Readers Question: Interest Rates are increased by the governments to bring down inflation rates, this makes exports price competitive as well, as a result, exports increase. However, an increase in interest rates can lead to an appreciation of the currency as demand for the currency increases. So this again increases the price of exports as the value of the currency increases. So I want to know whether an increase in interest rates improves the current account or worsens the current account.

The impact of an increase in interest rates on the current account balance of payments is uncertain. There are a few different implications. Interest rates affect both consumer spending (imports) and have an affect on the exchange rate (which affects the price of exports/imports) The effect of interest rates on the current account depends on which factor proves the most powerful. It is not possible to say definitely whether the current account will improve or worsen. – It depends.

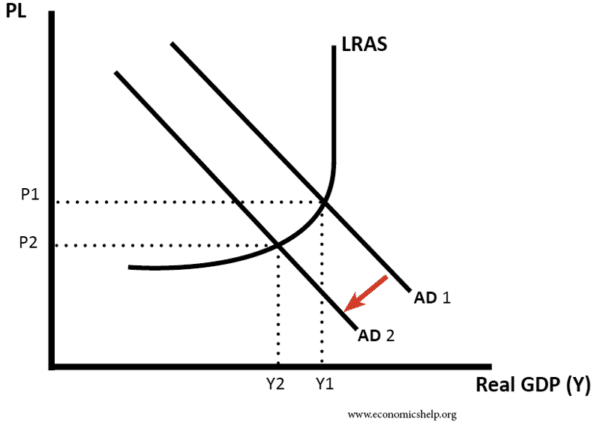

An increase in interest rates on macroeconomy

- Reduces consumer spending – (higher interest rates make it more attractive to save, and less incentive to borrow; therefore, this leads to lower disposable income after paying increased mortgage costs). Lower consumers spending will lead to lower import spending and therefore improve the current account

- Reduce inflation. Higher interest rates help reduce inflation making exports more competitive – improving current account

Exchange rate effect

- Higher interest rates lead to hot money flows and an appreciation of the exchange rate. This makes exports more expensive and imports cheaper. This tends to worsen the current account (assuming demand is relatively pricing elastic)

Which effect will be strongest?

In the UK, a rise in interest rates may often improve the current account because:

- Typically, the UK has a high propensity to spend on imports. A reduction in consumer spending could have a big impact on reducing import spending.

- Demand for exports is relatively price inelastic. Evidence suggests that movements in the exchange rate don’t have a big impact on demand for exports, suggesting in the short term at least, demand is inelastic.

