Capital intensive refers to a productive process that requires a high percentage of investment in fixed assets (machines, capital, plant) to produce.

A capital-intensive production process will have a relatively low ratio of labour inputs and will have higher labour productivity (output per worker).

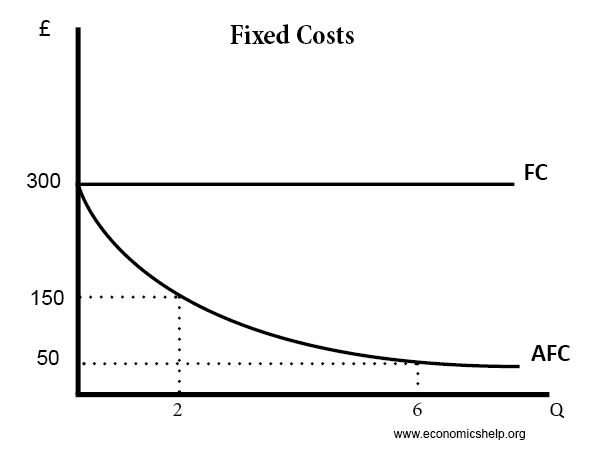

A capital intensive production process will tend to have a high ratio of fixed costs to variable costs. As a result, the productive process will have economies of scale (increased output leads to lower average costs)

In recent years, technological development have enabled increased capital intensity in many industries. New technology such as Artificial Intelligence, micro-computers and the internet have enabled previously labour-intensive industries (taxi’s, delivery to become more capital intensive – e.g. with the rise of self-driving cars.

Examples of capital-intensive production

- Modern car production. A large part of the production is automated with robots, assembly lines and machines to produce the car. This contrasts with very early methods of car production which were much more labour intensive, with groups of workers manually combining different components.

Importance of capital intensity

- Labour productivity. Increased investment in capital can help to increase labour productivity (output per worker). This capital intensity and labour productivity play an important role in determining long-run economic growth. More capital intensive methods enable increased output and higher living standards.

- Investment. To promote capital-intensive industry requires significant investment in fixed assets. Investment requires sufficient savings or the ability of firms to borrow to finance the investment.

- Skilled labour. Increased capital intensity usually requires sufficiently skilled labour. Increased capital intensity means that the workers who manage the machines need sufficient skills and training to operate/design them.

- New trade theory. New trade theory suggests production will concentrate in certain areas. Often specialisation occurs simply because countries were the first to produce and benefited from their capital intensity.

Measuring capital intensity

- Cost of capital to labour. A firm which spends £3 million on capital and £500,000 on labour is capital intensive. 3/0.5 = Ratio of 6 capital to 1 labour.

- Asset Ratio. Ratio of assets to sales.

Does capital intensive production cost jobs?

Increased capital intensity can cause some workers to lose their jobs because they are no longer needed. This can lead to structural unemployment – at least in the short-term. However, more capital intensive industries create different kinds of jobs. There are new jobs in the design of software, AI and marketing. Also, capital-intensive production can lead to lower prices and higher incomes. This causes increased demand for a greater variety of services in the economy.

Related concept: