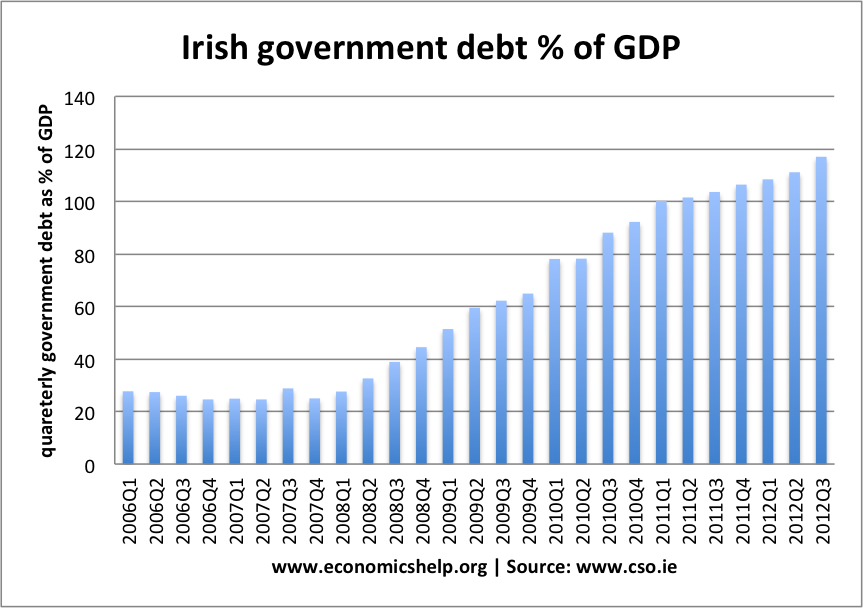

Irish national debt – the total amount of Irish government debt.

Irish national debt has increased to 117% of GDP in recent years because of a large financial bailout to Irish banks, deep recession which saw a 20% drop in nominal tax revenues, and continued weakness in GDP growth which has made it difficult to reduce debt to GDP, despite government spending cuts.

Source: cso.ie

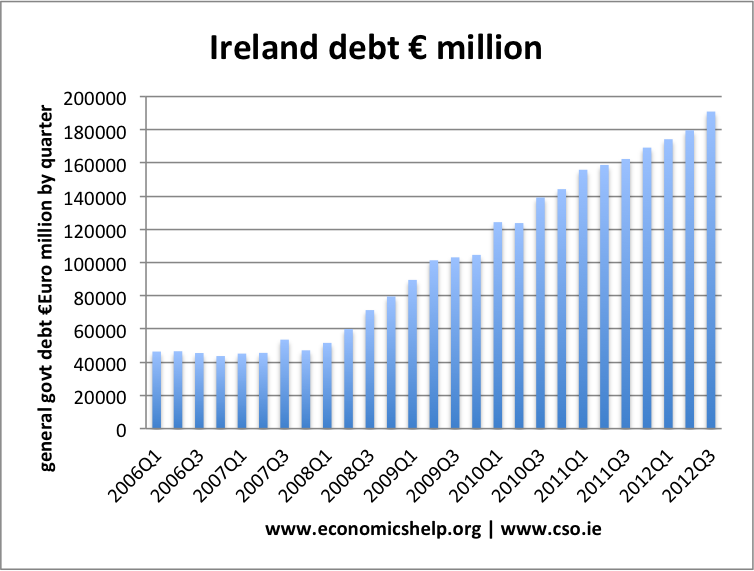

The Total Irish Government debt 2012 Q3 – €190,954 million – (117% of GDP)

Irish government debt millions

See also: stats at ECB (Debt based on – Maastricht assets/liabilities – General government (ESA95) – European Commission – All sectors without general government (consolidation) (ESA95)

