In recent years, we have had a devastating global credit crunch, the longest and deepest recession since the 1930s and then the impact of Covid. Yet, despite this financial and economic upheaval, UK house prices have bucked the trend, avoided a major collapse and now exceeded pre-crash levels. The economics of Covid have even made house prices (outside city centres) more expensive and the feasibility of working from home increases.

It is true that in the first years of the credit crunch, UK house prices did fall 20%. But, this proved a temporary blip and the ratio of house prices to earnings continue to rise.

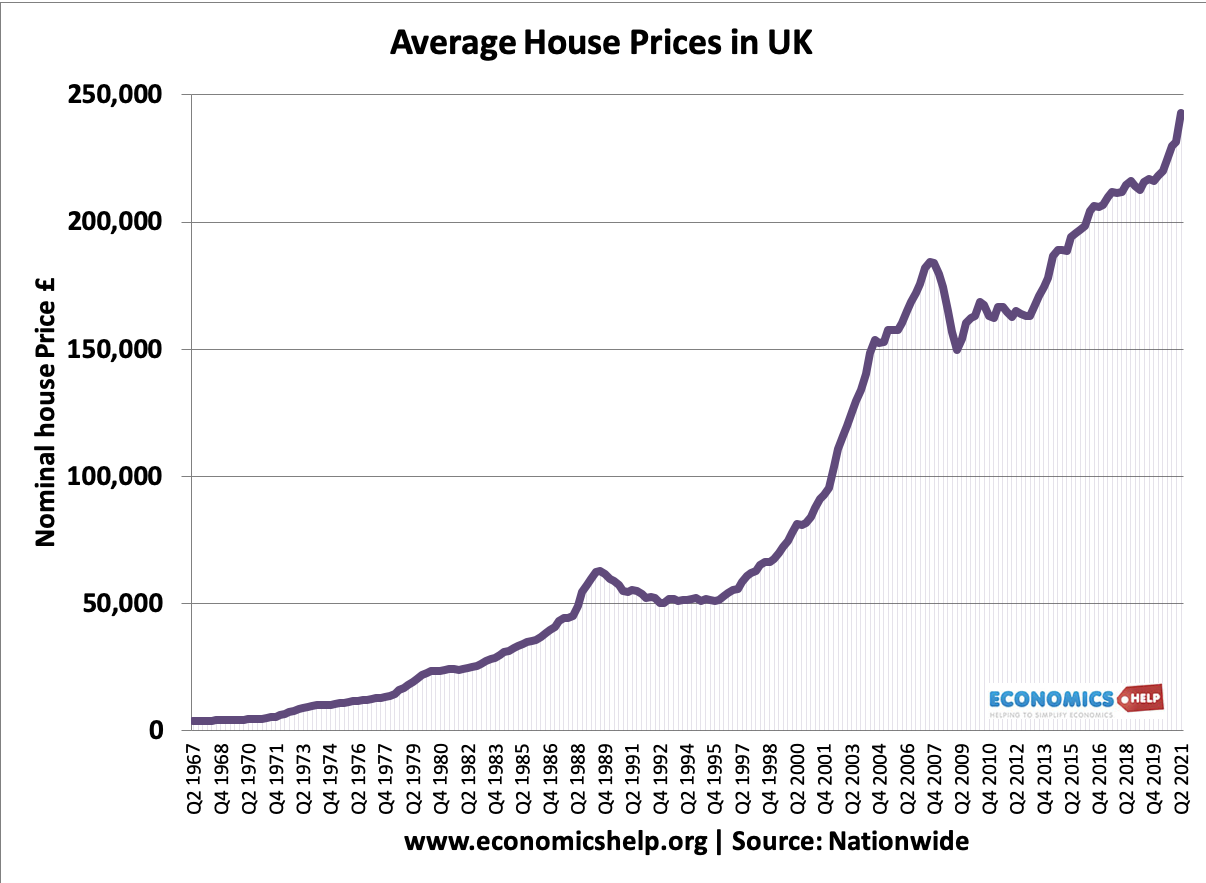

According to the ONS the average house price in the UK was £278,000 in March 2022. (ONS)

Average selling house prices according to the Nationwide

According to the Nationwide, house prices are now well above their 2007 peak.

