Definition of leverage ratio

The leverage ratio is the proportion of debts that a bank has compared to its equity/capital. There are different leverage ratios such as

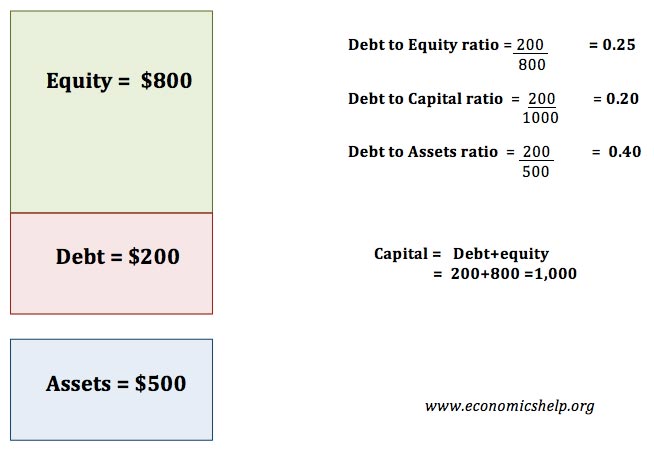

- Debt to Equity = Total debt / Shareholders Equity

- Debt to Capital = Total debt / Capital (debt+equity)

- Debt to Assets = Total debt / Assets

Leverage ratios give an indication of the financial health of a bank and how over-extended they may be.

Leverage ratios

Example of Bank leverage

- If the bank lends £15 for every £1 of capital reserves, it will have a capital leverage ratio of 1/15 = 6.6%

- A leverage ratio of 4% would mean that for every £1 of capital that a bank holds in reserve, the bank can lend £25. (1/25 = 4%)

- If the leverage ratio falls to 3%, it would mean that for every £1 of capital that a bank holds in reserve, the bank can lend £33 (1/33 = 3%)

Bank leverage explained

If a bank kept all its deposits as cash in bank vaults, it would have a large quantity of liquid capital. Whenever a customer came to demand his deposits back, the bank could go to the bank vaults and pay everything back. This is a very conservative method of banking. The bank wouldn’t have to worry about a fall in the value of assets or loans not paid back. However, this type of banking is not very profitable. Keeping capital reserves in the bank vaults doesn’t earn you any money.

Instead, the bank will lend a percentage of its deposits to customers wishing to take out a loan. This enables the firm to gain a better rate of return on its deposits. The more the bank lends, the greater the potential to make a profit. This is leverage.

Increasing the leverage ratio

Many regulators are considering raising the leverage ratio. This means that banks will have to keep more capital reserves. To increase capital reserves in order to meet higher leverage ratios requires selling assets to get cash or reducing lending. See: (WSJ)

Higher leverage ratio can decrease the profitability of banks because it means banks can do less profitable lending.

However, increasing the leverage ratio means that banks have more capital reserves and can more easily survive a financial crisis.

Governments are keen to increase the leverage ratio because it makes it less likely governments will have to bail them out.

Leverage ratios in the credit boom and bust

In the financial boom years of 2000-2007, banks increased their leverage. Leverage ratios fell as they decreased the capital buffer they had. The motive for increasing lending was that they were trying to increase profitability. Also, banks had little concern about going bankrupt because there is an implicit guarantee that the government will bail out banks (An example of moral hazard)

After the 2007 credit crunch, banks became exposed to bad debts. A small loss of equity meant that many banks became illiquid – they were short of cash because they had lent a high percentage of their assets. They had a low leverage ratio. Their loans could not be recalled in the short term. Also, it became more difficult for banks to raise finance on money markets because all banks were trying to raise cash.

Regulation on Bank leverage

Leverage ratio requirements in different countries. There is a global base leverage requirement of 3%, set in Basel III. But, other countries may have higher leverage requirements.

- Under Federal bank regulations, a US bank must have Tier 1 Capital ratio of at least 4%. The US is also considering raising the leverage ratio to 5% (WSJ)

- UK Regulation The Chancellor has announced that he is likely to support a new regulation which sets bank leverage ratios by 2018 (BBC)

- The European Bank Association, are working on bank leverage ratios (link)

Similar concepts

Related