Definition: Monopolistic competition is a market structure which combines elements of monopoly and competitive markets. Essentially a monopolistic competitive market is one with freedom of entry and exit, but firms can differentiate their products. Therefore, they have an inelastic demand curve and so they can set prices. However, because there is freedom of entry, supernormal profits will encourage more firms to enter the market leading to normal profits in the long term.

A monopolistic competitive industry has the following features:

- Many firms.

- Freedom of entry and exit.

- Firms produce differentiated products.

- Firms have price inelastic demand; they are price makers because the good is highly differentiated

- Firms make normal profits in the long run but could make supernormal profits in the short term

- Firms are allocatively and productively inefficient.

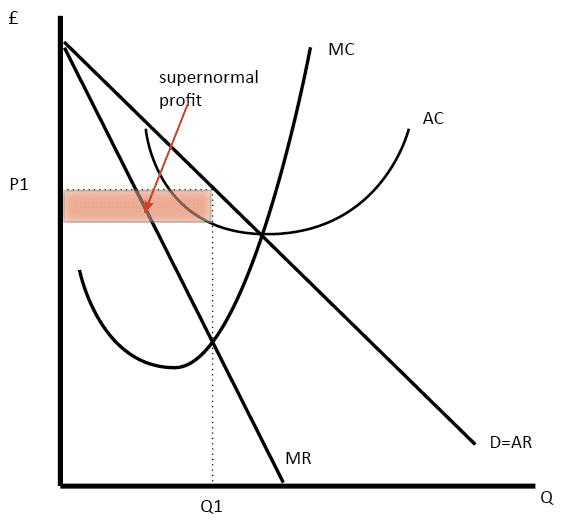

Diagram monopolistic competition short run

The firm maximises profit where MR=MC. This is at output Q1 and price P1, leading to supernormal profit

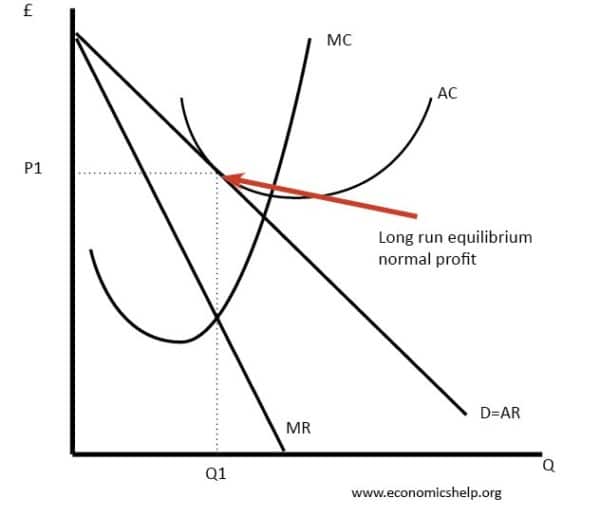

Monopolistic competition long run

In the long-run, supernormal profit encourages new firms to enter. This reduces demand for existing firms and leads to normal profit. I

Efficiency of firms in monopolistic competition

- Allocative inefficient. The above diagrams show a price set above marginal cost

- Productive inefficiency. The above diagram shows a firm not producing on the lowest point of AC curve

- Dynamic efficiency. This is possible as firms have profit to invest in research and development.

- X-efficiency. This is possible as the firm does face competitive pressures to cut cost and provide better products.

Examples of monopolistic competition

- Restaurants – restaurants compete on quality of food as much as price. Product differentiation is a key element of the business. There are relatively low barriers to entry in setting up a new restaurant.

- Hairdressers. A service which will give firms a reputation for the quality of their hair-cutting.

- Clothing. Designer label clothes are about the brand and product differentiation

- TV programmes – globalisation has increased the diversity of tv programmes from networks around the world. Consumers can choose between domestic channels but also imports from other countries and new services, such as Netflix.

Limitations of the model of monopolistic competition

- Some firms will be better at brand differentiation and therefore, in the real world, they will be able to make supernormal profit.

- New firms will not be seen as a close substitute.

- There is considerable overlap with oligopoly – except the model of monopolistic competition assumes no barriers to entry. In the real world, there are likely to be at least some barriers to entry

- If a firm has strong brand loyalty and product differentiation – this itself becomes a barrier to entry. A new firm can’t easily capture the brand loyalty.

- Many industries, we may describe as monopolistically competitive are very profitable, so the assumption of normal profits is too simplistic.

Key difference with monopoly

In monopolistic competition there are no barriers to entry. Therefore in long run, the market will be competitive, with firms making normal profit.

Key difference with perfect competition

In Monopolistic competition, firms do produce differentiated products, therefore, they are not price takers (perfectly elastic demand). They have inelastic demand.

New trade theory and monopolistic competition

New trade theory places importance on the model of monopolistic competition for explaining trends in trade patterns. New trade theory suggests that a key element of product development is the drive for product differentiation – creating strong brands and new features for products. Therefore, specialisation doesn’t need to be based on traditional theories of comparative advantage, but we can have countries both importing and exporting the same good. For example, we import Italian fashion labels and export British fashion labels. To consumers, the importance is the choice of goods.

Readers Question: if all firms in a monopolistic competitive industry were to merge would that firm produce as many different brands or just one brand?

Interesting question. I think it is an open-ended question with many different possibilities. One approach is to think how firms in different industries may behave if they did merge. Bearing in mind the model of monopolistic competition doesn’t always stand up to scrutiny too well in the real world.

If the firms merged together, there is no certainty how they would behave.

In some industries, it makes sense to have many differentiated brands creating an illusion of competition and providing a barrier to entry.

How many soap powders are there? About 35. But, most of these brands are owned by two companies, Unilever and Proctor and Gamble. Having brand proliferation means it is harder for a new firm to enter the market. This is because a new firm would have to compete against 30 established brands as opposed to 2. There is less chance of getting a good market share with so many brands. Therefore the new firm would have an incentive to keep different brands to deter competitors.

However, if you have merge different brands there may be economies of scale. You can devote more resources and investment to improving that particular product and maximising its efficiency. This might be appropriate for an industry like computer software or computers. There used to be many different brands of computers until the pc came to dominate.

Are the different brands catering to different sectors of the market. If you take the restaurant business, there is a big difference between Chinese and Indian. If 2 restaurants merge, they would be better off retaining distinct business. It would make no sense to have a restaurant which offered a mixture of Chinese/Indian – consumers would trust it less.

If you fear the arrival of a powerful company, it might be good to consolidate your brands. For example, there are many small search engines, but they would be better off combining forces to compete against the mighty Google.

Related

Thanks for writing this blog

It was a great help with my essay (If monopolistic competition combines the disadvantages of monopolies and perfect competition or not)

it was profitable for my understanding about monopolistic market

thanks for your valuable sharing

i was very confused in monoply & monopolistic competition.. A greatful thank you for ur blog..

Thank you for the the blog, it really helped me with my presentation on different market structures.

Thank you so very much! really helpful!

Thank you

This is very helpful article for business students.

are their any economies of scale in monopolistic competition

i had a question which explained situations of two restaurants one was priced higher than the other. the restaurant that had more customers waiting had relatively low prices and the other had a few. why wouldn’t the restaurant which is busy increase the prices and earn more profit. and how will maintaining low prices and making costumers wait be beneficial for the restaurant in long run

Thanks

More clarity

But its just cool

can you help me with more matter on monopolistic competition with some related news and facts for my project.

monopolistic have relatively elastic demand curve right ?