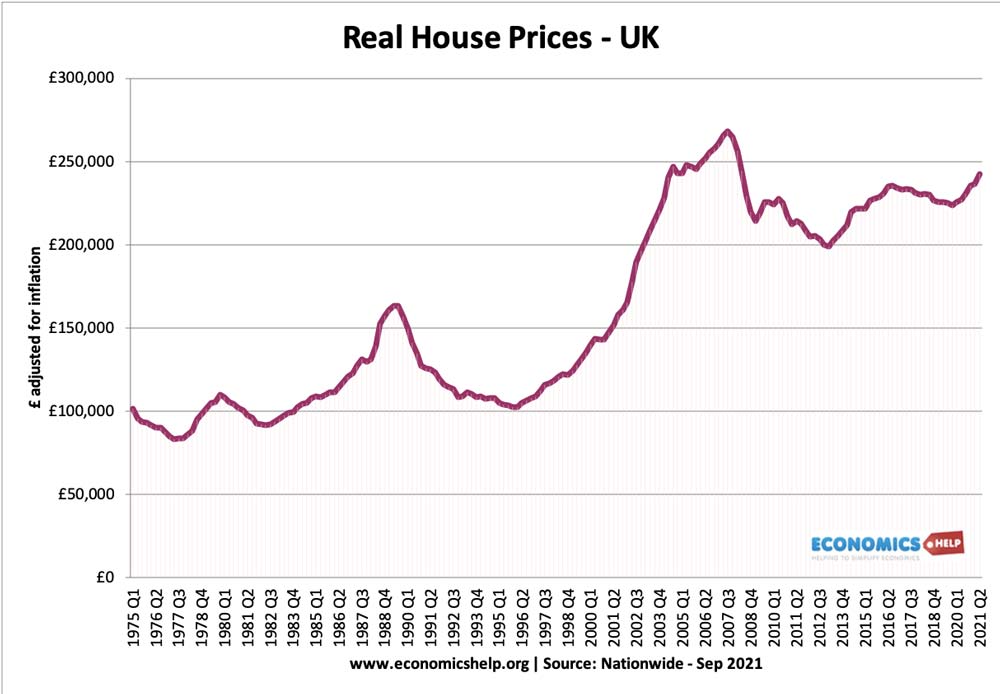

This graph shows that since the 1970s, house prices have risen significantly – even adjusted for inflation.

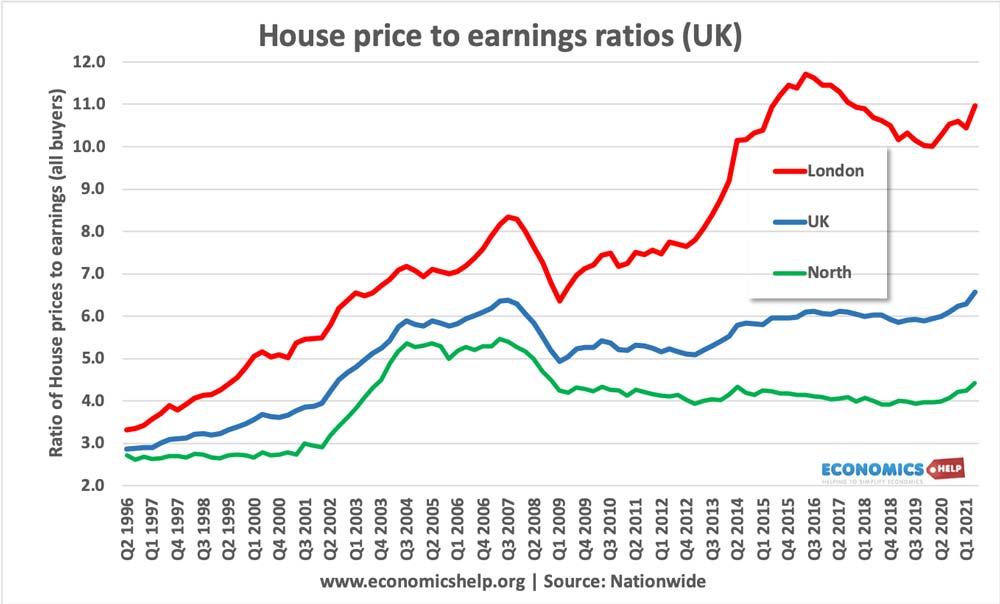

More worryingly, the ratio of house prices to income continues to remain above long-term trends.

This shows the ratio of house price to incomes for all buyers. House price to income ratios are more than double levels seen in the mid-1990s.

It is also worth noting there is a sharp north-south divide. House price rises in London are particularly unaffordable.