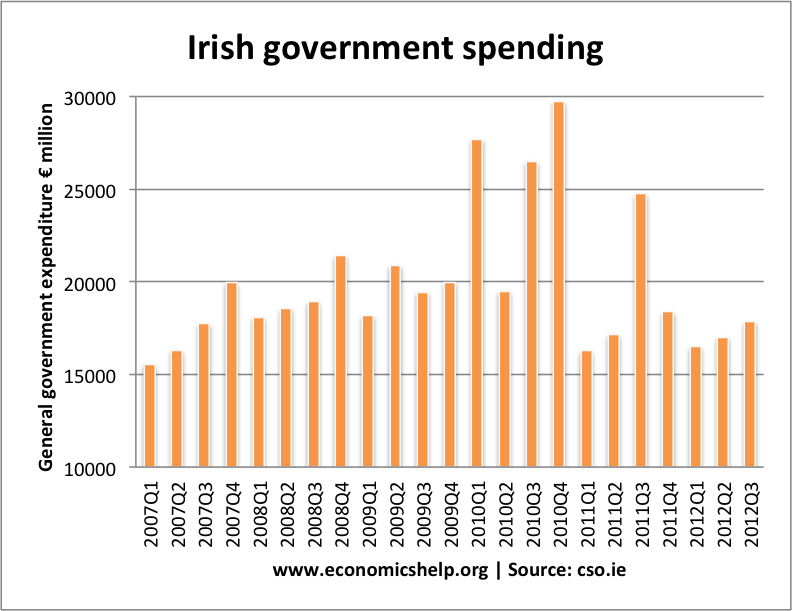

Irish government spending

The peaks in spending in 2010 were related to the Irish government bailout of banks. After the bailout, the government has pursued spending cuts.

Example of spending cuts from 2012 budget at Telegraph

Ireland 2012 budget

– €2.2bn of the €3.8bn of fiscal consolidation is on the spending side.

– Capital expenditure will be cut by €755m, while current spending cuts to contribute €1.4bn. (includes public sector pay, welfare payments, education and health care)

Irish Tax Revenue

Tax revenue fell significantly during the credit crunch.

- In 2007, total tax revenue was €47,887 million. (stats)

- In 2011 tax revenue was €36,801 million which is a 23% reduction and not 20% which is mentioned in the article (stats)

- That is a 23% fall in nominal tax revenues between 2007 and 2011.

Note: These statistics are not adjusted for inflation. The real decrease in tax revenues is even greater.

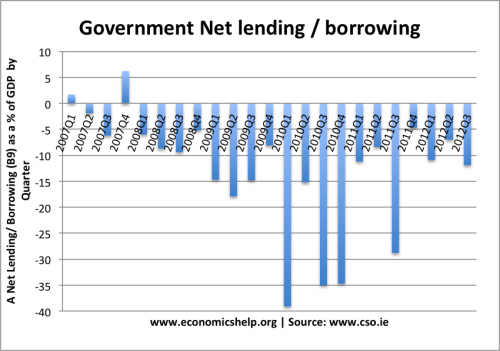

Government deficit

Causes of Irish Debt

- Pre-crisis (2007) national debt – €37.6bn, 19.5% – one of lowest rates of public sector debt in the EU.

- 2008-2013 deficit-related debt – €94.9bn, 49.2% Recession and housing collapse led to significant fall in tax revenues as government received lower income tax, property tax and VAT.

- Banking-related Debt – €60.5bn, 31.4% – cost of bailing out banks, led to record budget deficit of 32% of GDP in 2010.

