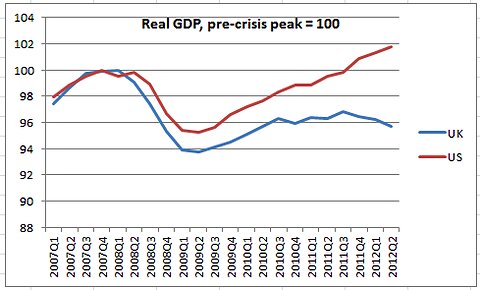

What explains the difference between UK and US economic growth rates since the start of the crisis in late 2007?

Firstly, the recession was slightly deeper in the UK with a 6% fall in real GDP during 2008. Possibly, the recession was deeper in the UK because of our greater reliance on the financial sector. Since the UK finance sector accounted for a bigger % of GDP than other countries, the financial crisis hit the UK economy particularly hard. With job losses and a fall in bank profits, there was a bigger knock on effect to UK demand and economic growth.

Difficulties Since 2010

Since 2010, the UK recovery has faded away. Real GDP is now at the same level compared to Q3 in 2010. This is not what you expect when recovering from a recession.

The break down of the UK recovery happens to coincide with the General Election of May 2010. You could argue this is unfortunate timing because the Eurozone economy also started to falter around this period too.

However, I don’t think you can ignore the link between the breakdown in economic recovery and the policy decisions of the new coalition government.

Firstly the rhetoric was significantly changed. Suddenly on coming to power, all we heard about was

- What a mess the economy was in.

- How critical it was to tackle the deficit .

- How necessary severe austerity would be.

Could the UK recovery have been Maintained?

Hindsight is a wonderful thing. But, if the government had stuck to a broadly Keynesian strategy of promoting economic growth over short-term deficit reduction, would the UK have continued it’s slow economic recovery? I believe the UK economy could have continued its recovery. And ironically, we would now be in a stronger position to reduce long-term debt.

As Ralph Musgrave posted in a comment about Keynes’ saying. “Look after unemployment and the budget looks after itself”. (UK borrowing figures dissapoint) But, has the government understood this?

Yes, the Eurozone was experiencing difficulties, but the Eurozone crisis alone, wasn’t sufficient to bring about a double dip recession. The main drags to UK growth have been in the construction and manufacturing sector, and also the collapse in consumer confidence. Construction is a sector government intervention could have promoted the construction sector. Talk of recovery rather than austerity would have helped consumer confidence.

Related