What explains the continued lack of affordability for the UK housing market?

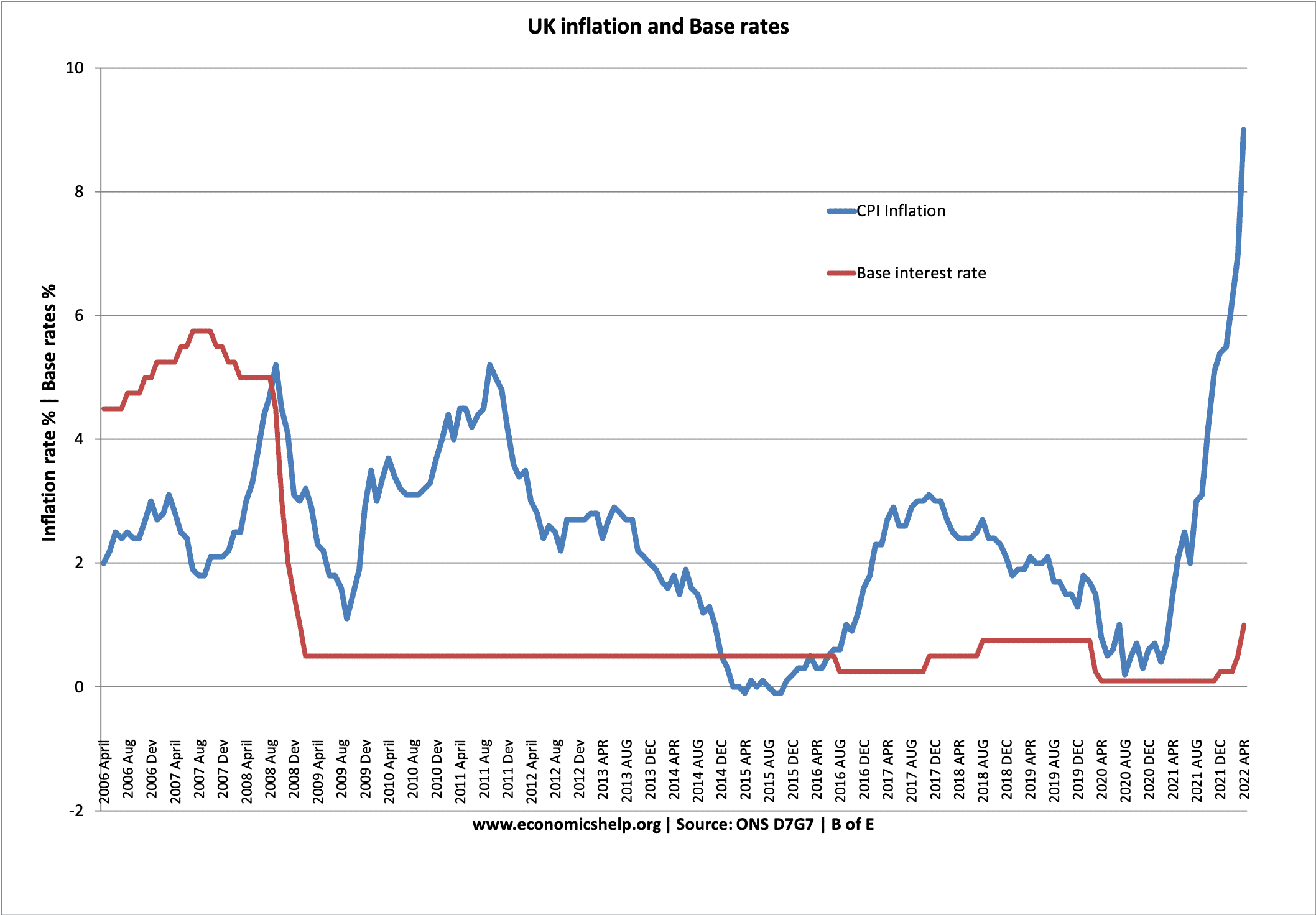

1. Relatively Low-Interest rates

Low interest rates have definitely helped increase house prices. Low-interest rates make buying a house more attractive than renting. Also, low interest rates mean that buying a house can give a better rate of return than buying other forms of investment, such as shares. An investor looks at the return on housing (rentable income) vs cost of buying a house (mortgage interest payments). Very low interest rates increase the attractiveness of buying a house as an investment.

Since 1992 interest rates in the UK have fallen from 15% to 0.5%, making the cost of getting a mortgage much lower.

