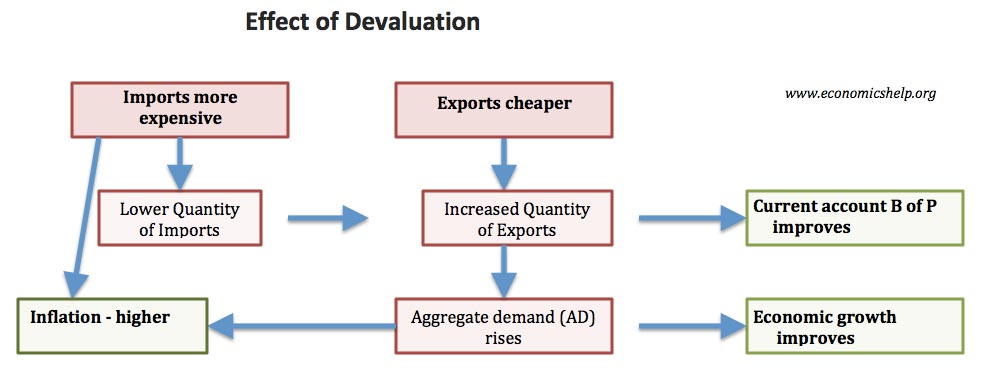

If you devalue your currency, it means your exports are relatively more competitive (cheaper to foreigners). Therefore you will export more. Also, imports become more expensive so there should be a rise in Aggregate Demand. This should help boost economic growth and reduce unemployment.

See: Effect of devaluation of dollar

I thought countries wanted a Strong Exchange Rate?

Often countries want to maintain a strong currency. A strong currency increases living standards and enables cheaper imports. Also, a devaluation may cause inflation because imports are more expensive and Aggregate Demand rises. However, in a recession and liquidity trap, inflation is not seen as a problem and therefore, countries seek to boost demand by the exchange rate.

How does an Economy Weaken its Currency?

- Cut interest rates. Lower interest rates make it less attractive to save in an economy and less hot money flows

- Print money / Quantitative Easing. Increasing the supply of money, increases the supply of dollars (or Pounds). This leads to a fall in the value of the dollar (Pound)

- Intervention Buying. By purchasing the assets of other countries, you increase the value of their currency. For example, if China uses its foreign currency to buy US Treasuries. It increases demand for the dollar and therefore the dollar becomes stronger compared to the Yuan.

For example, at the moment the US Federal Reserve is pursuing quantitative easing. Japan has been recently been selling Yen and buying US assets. China has long been accused of currency manipulation

Jean-Claude Juncker, chairman of the eurozone group of finance ministers, said: “China’s real effective exchange rate remains undervalued… The Chinese authorities do not share our view.” (BBC Link)

Who Started the Currency War?

The US will say that China has been maintaining an artificially weak Yuan for years. This is reflected in the huge trade surplus China has. It has been neutralising this trade surplus by buying US assets to keep dollar artificially high.

Others say it is the fault of the US Treasury for pursuing quantitative easing and increasing liquidity around the world.

Problems of Currency Wars

- Instability which discourages investment and trade

- Policies to weaken currency like printing money can cause instability such as potential future inflation.

However, others argue the dangers of currency wars are overstated. They argue that in a deep recession, countries facing deflation do the right thing to try and boost the money supply.

Is the US Right to Pursue Quantitative Easing and Weaken Dollar?

The US may claim the pursuit of quantitative easing is not just to weaken dollar but the pursuit of independent monetary policy. They may point to the fact that despite zero base rates, there is the threat of slow economic recovery and deflation. Thus their policy is aimed at avoiding deflation and they have a right to pursue quantitative easing. Furthermore, the rest of the world will benefit from a strong US economy which buys their exports. A devaluation of the dollar will help rebalance the global economy and reduce imbalances in trade deficits.

Related

Thank you very much!!! :):):)

Ima use this for ym essay 😉 Thanks brooo.

Intervention Buying. By purchasing the assets of other countries, you increase the value of their currency. For example, if China uses its foreign currency to buy US Treasuries. It increases demand for the dollar and therefore the dollar becomes ***STRONGER*** compared to the Yuan.

Can it work the other way around like if dollar buys yuan, yuan will become stronger?

Yes, if US used up dollars to buy Yuan, Yuan would become stronger