I have quite a few readers in India, so I’d like to have a brief look at the Indian economy and it’s prospects for the coming year. After spending so much time looking at the (rather depressing) economics of austerity in Europe and UK, it makes a welcome change to look at a developing economy with a different set of challenges and problems.

Indian economy in summary

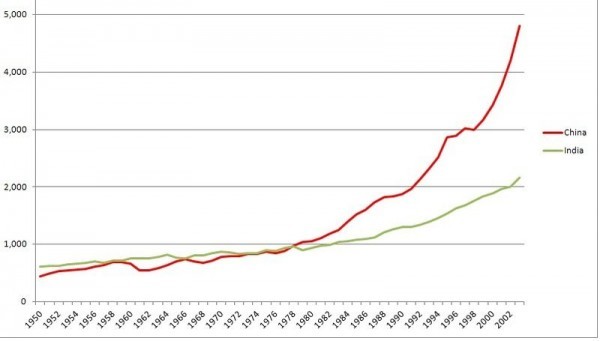

For those not familiar with the Indian economy. In the post-independence era, 1947 – 91, India was a mixed economy with a high degree of state intervention – including nationalisation and price controls. The economic performance was mixed but generally disappointing. Since 1991, the economy has pursued a general approach of free market liberalisation and greater investment in infrastructure. This helped the Indian economy to achieve a rapid rate of economic growth and economic development. The economy has become more open, with significant growth in exports and imports. The economic growth has led to a boom in investment, real estate and a growth of the financial sector. To many, India is the second China and the economy has the potential to become one of the largest in the world.

However, at the present time, the Indian economy faces several challenges.

- In the past couple of years, there has been a fall in the rate of growth causing concern that the period of high growth is coming to an end. (growth fell to a low of 4.4% in 2013 – bear in mind, India’s rising population mean GDP per capita is less impressive than just real GDP growth)

- India has struggled to keep inflation low. In 2013, inflation was nudging near 10%, hurting the living standards of the poor who are particularly vulnerable to the price of food. High inflation is also harming confidence for investment.

- Current account deficit. India’s growth has been at the cost of a persistent current account deficit (which reached over 6% of GDP in 2012). India needs to import crude oil, machinery and many other raw commodities. Its export sector has struggled to match the growth of imports.

- Rupee devaluation. The large current account deficit has caused the Rupee to fall, despite very low-interest rates in the US and Europe.

- Inequality / poverty. Parts of the Indian economy have made rapid growth, but it has proved difficult for the fruits of economic growth to filter through to all areas of the economy, especially isolated rural areas where there is poor infrastructure.

- Government budget deficit. Despite years of economic growth, the government has found it difficult to balance the budget. The budget deficit is 4.8% of GDP in the year 2012–13. Public sector debt is 68.05% of GDP, one of highest for a developing economy. Tax collection is still limited by tax evasion and corruption (tax collection only accounts for 9% of GDP – one of lowest in the world). The government is committed to reducing the budget deficit, but this may be at cost of social welfare programmes.

More detail on the Indian economy

Economic growth

Indian economic growth is predicted to be around 5% by March 2014. From European standards, this sounds very impressive. But, is much lower than the rate of nearly 10% achieved in much of the recent decade. Growth of 5% reflects the fact there is much spare capacity and scope for improvement. Without a high rate of growth, the concern is that it will lead to unemployment and discourage future investment. Politicians have been predicting upturns in the rate of economic growth for a long time, hoping it would come in the next quarter. Unfortunately, this has raised and then broken expectations. However, growth did finally pick up to 4.8% in Q3 2013. (higher than previous quarter of 4.4%)

Inflation

Inflation is a real problem for the Indian economy. It has proved stubbornly high. Inflation reached 11.24% in November 2013 – the highest for years. Inflation did fall back to 9.92% in Dec, but there is concern about the stubbornness of high inflation, despite the relatively sluggish growth. The chief of the Reserve Bank of India, Raghuram Rajan has made control of inflation his highest priority and has increased interest rates twice since his appointment in September. Rajan argues that price stability is key to India’s long-term prosperity. However, the concern is that inflationary pressures tend to be due to supply side factors (e.g. rising vegetable prices) and the use of monetary policy may be limited in solving this. For Rajan to tackle cost-push inflationary pressures using interest rates may damage prospects for growth without tackling the underlying inflationary causes. To tackle supply constraints which are behind the cost-push inflation will prove much more difficult.

The Central Bank repo rate is 7.75% (Central Bank of India)

Current account deficit

One benefit of the slowdown in economic growth has been the improvement in the current account deficit. Reaching a deficit of over 6.7% in last quarters 2012, the deficit has fallen to 1.2% in Q3 2013. This is an important improvement and means less foreign currency needs to be attracted to finance the deficit. However, the Economist notes that 75% of the deficit reduction is artificially related to reducing imports of gold through government restrictions. Therefore, there is still an underlying trade deficit, India will need to work on through increasing exports and competitiveness. This may require further devaluation in the Indian Rupee, which will increase the cost of living for many.

Indian Rupee

Since the beginning of 2012, there has been a significant fall in the Indian Rupee against the US dollar.

From 1 Indian Rupee = 0.023 US dollars (2012), the Rupee has fallen to 1 Indian Rupee = 0.0016 US dollars (2014). This is a reflection of the large current account deficit and uncertainties about the Indian economy. The concern is that a recovering American economy could see US rates and the US dollar increase, putting more pressure on the Indian Rupee.

To some extent, the devaluation of the Rupee has been necessary to improve India’s competitiveness. But, there is a danger that a rapid fall can cause a loss of confidence and increase import prices.

Open economy

One of the success stories of the Indian economy has been the improvement in trade in recent years. India has liberalised trade and seen its exports of both visibles and Invisibles grow. However, the downside of a more open economy is that the Indian economy is now more vulnerable to a downturn in the world economy. This can be offset by a diversification in trade away from Europe and the US.

Other indicators

- Unemployment in India is only 8.5% (2012 est.)

- There are still levels of extreme poverty. 21.9% of the population are considered to be living in poverty during 2011–12 (Tendulkar Methodology)

- Agriculture produces 17.4% of economic output but, over 51% of the population work in agriculture

India Statistics

- GDP PPP $4.716 trillion (2012 est.) 4th world

- GDP PPP per capita $3,800 (2012 est.) 168th

India at CIA fact file

Related Pages

Link between economic development in education and health and state whether education and health has effect on Indian’s economic development