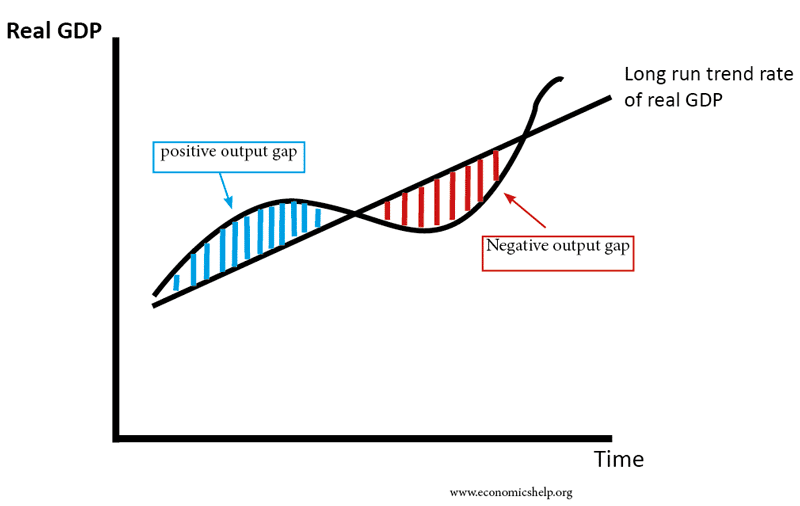

The output gap is a measure of the difference between actual output (Y) and potential output (Yf).

- A positive output gap means growth is above the trend rate and is inflationary.

- A negative output gap means an economic downturn with unemployment and spare capacity

- The output gap = Y- Yf

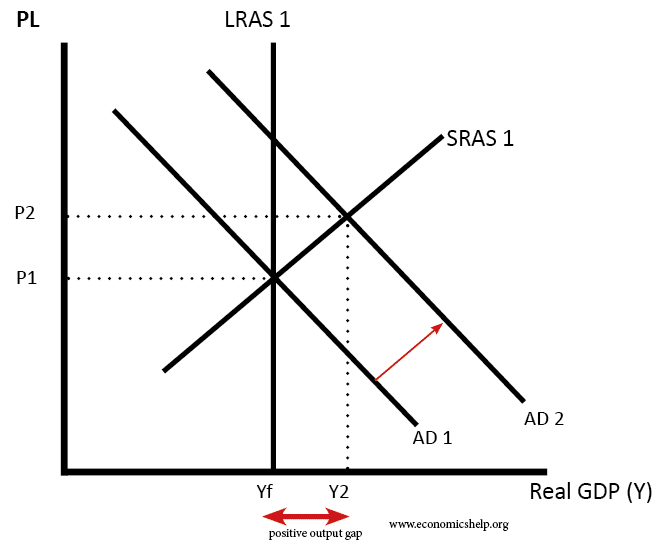

Diagram for Output Gap

The long-run trend rate of economic growth is the average sustainable rate of economic growth over a period of time. The long-run trend rate is determined by the growth of productivity and growth of long-run aggregate supply. (LRAS). If actual growth is higher than the long-run trend rate, then we get inflationary pressures. If growth is below the long-run trend rate, we get a negative output gap and inflation.

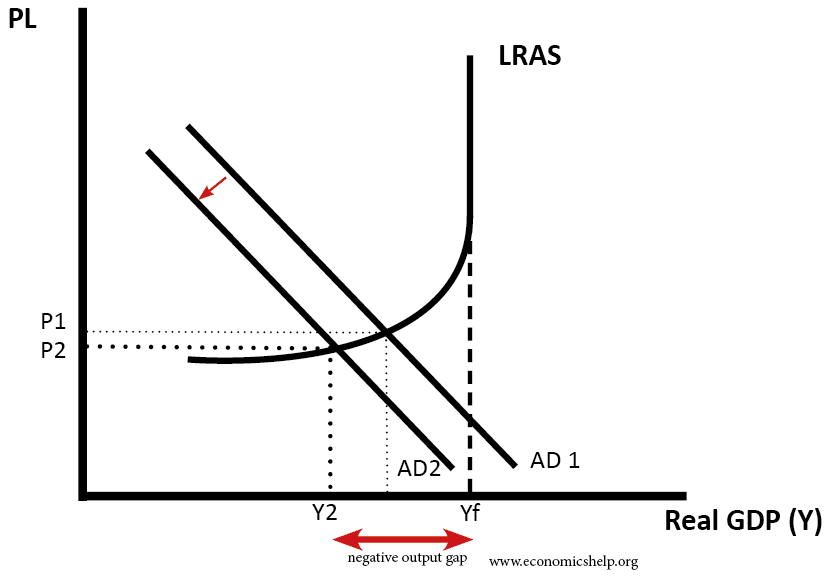

Negative Output Gap

This occurs when actual output is less than potential output gap. This is also called a deflationary (or recessionary) gap. In this situation, the economy is producing less than potential. There will be unemployment, low growth and/or a fall in output. A negative output gap will typically cause low inflation or even deflation. A negative output gap may imply a recession (fall in GDP) or just very low economic growth.

