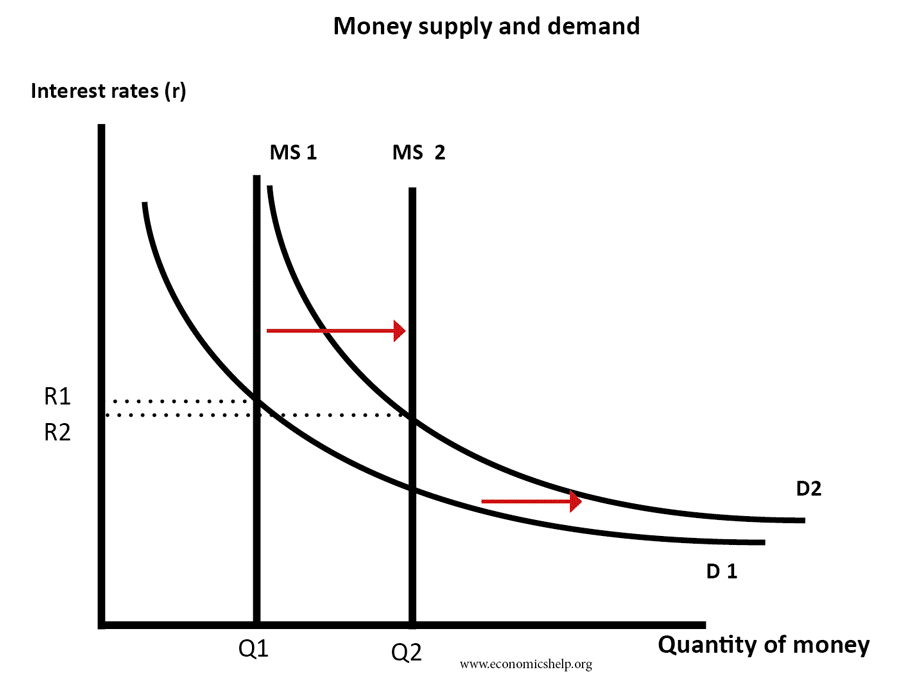

Accommodative monetary policy means a policy of allowing the money supply to rise in line with national income and the demand for money. Accommodative monetary policy will also usually involve lower interest rates.

Accommodative monetary policy may also be known as ‘easy monetary policy’ / loose monetary policy / expansionary monetary policy.

The aim of accommodative monetary policy is to enable higher economic growth and lower unemployment.

Accommodative monetary policy involves:

- Lower interest rates.

- Lower interest rates make borrowing cheaper and tend to encourage consumer spending, investment and economic growth.

- Allowing money supply to increase.

- In some circumstances, the Central Bank could directly increase the money supply through quantiative easing or printing more money.

Impact of accommodative monetary policy

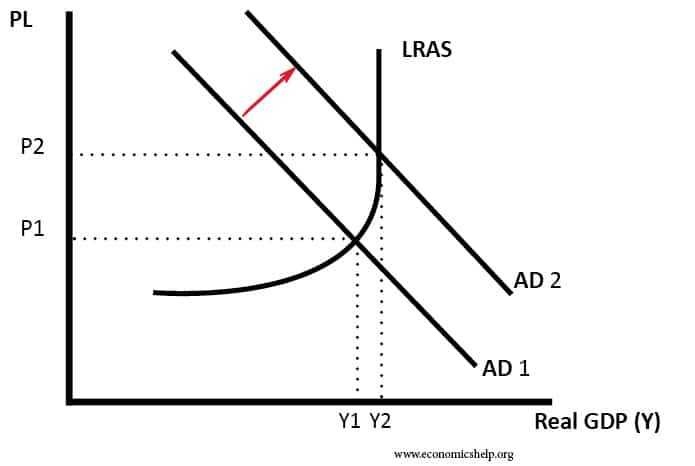

In theory, lower interest rates and increased money supply will lead to higher economic growth:

- Higher growth will lead to greater employment and lower unemployment.

- It is likely to cause a relatively higher inflation rate.

- It is likely to cause a depreciation in the exchange rate.

- It is likely to cause a rise in the value of assets, such as housing.

What factors would lead to accommodative monetary policy?

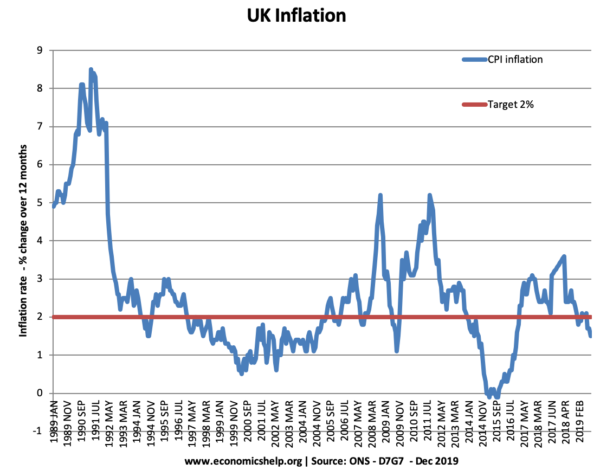

- Inflation below target. If inflation is below the government’s target of 2%, they will pursue a more accommodative policy to allow inflation increase and enable higher growth.

- High unemployment. In a period of high demand-deficient unemployment, the Central Bank will be keen to increase demand in the economy to create more employment. Inflation is likely to be a serious problem during periods of high unemployment.

- Recession/negative growth. In a recession, monetary policy needs to be accommodative to boost spending.

Examples of accommodative monetary policy

- Monetary policy in US / UK post 2008/09 recession. Interest rates cut to 0.5%. Quantitative easing (increase in money supply) pursued. The aim was to overcome the recession – even though cost-push inflation was quite high.

- This period of accommodative monetary policy struggled to overcome the depressed demand and interest rates remained low for a considerable time.

Related

Published 12 October 2015, Tejvan Pettinger. www.economicshelp.org