During a period of high inflation (as we see in 2022) it also makes it attractive to buy a house as during periods of high inflation, houses (a real asset) will hold their value better than cash in a bnk.

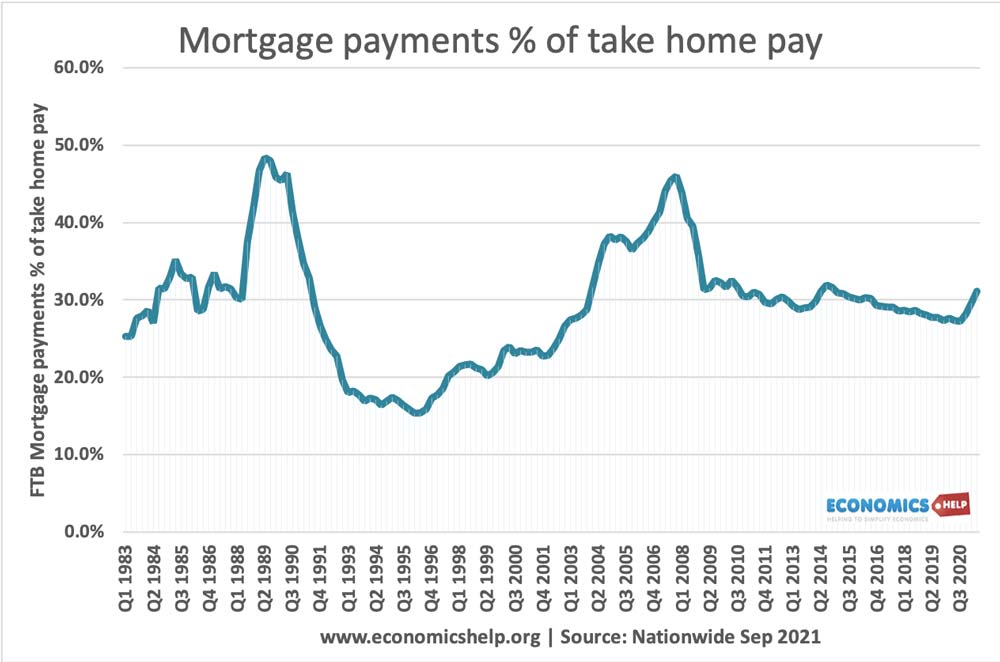

This shows the affordability of mortgages – despite rising prices, low-interest rates have kept buying relatively affordable.

To highlight the importance of interest rates on house prices, In a recent paper by the Bank of England, Miles and Monro calculate that:

“Over time, a 1 per cent rise in real interest rates from their present level would push real house prices down by nearly 20 per cent.”

Bank of England Staff Working Paper No. 837, Dec. 2020.

Basically, the era of very low interest rates has been a key factor in pushing up house prices.

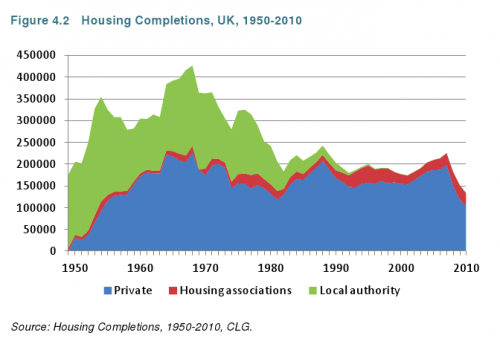

2. Constraints on House Building/supply

Because of the growing number of households and growing demand for housing, the government estimate we need to build 250,000 new houses a year, just to keep pace. However, despite many politicians talking about the necessity of building homes, in practice, we have a reluctance/inability to build houses. House building is at its lowest level since the second world war. In 2012, only 107,000 houses were built – much less than the 250,000 the government feel is necessary to keep pace with a rising population.

There are many constraints on the building of houses:

- In the most popular areas, there is a shortage of supply. It is difficult to find new land around greater London

- Environmental cost. The British have a strong attachment to preserving “greenbelt land” Many areas are protected from further housing development.

- Not in my back yard. People are usually in favour of more homes being built, as long as they are not in their local area. Increasing supply of houses leads to more congestion, crowded amenities and loss of greenbelt land.

- Vested interests perhaps most importantly increased supply reduces the value of your existing home. Therefore, existing homeowners have a vested interest in keeping the supply as low as possible in their area.

