Readers Question: Could you comment on This BBC programme on Q.E.

The programme highlights several criticisms of Quantitative Easing, especially the Q.E. adopted by the Bank of England.

Since 2009, the Bank of England’s balance sheet has quadrupled, and now a third of all government bonds are now held by Bank of England. The programme fears this is storing up future inflation and a possible loss of confidence in the bond market.

Firstly, just to recap:

Quantitative easing involves

- Central Bank creating money electronically

- Using this electronic money to purchase bonds (mostly government bonds)

The effect of quantitative easing has been

- To reduce bond yields on government debt.

- Increase money supply and bank reserves of commercial banks.

Drawbacks of quantitative easing

- The new inflow of money into commercial banks from quantitative easing has encouraged banks to use this extra money through greater risk-taking. Some argue that Q.E. has increased the risk-taking nature of banks (a problem behind 2008 crisis)

- Bond traders have benefited from making large profits out of the Bank of England by manipulating the bond market.

- Because government debt is being financed by quantitative easing, the government has less market discipline to think about reducing fiscal deficits and tackle the underlying problem of UK public sector debt rising to 100% of GDP by 2016.

- Quantitative easing has been a stealth method of reducing the value of the Pound and Dollar – and therefore making UK exports cheaper. Some commentators call this currency manipulation (or currency wars). They argue this is unfair on emerging markets who are seeing their exports become less competitive.

- The increase in money supply has led to an unexpected rise in commodity prices, such as oil. This is unusual when the Western economies are in recession; rising oil prices have led to cost-push inflation.

- By depressing interest rates, quantitative easing has wiped out people’s return on savings (though share price rises have compensated to a certain extent.)

- Quantitative easing is causing inflation in the UK. (Inflation has frequently been above the government’s target of 2%, and when the velocity of circulation rises, these extra bank balances will be lent – causing a possible inflationary surge.

- The scale of quantitative easing could make it impossible to sell bonds back to the market and this will damage the UK’s ability to borrow in the future. If the UK’s ability to borrow is constrained, this will lead to higher interest rates and reduce economic growth.

- Evidence in the US suggests even raising the possibility of tapering could cause damage to the bond market, and higher interest rates. These higher interest rates could reduce economic growth.

Potential benefits of Q.E.

- Low bank lending. There is no real evidence that there has been a surge in risky bank lending. In fact, the opposite has been the main concern over the past few years. – A more potent criticism of Q.E. is perhaps that it did so little to increase commercial bank lending. Bank lending is still very low compared to pre-crisis trends.

- We need fiscal expansion, not austerity. It is a very good thing if Quantitative easing has reduced the need for austerity and immediate measures to cut budget deficits. If the UK has pursued Greek or Spanish style austerity, the UK recovery would have been much weaker or non-existent. A recession is not the time to tackle the public sector debt. The important thing is to promote economic growth; this will enable debt to be tackled in the long term when the economy can better absorb spending cuts and tax rises.

- No currency manipulation. It is hard to accuse the UK of currency manipulation when we have a current account deficit of nearly 3% of GDP. The current account suggests the UK is still uncompetitive. Given the fact the UK GDP is still lower than in 2008, it is the correct thing for the monetary authorities to try and pursue monetary policy which promotes economic recovery and higher employment. It is not currency manipulation when you are pursuing a reasonable monetary policy given the state of the economy and lost GDP.

- Inflation has not been a macroeconomic problem since 2008. The main macro-problem has been significant fall in GDP and unemployment. The Bank of England is correct to concentrate on these real problems. True, inflation has been a little above target, contributing to a reduction in real wages. But, the inflation is due to cost-push factors like rising oil prices and the effects of depreciation. There is no sign of an inflationary surge. The programme blames Q.E. for the fall in real wages. But, I believe this is wrong, the fall in real wages is because of the recession and collapse in wage growth. The best way to promote real wage growth is to target economic recovery. It is economic recovery which will enable real wage growth and higher living standards. I don’t accept that Q.E. is the major factor behind falling real wages. Real wages would definitely have fallen without Q.E.

- Europe inflation still too low. Inflation in the ECB is 0.8% – that is still low and creates the risk of deflationary pressures. This suggests the ECB have done too little money creation and have pursued too tight monetary policy. Unemployment in the Eurozone is 12%, significantly higher than the UK. UK unemployment may well be higher if we hadn’t pursued quantitative easing.

- Future inflationary surge? It is true that if the velocity of circulation rises, there could be inflationary pressure. But, given the level of unemployment and spare capacity in the economy, the inflationary surge is hard to see. It hasn’t materialised in past 5 years.

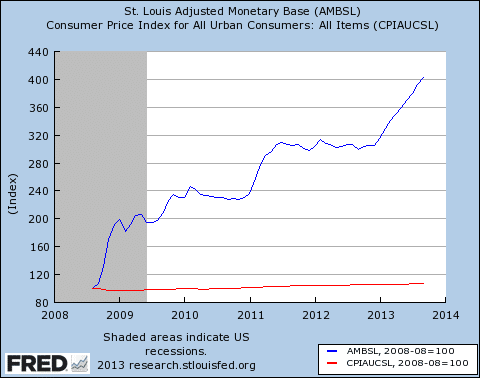

The blue line is the monetary base (one form of money supply). This surge in the monetary base has had no effect on inflation.

- Also, as Adam Posen says, it is possible for the Bank of England to deal with inflation, should it reappear. It is more difficult to deal with the stagnant economy.

Conclusion

Quantitative easing is an untried and imperfect policy. The programme makes good points about how traders benefited unfairly, and also it is a significant point that Q.E. has created a strong political and economic pressure group to maintain Q.E. out of selfish motives. It is also very uncertain what will happen as the economy returns to normal and the Central Banks try to taper and end Q.E. But, though it is imperfect and there is risk of different problems – given the uniquely dire state of the economy in the past few years, I still feel Q.E. was better than the alternative – that alternative was accepting a deeper and more prolonged recession.

QE is not new. Only the scale of it recently is new. The big problem IMO is not the use of QE but the contradictory combination of QE with fiscal austerity; especially prolonged austerity. One or the other and austerity for the minimum possible length of time. Only long enough to re-prioritise where money is spent, rather than blanket austerity.

The biggest criticism of QE is the house price and stock market inflation that has been created. This has caused massive housing poverty.

The major complaint of QE is the inflation it has caused in stock and housing prices. The result has been extreme housing poverty.

This has caused massive housing poverty.

QE is the house price and stock market inflation that has been created. This has caused massive housing poverty.

This has caused massive housing poverty.