Examples of current account and interest rates

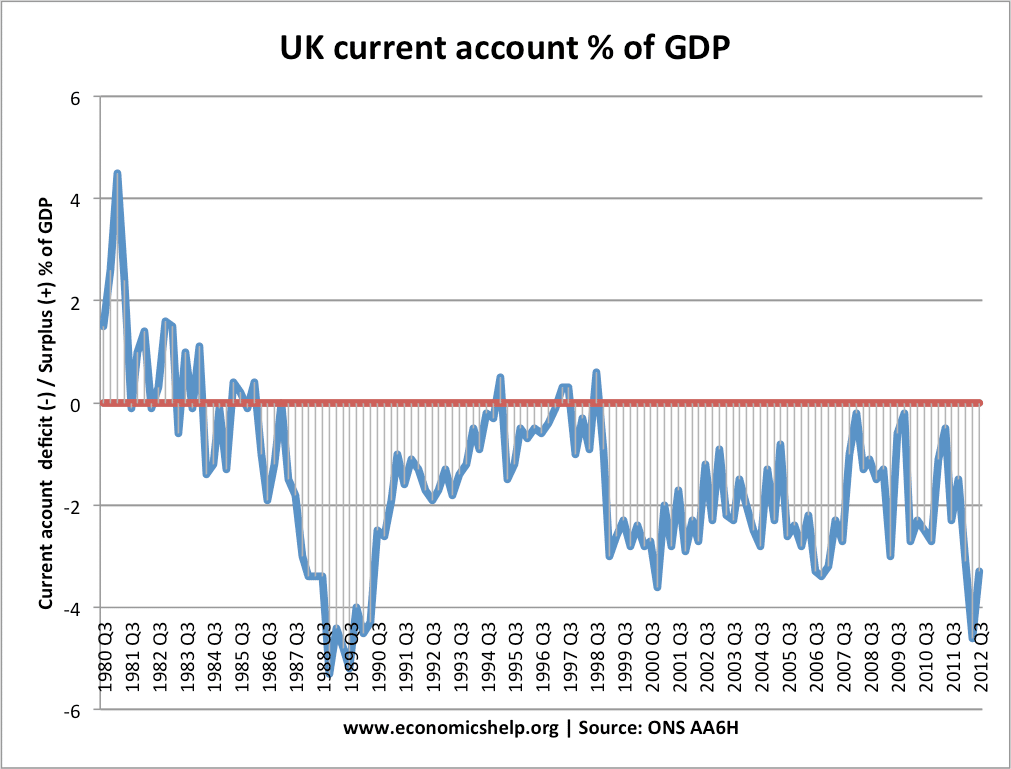

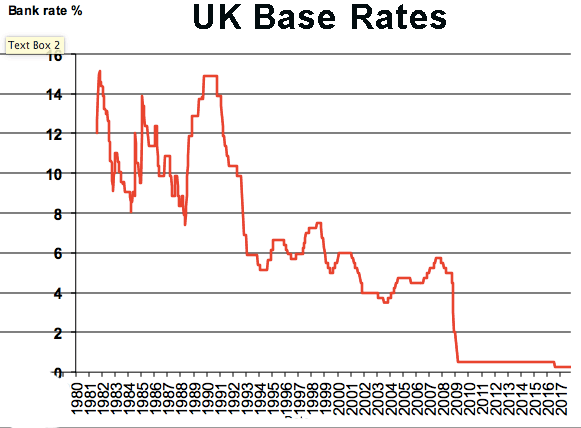

In 1989, the UK has a current account deficit of 5% of GDP. This reflects a period of strong economic growth, inflation and rising import spending.

However, because of the inflation, the government increased interest rates. This contributed towards the recession of 1991/92. As the economy slowed down, import spending fell and the current account improved.

The high-interest rates didn’t cause an appreciation – because markets felt the exchange rate was already overvalued.

Conclusion

The current account depends on many factors other than interest rates. This includes:

- Relative inflation rates. Higher inflation in the UK would make UK goods less competitive

- Stage of the economic cycle. Strong consumer spending will increase imports

- Nature of economy. If the economy is weighted towards export-led growth, then the economy may run a current account surplus – no matter what happens to interest rates. The UK has mostly run a persistent current account deficit since 1980, due to the process of deindustrialization.

Related

Wow, this site is amazing. I wish I could look at more of it, but I have an exam in about an hour :(. Yes, it’s economics :(. But with your help, and a few textbooks, I plan to absolutely nail my finals and get a good ATAR (I live in Western Australia, Albany). I’m doing your equivilent of A levels, we call them TEE level subjects.

I love the conclusion in this entry: ‘it depends’ haha how very true.

Well, I look forward to catching up with you sometime later on the net.

All the best,

George

Thank you for answering my question. It really did come in handy.

What happens to Monetary and asset approach to the Balance of payment when domestic interest rate falls?

How will a reduction in interest rates reduce a current account surplus after this country has been in a recession?

hopefully by reducing the exchange rate and therefore making exports cheaper and so increasing exports.

interest rate falls will stimulate consumer demand therefore imports will increase. Exports also become competitive because of the fall in the exchange rate . Whether current account surplus reduces or increases depends which is impacted most ie most responsive, the level of elasticity. For interest rate reduction to reduce a surplus then imports have to increase more than exports. The net effect hoped in this instance would be increase in imports are greater than any increase in exports, thus reducing the surplus.