- Lack of Social Housing. Since Mrs Thatcher encouraged the sale of council housing, the number of new social housing (a euphemism for council housing) has been very low.

The consequence of this growing demand compared to limited growth in supply, is that there is strong economic pressure on house prices.

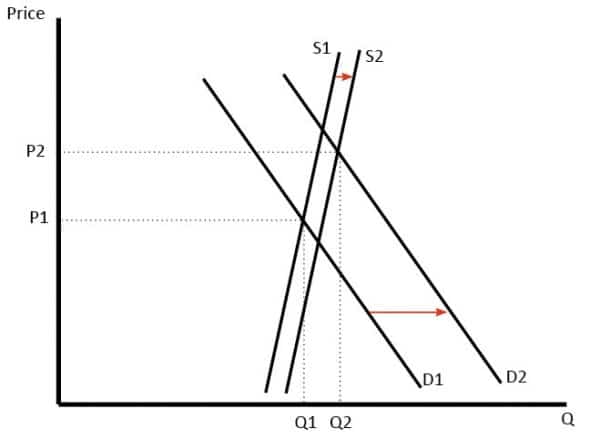

UK Housing market has often seen demand increase at a faster rate than supply, causing price to rise.

When Ireland and Spain experienced a housing boom, they also built 400,000 homes a year. When the bubble burst, there were numerous unsold properties. This excess housing stock dragged down prices. The UK never had this excess supply, which explains why prices didn’t fall as rapidly.

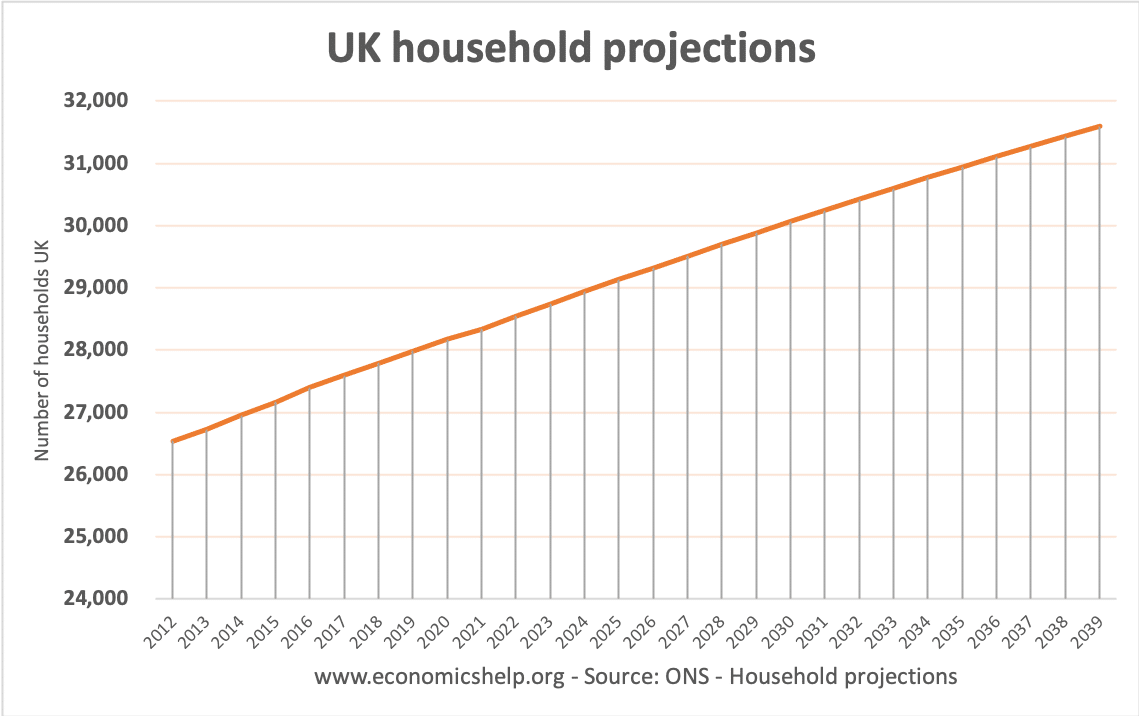

3. Demand is growing

A very simple economic truth: if demand increases faster than supply then prices will rise. Despite some short-term fluctuations, demand for housing has been rising at a faster rate than the supply. The UK population continues to grow (52 million in 1960 to 63.23 million in 2012). The forecast is for 71 million by 2033. Also, the number of householders is growing at a faster rate than the population. Demographic changes, such as higher divorce rates, and more single people living alone, have meant an increase in the number of households.

