Internal Devaluation – where a country seeks to regain competitiveness through lowering wage costs and increasing productivity and not reducing the value of the exchange rate.

A devaluation of the currency is a decision to allow a currency, in a fixed or semi-fixed exchange rate, to decrease in value. Devaluing the currency means that the economies exports will become more competitive, imports should be more expensive. This should lead to greater demand for exports and an improvement in the current account.

In some cases, a country may be unable or unwilling to allow a typical devaluation of the currency, but they still need to improve their competitiveness. To improve the competitiveness they may seek to reduce wage costs and increase labour productivity. This enables cheaper exports without resorting to a devaluation in the currency.

How to Pursue Internal Devaluation

- The government could increase VAT (expenditure tax) and reduce payroll taxes like National Insurance. This leaves overall tax intake the same but reduces the cost of hiring labour.

- Secondly, the government could reduce public sector wages and put pressure on other wages to decrease.

In practise internal devaluation, as practised by Latvia, Greece and Ireland, refers to a situation where there is much pressure to cut government spending and pursue fiscal austerity. This deflationary fiscal policy puts downward pressure on wages and inflation and gets close to actual deflation.

J.Stiglitz makes the point that when pursuing internal devaluation, it is important to also seek to increase competitiveness. This is to make sure wage cuts are passed onto consumers as lower prices and not just higher profit margins. (see: Fairness needed in internal devaluation)

Problems of Internal Devaluation

- Cutting public spending without any monetary stimulus leads to lower economic growth and higher unemployment. Internal devaluation can be a very painful process as it can take a long time to regain competitiveness by reducing prices and wages. Latvia has witnessed a long period of economic decline and higher unemployment since seeking to pursue a form of internal devaluation. The decline in Latvia GDP is a near record fall of 25%. [1. CEPR put much of the blame on the decision to maintain a fixed exchange rate and internal devaluation]

- Resistance to wage cuts. As Keynes noted, there is much resistance to nominal wage cuts. Unions invariably seek to maintain nominal wage levels leading to potential strikes and disruption.

- Inequality. Countries pursuing internal devaluation often rely on public sector wage cuts. However, some sectors are able to avoid the wage squeeze. Therefore, there is a feeling of unfairness – especially when high paying jobs like the banking sector were responsible for the problem in the first place.

- Debt Deflation. Countries which need internal devaluation, typically have high private sector and high public sector debt. By reducing inflation and possibly causing deflation, this increases the real value of debt and makes it difficult to reduce debt / GDP ratios. This rise in the debt to GDP ratio can make markets nervous. (see: Debt Deflation)

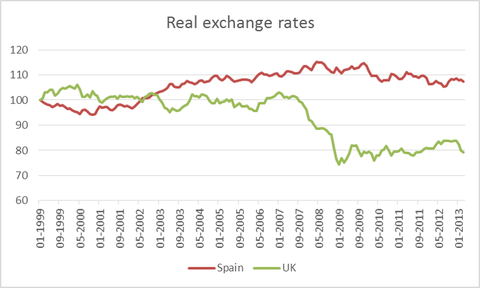

Comparison of UK vs Spain

BIS estimates of the Spanish and UK real exchange rates, 1999-01 = 100:

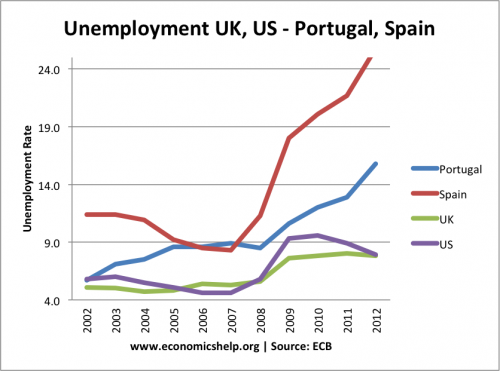

In 2007, the UK achieved a significant depreciation in the exchange rate. This helped to restore competitiveness in the UK economy. However, by comparison, Spain was in the Euro. It couldn’t devalue, however, Spain also faced uncompetitive wage costs. To restore competitiveness, Spain experienced a prolonged period of internal devaluation – negative growth and unemployment. A more painful way to reduce labour costs and restore relative competitiveness.

Related

‘We keep hearing that the authorities are going to do X, Y or Z and punish these people. The punishment is never strong enough. There’s never been one massive statement made.