A trade weighted index is used to measure the effective value of an exchange rate against a basket of currencies. The importance of other currencies depends on the percentage of trade done with that country.

For example in calculating the trade weighted index of the Pound Sterling, the most important exchange rate would be with the Euro. If the UK exports 60% of total exports to the EU, the value of £ to Euro would account for 60% of the trade weighted index.

A trade weighted index is useful for measuring the overall performance of a currency.

For example, if the Pound appreciates against the dollar, that might be due to the dollar’s weakness. But, if the trade weighted Sterling index increases, this shows the Pound is getting stronger against its main trading partners.

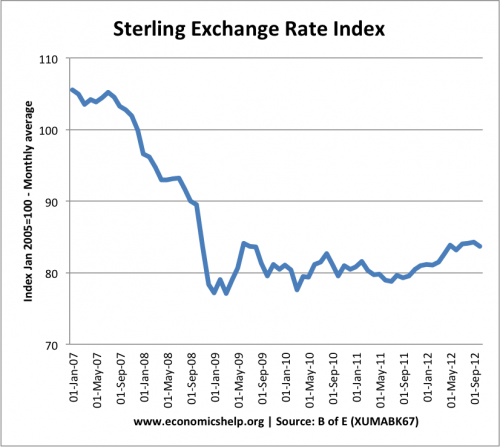

Example of Sterling Trade Weighted Index

Related