4. Strong demand for homeownership

In recent years, the % of first-time buyers has fallen. The number of people able to buy a house has fallen, due to the decline in affordability. However, there is a strong cultural and economic desire to own your property. Increasingly common is for parents to help their children to buy a house, with a deposit or even putting the mortgage in their name. This has enabled first-time buyers to overcome the impossible income multiples and buy despite the expensive prices.

5. Speculation / Buy to let

Despite the volatile nature of the housing market, housing has increasingly been seen as a good investment. The returns on buying a house have consistently outperformed the stock market. This has encouraged a new generation of buy to let investors, this has helped to increase demand further. In London, there has been a lot of demand from foreign nationals such as Russians and Arabs. Some argue this speculative increase in demand means the high house prices are unsustainable and are liable to fall. But, it also shows that the housing market is highly regional with London prices strongly outperforming other regions, especially in the north.

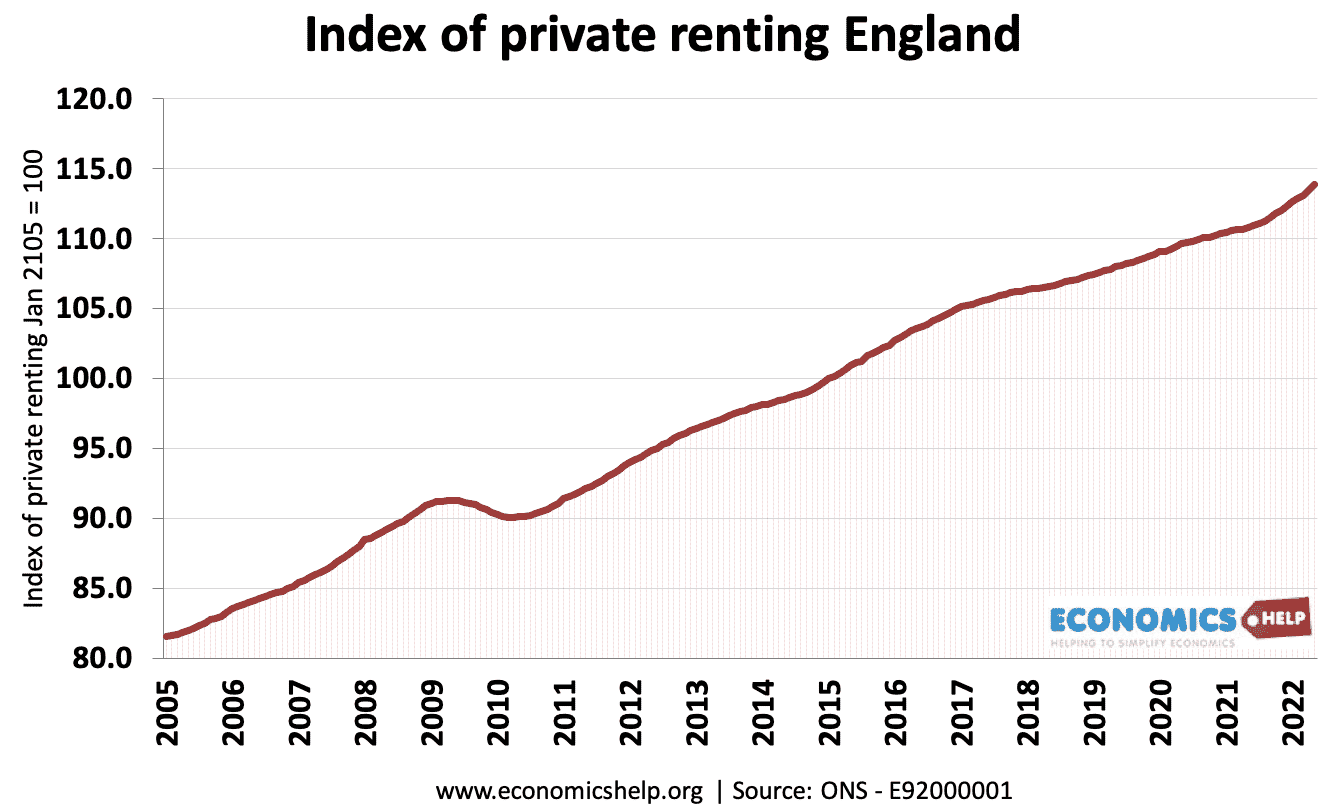

6. Renting is also expensive

The alternative to buying a house is renting. But, the cost of renting has also risen faster than incomes. If you are paying £800 a month, it makes sense to try and get a mortgage where you will be paying £900 a month, even if it means borrowing up to 6 or 7 times your income. The increased price of renting reflects the fundamental imbalance in demand and supply. It is true that the price of housing is now rising faster than renting, but it still makes economic sense to buy rather than rent. This means people are increasingly looking towards unconventional mortgages to help them buy a house.