Positive Output Gap

A positive occurs when actual output is greater than potential output. This will occur when economic growth is above the long run trend rate (e.g. during an economic boom). It will involve firms asking workers to overtime.

With a positive output gap, there will be inflationary pressures. It will also tend to cause a bigger current account deficit as consumers buy more imports due to domestic supply constraints.

This shows a positive output gap with the monetarist view of LRAS. In this case, the economy is already at full employment, but there is an increase in the money supply and a further rise in AD. In the short-term firms can meet demand by paying higher wages and encouraging overtime. However, this short-term economic growth is unsustainable and leads to inflationary pressures. Output invariably returns to Yf – the level of full employment.

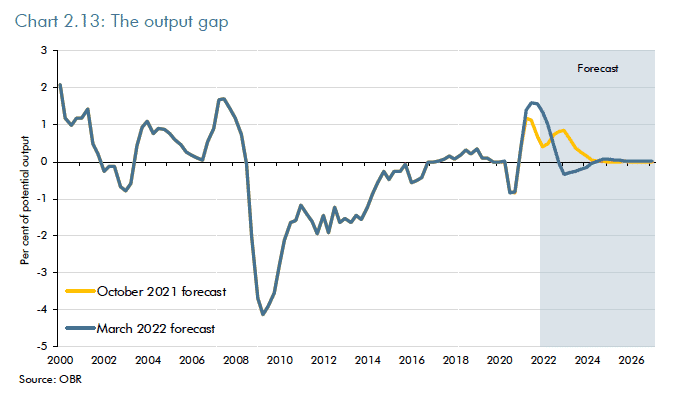

UK Output Gap 2022

In 2020, there was a modest output gap due to the Covid led economic contraction. However, this output gap was relatively limited because although demand fell, so did supply.

In 2021/22 as Covid restrictions were loosened, there was a surge in demand from pent up savings, leading to excess demand and supply bottlenecks. This led to a positive output gap and inflation. (see: supply bottlenecks)

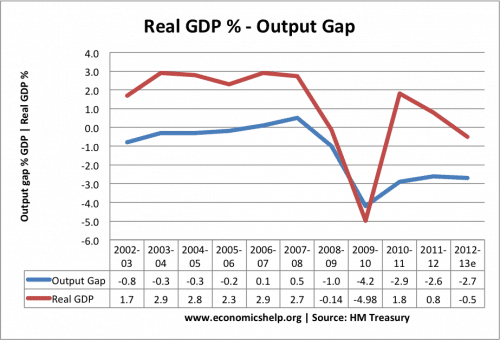

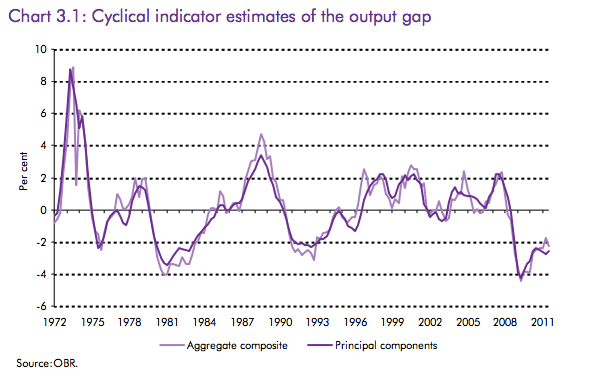

Output Gap 1972-2011

Source OBR

In this example, HM Treasury forecast an output gap of -2.7% for 2012/13. This is the amount of spare capacity they feel the UK has.

