Crowding in occurs when higher government spending leads to an increase in private sector investment.

The crowding in effects occurs because higher government spending leads to an increase in economic growth and therefore encourages firms to invest because there are now more profitable investment opportunities.

Difference between crowding out and crowding in

When the government pursues expansionary fiscal policy (higher spending financed by borrowing) there are two possible effects

- Crowding out – higher government spending financed by borrowing leads to a fall in private sector saving. This is for two main reasons

- With expansionary fiscal policy, private sector savers buy government bonds and so have fewer savings to fund private sector investment.

- Also, higher government borrowing tends to push up interest rates and these higher interest rates reduce investment.

- Crowding in – this relates to how higher government spending encourages firms to invest more.

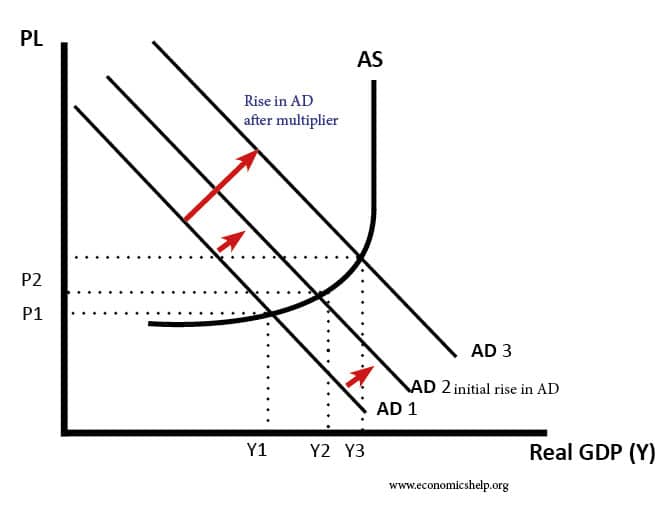

- This is due to the income effect of higher government spending. If the economy is in a recession or below full capacity, expansionary fiscal policy can increase the economic growth rate and create a positive multiplier effect, which leads to greater private sector investment.

- Crowding in is more likely to occur in a recession when the private sector has unused savings. Crowding in may prove to be a temporary effect.

- Crowding out will occur when the economy is close to full capacity and limited spare savings.

When will crowding in occur?

Keynesian economists are more likely to support the idea of crowding in because they believe the economy can be below full capacity with unused private sector spending. However, if the economy is at full capacity, the same economists may say crowding out is more likely to occur.

Factors which make crowding in more likely

- Recession. If the economy is in recession, there are unused private sector savings. Therefore, if the government borrows from the private sector, then it doesn’t reduce private sector investment because there is still sufficient levels of savings.

- Induced saving. If expansionary fiscal policy leads to a significant increase in economic growth, then this will lead to higher incomes and higher level of savings. This growth and higher savings will increase private sector investment, at least in the short-term.

- High multiplier effect. If there is a high multiplier effect of increased spending, there will be more crowding in. The size of the multiplier effect depends on marginal propensity to consume (MPC)

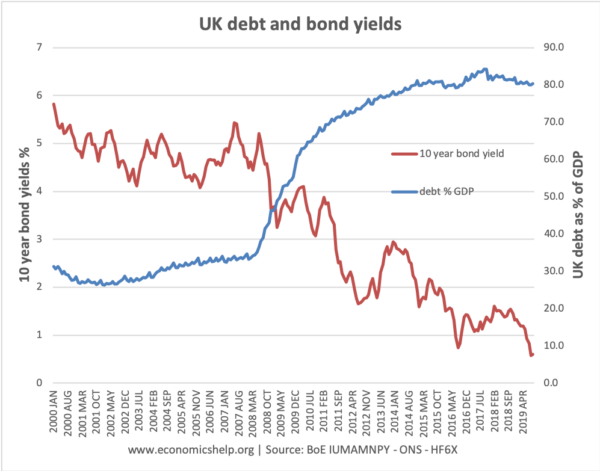

- Deflation/liquidity trap. If there is deflation (fall in prices) and interest rates are at the zero bound rate, then higher government borrowing is unlikely to have any effect on pushing up interest rates. In a situation of deflation, real interest rates (nominal rates -inflation) may be quite high. Therefore, if government spending reduces deflation, it may actually help to reduce real interest rates and therefore increase private sector investment.

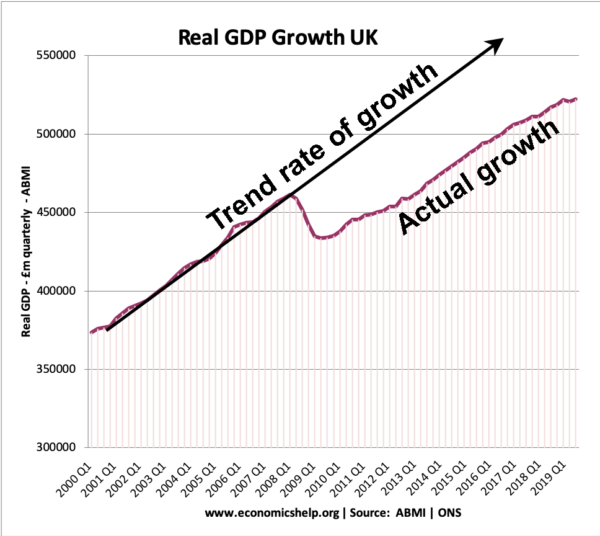

After great recession 2008-13, higher debt – leading to a fall in bond yields. This suggests there is no crowding-out effect, but there is scope for crowding in.

Limitation of crowding in

Expansionary fiscal policy can cause a boost in aggregate demand and therefore encourage private sector investment. But, crowding in will be limited in effect.

- When the economy returns to its long-run trend rate of growth, interest rates may start to rise deterring investment.

- If the recovery is strong, we may see rising inflation. Rising inflation will encourage Central bank to increase interest rates.

What factors determine whether firms invest?

In Macroeconomics: Principles and Policy (Baumol and Blinder), they define investment as depending on both interest rate (r) and income (y). I = I(r,y), where Ir<0 and Iy>0.

- Investment is a negative function of the interest rate. Higher interest rates reduce investment as it is more expensive to borrow.

- Investment is a positive function of income. A major determinant of investment is expected demand. If the economy is stuck in a recession, private investment will fall as investment does not look profitable. If government spending stimulates economic activity then this will encourage firms to invest because they expect rising demand. Therefore, in a recession, crowding in is more likely.

Related