The expensive nature of the UK housing market raises significant concerns such as – lack of geographical mobility, wealth and income inequality, an economy vulnerable to boom and busts in house prices. But, it doesn’t look like changing in the near future.

7. The Covid Effect

In March 2021 the Covid shutdown led to an unprecedented fall in GDP, with many workers losing income or their jobs. Despite GDP still being below the pre-crisis trend there has been no let up in the rise in UK house prices. Whilst those on furlow may struggle with rent, Covid has ironically made buying a house even more attractive. There is likely to be a long-term shift towards buying a house. Therefore, a good living space becomes even more desirable. This is shown in the contrast between growth of prices in city centres and in the suburbs.

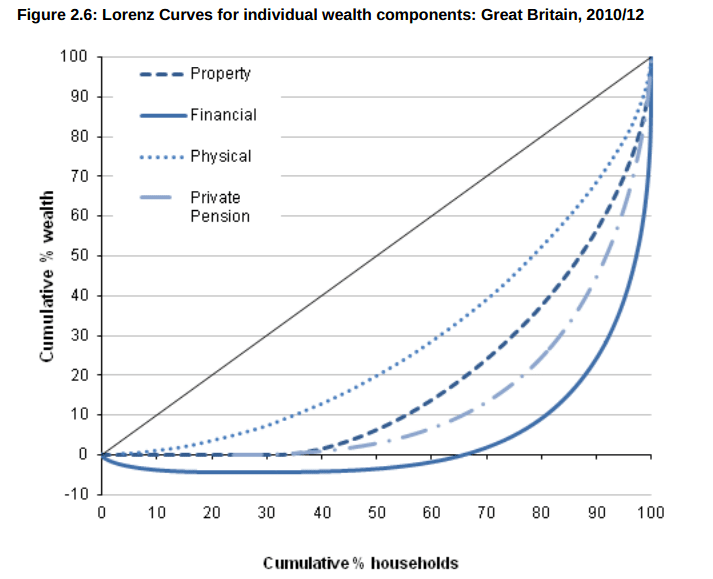

8. Wealth inequality

Related

I’m still puzzled by the house price increases over the last 20 years or so. There is no one factor that’s obviously the explanation.

Coincidentally the same thing has happened in Sweden. See:

http://larspsyll.wordpress.com/2013/09/17/lars-e-o-svensson-gets-it-so-wrong-so-wrong/#comment-6735

What have Sweden and the UK got in common that explains the house price increase in both countries? Darned if I know.

Mass immigration

It’s the accumulation of wealth by the rich and super rich:

https://youtu.be/LsWl-2UdgQk

It’s ridiculously expensive to live in London and the South East, but where will new houses be built?

They will be built where there is high demand, which is where there is access to well paid jobs i.e. London and the SE, since global companies want the prestige of a London postcode for their head offices.

House prices are completely a function of bank lending.

Housing supply is essentially fixed, even in an economy that is building houses, they take time to construct and are drip-fed by developers to maximise profit.

New housing is typically built on marginal land – all the best locations are already occupied. This means that whilst you might be able to build enough houses for everyone, you can’t build a house for everyone in the most desired locations. Thus you can never satisfy demand just with new supply.

If mortgage credit is in ready supply and cheap then prices will be bid up. Ultimately of course credit expansion cannot go on for ever; debts needs to be serviced by wages and profits. History shows us that credit expansion always outstrips the productive economy, driving booms and busts.

Counter-cyclical policies need to restrict lending for property purchase and I would also propose a location value tax to control demand and encourage efficient usage of land.

Debasement of currency through credit expansion (we live in a Creditist not a Capitalist economy), coupled with near-zero interest rates, which, adjusted for CPI inflation, means negative real interest rates (and then adjusted again for real inflation, i.e.: set by 1980 levels), you have a colossal deflationary arc. Bond and gilt yields falling steadily towards zero, meaning bond prices rise – the only way to grow or protect wealth is through trade in assets, especially since the global eurodollar drought that finally hit in August 2007, and has meant that real growth in terms of business activity has been anaemic since the GFC.