- Fin facts

- Other put cost of bank bailouts slightly higher at over 70bn Euros (link)

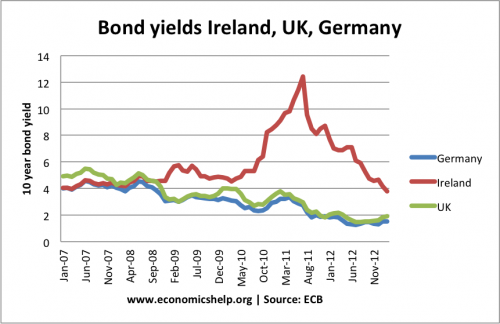

Interest rates on Irish Government Bonds

Bond yields have fallen significantly since 2011 crisis. Helped by ECB intervention, Irish bond yields have fallen to a more manageable 3.8%. ECB long term bond yields

Irish debt back to 1994

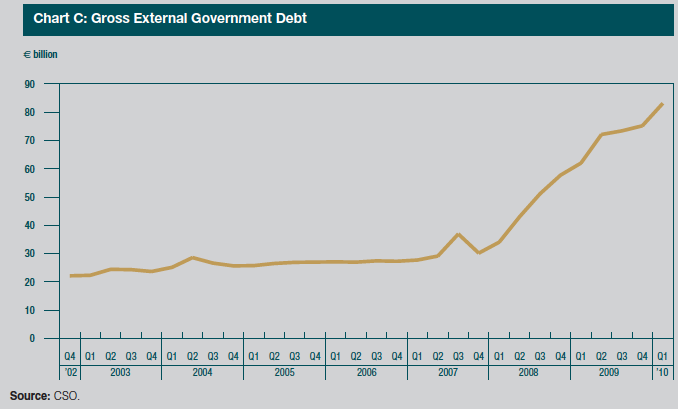

External Debt

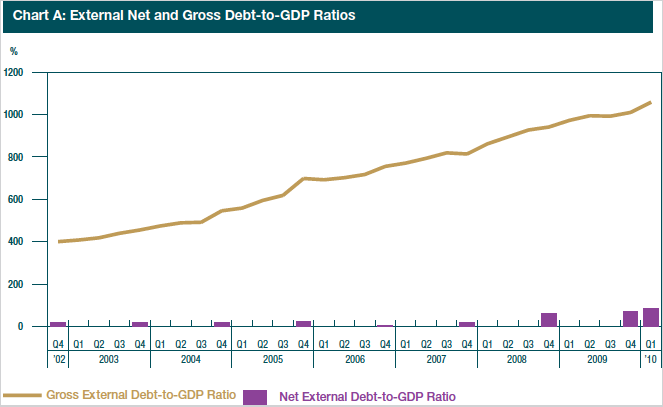

Source: C Bank 2010

Gross External debt to GDP shows the liabilities to non-Irish residents. This amounts to over 1,000 % of GDP march 2010. However, these external liabilities are mostly offset by external assets. e.g. non-banking firms owning foreign assets.

Net External debt, is the difference between external liabilities and external assets. Net external debt has increased to 80% of GDP, Q1 2010. This rise in external debt reflects

- Liabilities to European System of Central Banks (ESCB)

- Growth in foreign investors holdings of long term Irish bonds has grown from €29.3 billion at end-2007 to €69.5 billion at end-March 2010.

Gross external government debt has increased from €30billion to over €80bn in 2010.

Credit Rating

- Fitch Ratings BBB+ Negative

- Moody’s Ba1

- Standard & Poor’s – BBB+/A-2.

- Credit rating helped by Irish switch of €28bn promissory notes to long term bonds FT

Related

- List of National Debt by Country

- Problems of Irish Economy

- Irish Economic Crisis

- Facts on EU debt crisis

Hello i am from ireland

it is unfair that the bigger counties like the UK find it easyer to sell bonds and interest rates are way below

that of irelands to borrow even as there dept and out look for 2013 is just as bad as ireland i heard is because of them haveing there own money. central bank why did we ever get the euro????? Because i know one thing there is no getting out of the euro now…. Bein in the euro its cost ireland 50% of its wealt ,,,, to get out of the euro it will

take the other 50% of ireland wealth

Neo Liberalism has caused this problem V.A.T is a return to feudalism paying tax to upkeep landlords and leaving land unused . It destroys industry increasing the unit costs . Fiat money is created by double entry book keeping creating a bubble property market . Paying private banks interest to borrow money when the state could create it for free ending austerity . Smell the coffee