Readers Question: Is “national debt” interchangeable with the term with “foreign debt”?

- National Debt represents the total amount the government owe the private sector. National debt builds up because the government spend more than they receive in tax.

- Foreign or External debt represents the amount a country (both public and private sector) owe to other countries.

So they are different things.

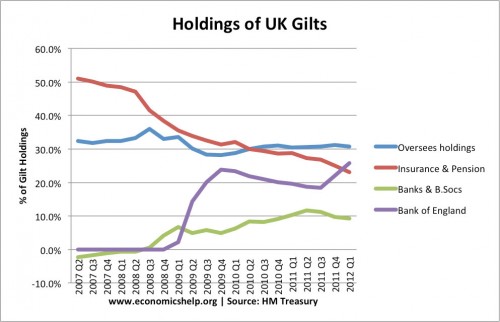

The UK measure of National debt is termed the public sector borrowing requirement. Some of the National debt is financed by selling bonds to oversees investors. But, most of the UK National debt is bought by domestic financial institutions.

on June 2009, UK public sector debt stood at £798.8 billion (or 56.6% of GDP) – UK National Debt

What is the UK External Debt?

According to National Statistics the UK External Debt – Gross is £6,290 bn (this is roughly 430% of GDP) (of which only £26bn is owed by General government). The biggest balance is the banking sector which owes nearly £4,000 bn. These banking liabilities should be cancelled out by an equal amount of foreign assets.

See: UK external liabilities and external assets

Though if these assets deteriorated, the UK’s position would definitely worsen.

But, they aren’t quite as shocking as they might first appear.

If you really want to delve into different types of debt – try Understanding different types of debt

How Much of UK Government debt is held by Overseas investors?

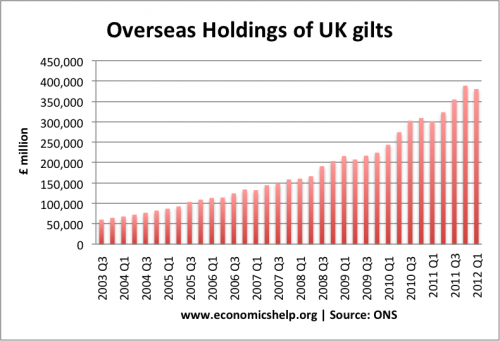

Overseas holdings of UK gilts (this makes us part of UK’s total external debt)

4 thoughts on “UK External (Foreign) Debt”

Comments are closed.