History shows us that if credit does not expand by at least 2% per year, then recession happens, this may be why 2% is the sought after inflation number or it may be a coincidence, like the coincidence of the annual inflation rate of gold.

The situation looks primed for a long period of stagflation well into the 2030s, if not persistent inflation pricing the majority out of both buying and renting if you’re not in the top third of households.

Thsi Creditism seems unsustainable given the long-term deflationary demographics that don’t just afflict the west, but also are a daunting prospect for the workshop of the world, China, which is now engaged in a colossal and painful derisking process.

The revcovery stage of the housing market is definitely over. I believe the Help To Buy Scheme that was introduced in 2013 has had an impact on house prices increasing and as you pointed out a strong hold in home owner ship rather than to let properties. Bob has a good point…where are new houses going to be built? From living in the South-East there are numerous new housing developments being built with most first time buyers grasping on the government scheme to ensure ownership.

what the hell is the govt doing with all that vat, they are doing to us as they did to americans over 200 years ago,thats why they kicked us out.its taxation without representation.they need to be accountable.they could do something about the housing crisis.seems like they dont care.in ny vat 8% .i thought we were self sufficient in oil,so is us but their petrol price average 85p liter.oppress the poor feed the rich.damned socialist regimn

Oppressing the poor and feeding the rich is the motto of Capitalism.

This is really informative and helpful. Great blog by the way and thanks for sharing this useful information.

It’s because we have let the Developers have full monopoly on the land in the UK. If we stopped selling land to overseas investor then people would not be in this financial pit. Councils have no accountability so all services are poorly handled and Councillors have the upper hand which opens the whole process to corruption. A lot of the Councillors within Councils are good friends or family of the big building developers buisnesses. Often what happens is the Developers puts pressure on Green belt land and get it converted and then just sit on it and sell it off later on with a massive profit.

The Government clearly has no idea and likes to put out blame, but the truth is there is loads of land to be build on. If the Government put in requirements on land that hasn’t been built on within a certain time frame it will be converted back to Green belt then real building will happen instead of the dribs and drabs.

Informative article. Thanks!

I see mortgages and the control of the banks on lending as being key to house price inflation. Every pound of a mortgage loan gives the banks multiple pounds (10 x + ?) to use so they don’t need high interest rates anymore to make money. This creates ‘debt growth’ and an inflated supply of buyers dependent on mortgage loans to pay for and perpetuate inflated prices. The Government is in record levels of debt and is influenced to align with the banks and financiers interests of promoting debt and mortgages in society. I don’t think most people realise or understand the consequences of this for price inflation in what is effectively a fixed or limited supply of housing!

Less than 1% of the population owns 70% of the land. This is a problem stemming back almost 1000 years, from when the Normans invaded and William the Conqueror declared that every acre of land in England now belonged to the monarch.

The dukes and earls who still own so much of the nation’s land, and who feature every year on the breathless rich lists, are the beneficiaries of this astonishing land grab.

Coupled with mass immigration as John Rutherford said, house prices have continued to rise.

Not only that, shorthold tenancies offer little protection to sitting tenants who can readily lose their home at the end of the term. Coupled with high charges for landlords who want to evict their tenants, and the way the Government is using landlords to resolve the social housing crisis by passing a law that states landlords can’t evict tenants and blaming covid-19, landlords have had enough and are now selling their properties. The high capital gains tax they then have to pay is ensuring prices stay high as they can’t sell for any less without making a loss.

So what we now have is frustrated landlords, frustrated tenants with little to no security, a divide between the north and south, very low interest rates, and people having to resort to asking their family for help. It has all gone to pot.

Do you really think that now we are 9 months into the year with a recession, massive job losses, and no hope that the pandemic will be over soon, that it doesn’t look like there is going to be a crash very soon?

I agree totally with you Matt , the job losses are coming mid year, and all the furloughed staff being cut off , with companies reporting bankruptcy and people defaulting on the loans given to businesses will be a messy 2021

What about building with dangerous cladding grenfell tower and other buildings.

Very valuable information, it is not at all blogs that we find this, I was looking for something like that and found it here.

Unfortunately it is entirely due to the knock-on effect of uncontrolled immigration.

People have to live somewhere.