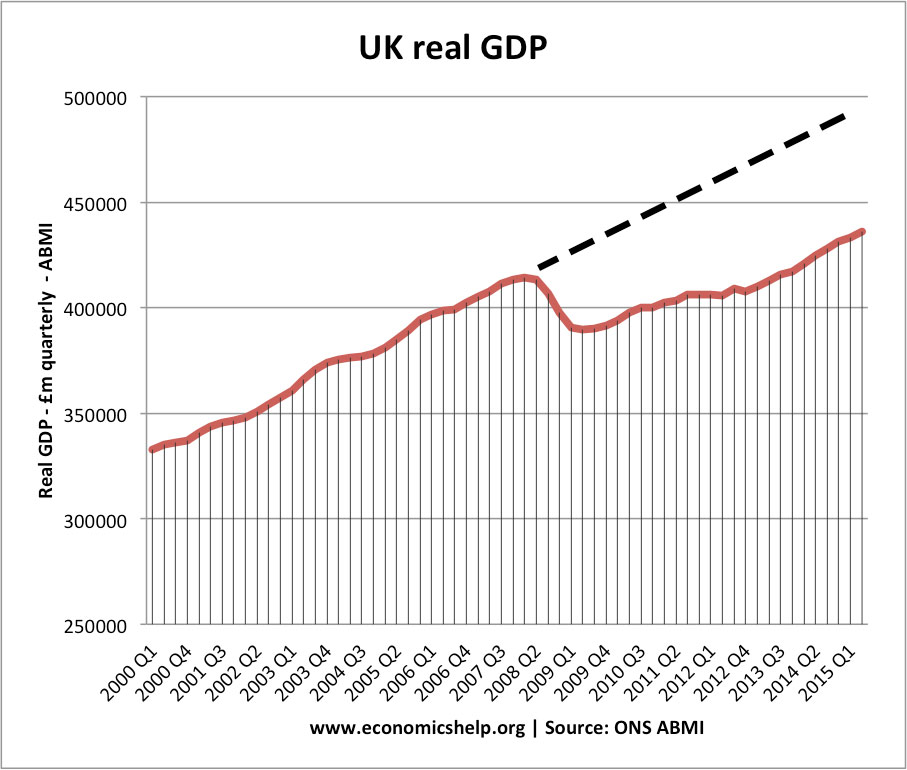

Lost Output During 2008-12 Recession

If we look at real GDP compared to long-run trend rate – it implies a very significant degree of lost output. Real GDP is approx 20% less than the pre-crisis trend rate of growth.

However, this doesn’t’ mean the UK has an output gap of 20%. This is because

- The recession led to a permanent loss in output

- Productivity growth has slowed down. Therefore, the amount of potential GDP has fallen behind

This shows that determining the output gap is a difficult decision. However, it has important implications for monetary and fiscal policy. If the UK has a large negative output gap, we should pursue expansionary fiscal policy and/or expansionary monetary policy.

However, if there is a smaller output gap than we believe, expansionary monetary policy could cause inflation.

Should the UK increase interest rates? – depends very much on whether we believe the output gap is closing.

What Determines the Size of Output Gap?

- Level of unemployment. Higher unemployment increases the negative output gap. A fall in unemployment implies economy getting closer to the level of full employment.

- Firms reporting hiring difficulties. If firms struggle to fill vacancies this indicates a positive output gap.

- Wage inflation. Rising wage inflation, indicates firms are struggling to fill vacancies.

- Capacity utilisation. If firms report they are under-utilising capacity, there is a bigger negative output gap.

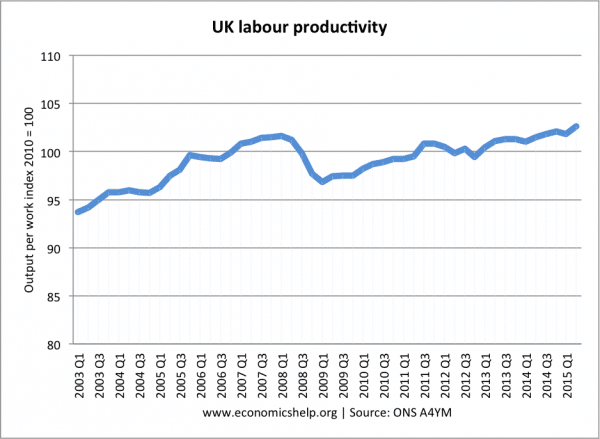

- Productivity growth. If productivity growth falls, this decreases the growth of potential output and therefore limits the negative output gap.

- Inflation. Inflation can be a guide to the output gap. If inflation is high and firms pushing up prices, this suggests there is a positive output gap.

Output Gap and Economic Growth

Output gap and real GDP

very powerful notes for an alevel student shukriyaa

How do you solve a positive output gap and negative output gap

To solve a positive output gap, the government would have to use contractionary fiscal or monetary policy. To solve a negative output gap, the government would have to use either expansionary fiscal or monetary policy

three potential ways of measuring the level of output in an economy.

Expenditure, income or output

In what 5 ways does supply solve the output gap of a nation

to solve a negative- supply side polices such as expenditure on education to increase productivity and reduce unemployment, or if its just due to lack of AD, eg if consumption if low, decreasing taxes( example of expansionary fiscal policy), so basically if its a negative output gap, any expansionary policies. dependent on current situation, to then decide if its supply or demand side policies. (eg if there’s high inflation , then don’t use demand side as they’re inflationary)

to solve a positive output gap- do the opposite, so contractionary polices, once again dependent of the economy’s climate to then decide whether to use supply or demand side.

->if you any understand i recommend learning about policies (supply and demand side)- i know there are 3 main ones for my course which are supply side, and then two demand side: monetary and fiscal