The capital account measures transfer in assets and liabilities. For example, this may involve a Japanese firm building a factory in the UK. This is counted as a credit on the UK Capital Account. The Capital account can also involve the purchase of securities and liabilities, for example, a Japanese Banker buying UK Government securities.

Note in the UK the official name for the capital account is now the financial account.

If a country has a current account deficit then, assuming exchange rates are floating, it will have an equivalent capital account surplus. This is necessary to finance a current account deficit.

Some people worry about a current account deficit. But, if it is financed by a capital account surplus e.g. investment then this can be beneficial.

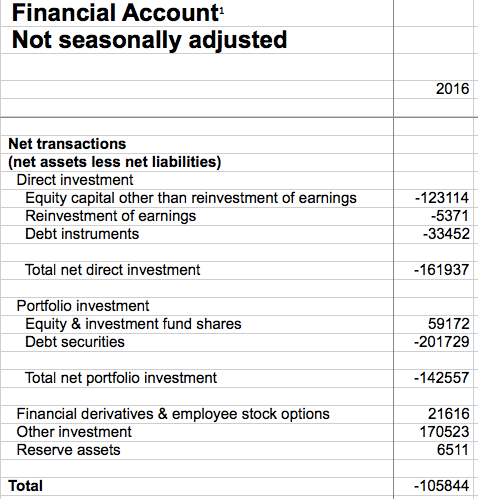

Components of Financial Account

The UK Balance of Payments at ONS

- Direct investment (building factories)

- Portfolio investment (saving money in pension funds/investment trusts)

- Financial derivatives (net) (CDOs, options e.t.c)

- Other investment (e.g. housing)

- Reserve assets

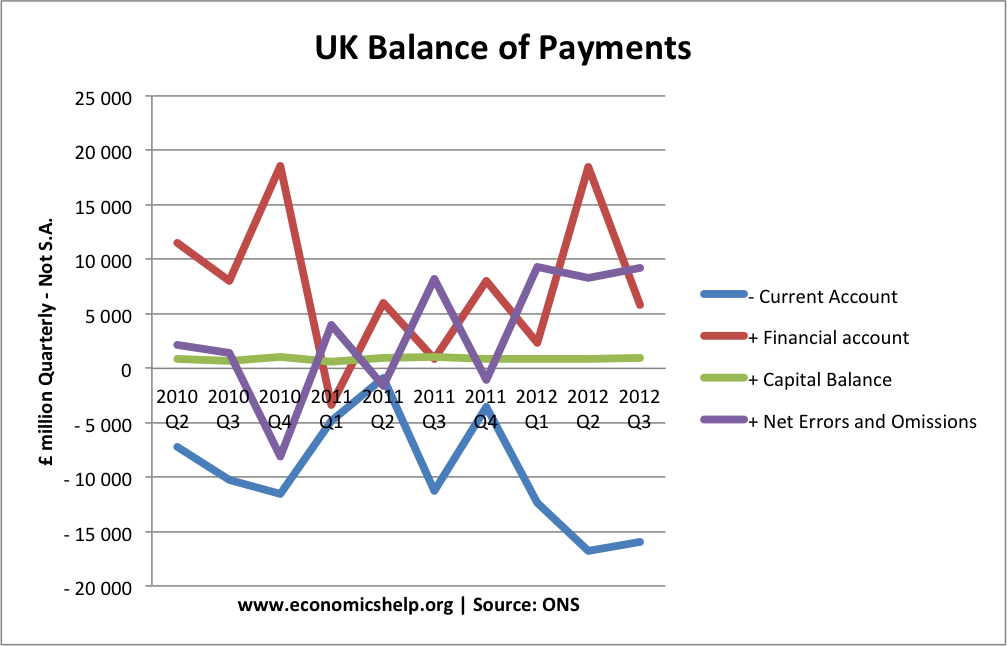

Components of UK balance of payments 2012

In Q2 2012, the main components of the balance of payments were:

- Current Account: £ -15,962m

- Financial Account: + £ 5,785m

- Capital Account + £1,000 m

- net errors and omissions + £9177 m

- net balance = £0 m

These stats show a large amount to account for net errors and omissions – showing the difficulty of collecting statistics but, roughly a current account deficit is mirrored by a surplus on the financial/capital account.

Related