Readers Question: would you be able to comment on what the Labour party’s latest proposal to break up the banks to create competition? I can see some reasons that relate to safe guarding possible failures of large banks which can prove costly if the government are needed to bail them out. However, in terms of helping to stimulate economic growth, would it help or is it like shuffling a deck of cards? I would greatly appreciate hearing your opinion on this.

Labour bank reforms include:

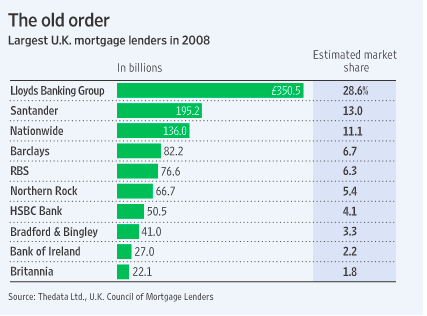

- A cap on the size of banks’ market share; this will involves splitting up large banks, such as Lloyds and RBS

- The introduction of two new challenger banks with an 8% market share.

- Refer the issue of banking competition to the Competition and Markets Authority (CMA), within one year of being elected.

Motive for bank reforms

- The UK banking sector has become more concentrated in recent years. This has created less competition and more market power. If the government is able to reduce market concentration and increase competition, then they hope that consumers will benefit from more choice and greater price competition. If the banking sector becomes more competitive, the theory is that it will put downward pressure on the cost of borrowing, and upward pressure on saving rates.

- The OFT found in a review of the current account market that, while the share of the four largest providers fell from 74 per cent in 2000 to 64 per cent in 2008, it then rose to 77 per cent in 2010.

- A report by Bain & Company, showed that the market share of the top six banks together account for 91% of retail deposits. The problem of high market concentration of retail banks is that market power leads to dominance in related financial products, such as mortgages, loans and overdrafts.

- Reducing the size of banks helps to deal with the issue of banks which are too big to fail. After the credit crisis, the government had to bail out large banks, at a cost to the taxpayer. Reducing the size of banks means that any bailout will be less costly.

source: WSJ – UK bank competition

- During the credit crisis there was a merger of Lloyds TSB and HBOS, to enable Lloyds banking group to gain a monopoly market share. The Competition Commission allowed the merger only because of the exceptional circumstances surrounding the credit crunch. Usually, they would not have allowed a merger which created more than 25% of market share. This is an opportunity to reverse this.

Difficulties of reforms

- Limiting market share is very difficult. It becomes a penalty for growing in size. It is one thing to block a merger, but to limit organic growth seems quite arbitrary.

- Limiting the size of banks to say 15% of market share is no guarantee that consumers will face lower prices and cheaper cost of banking. Many factors determine the cost of loans. The aftermath of the credit crunch has been a key factor in limiting small business lending. Economic growth is probably the most important thing for giving banks the incentive to lend.

- Limiting market share may encourage banks to go the other way and increase the cost of loans. If you can’t grow beyond a certain market share, a bank may feel it’s best strategy is to make loans expensive. If it reduces the cost of loans and gains more customers – it will have to sell off its banks anyway.

- Encouraging new banks into the market could be beneficial. But, it is not clear how a government could suddenly create banks with 8% market share to ‘challenge’ the other banks. It is worth noting that companies have been trying to enter the banking sector, with varying degrees of success. These include Virgin Money, Tesco finance – right down to very small scale, non profit making banks such as the Burnley and Saving Bank.

- Competition in banks is tricky to evaluate. The UK is rare in having free retail banking. In many countries you pay a monthly fee to have an account. We tend to subsidise this free banking by paying higher costs for overdrafts and loans. This can make it difficult for new firms to enter because the price structure is not transparent.

- The UK banking sector is less concentrated than many other countries.

Conclusion

I sympathise with the attempt to make the banking sector more competitive. In the long run, a more competitive market would have benefits for savers and business. However, it is tricky in practise to achieve. Unfortunately, I’m rather sceptical of the idea you can wave a magic wand and the market becomes more competitive. As much as I am suspicious of the banking sector, I think they have a point that arbitrary government limits on market share will be difficult to implement and limited benefits.

Perhaps the best way forward is for a government to concentrate on making the banking sector more contestable.

- Making it easier for local / community banks to set up – such as, reducing onerous costs of regulation for small scale local banks.

- Making it easier for consumers to switch accounts (rather than the four weeks it often takes at the moment)

- There might be scope for a government bank dedicated to helping flow of credit to small business. But, whether a government owned bank would be efficient and a good lender, it is hard to know

The final point is that bank competition is only one aspect of banking. Since the credit crunch, the spread between base rates and mortgage rates has increased significantly. I don’t think this is to the relatively small increase in market concentration, but due to the wider issue of banking sector health.

Related

- The future of UK banking (2008)

Hasn’t there already been widespread agreement about easing the switching of bank accounts? Towards the end of 2013 there was an agreement to enable customers to switch accounts within 7 working days: http://www.bbc.co.uk/news/business-25758345