Nudge theory suggests consumer behaviour can be influenced by small suggestions and positive reinforcements.

Proponents of nudge theory suggest that well-placed ‘nudges’ can reduce market failure, save the government money, encourage desirable actions and help increase the efficiency of resource use. Critics argue nudges can be misused and become a form of social engineering or way to encourage consumers to buy goods they don’t really need.

With Richard Thaler being awarded the Nobel Prize in economics for his work on behavioural economics, nudges are likely to become increasingly common in everyday life.

In the UK, the Behavioural Insights Unit was set up to use behavioural economics in order to improve choices. Their remit includes:

- making public services more cost-effective and easier for citizens to use;

- improving outcomes by introducing a more realistic model of human behaviour to policy, and wherever possible,

- enabling people to make ‘better choices for themselves’. Behavioural Insights Unit

Examples of nudges

- Up-sell. If you go to a fast-food restaurant, servers are trained to ‘up-sell’ – this means they offer extra options to go with the meal. Often it is ‘drinks, extras and deserts’ which are the most profitable part of the meal.

- If you buy a coffee, and a barista offers a pastry as well – we are more likely to buy the pasty when it is offered as a suggestion.

- Product placement. To encourage healthy eating, healthy options could be made more easily available, e.g school lunches could be carefully monitored – reducing the number of unhealthy options. This is related to the concept of ‘choice architecture’ – the idea that if goods are presented in a different way, it can help ‘nudge’ people’s consumption to the desired option.

- Default options. A powerful way to encourage take-up rates of ‘desirable options’ is to set the desired outcome as the default option. For example, at the moment, people have to ‘opt-in’ to be an organ donor. This leads to low rates of organ donation as people don’t want to carry a card. But, the other way would be to change rules so you have to ‘opt-out’ of organ donation. This would cause donation rates to retire.

- Save more tomorrow™ Economists Richard Thaler and Shlomo Benartzi developed a programme called: Save More Tomorrow™. The idea is to nudge people into taking private pension plans by using behavioural economics. It uses the default choice of enrolling people in a pension scheme, with the added proviso they only start off making small contributions. Only when their wages rise, will their contributions automatically increase. It has seen saving contributions quadruple at companies which use it. (FT link) The way it designed makes the scheme very attractive, and few people choose to reject the offer.

- Calorie/sugar counts. To discourage unhealthy eating, the amount of sugar can be included prominently on the packaging to make consumers think twice about purchasing. Would you be less willing to bu a muffin, if it is labelled as 450 calories?

- Use of technology. Technology can be left to make better decisions for us. For example, when the UK behavioural team tried to reduce energy use in heating homes through education, they had little effect. But, when they trialled the use of automated technology – it was much more successful. The Nest Learning Thermostat uses sensors and machine-learning to understand the thermal properties of your building and your occupancy habits. It led to a 6% fall in energy use. (Blog, 30 Nov 2017)

Examples of nudges

- Displaying social trust. One of the strongest nudges is to show feedback from peers. Positive reviews displayed prominently – play a significant role in encouraging people to buy. Companies may display favourable reviews next to their product. The government may also show examples of people who have benefited from certain schemes (or show images of people caught and then named and shamed for tax evasion/benefits fraud.)

- Specific messages. To reduce missed hospital appointments, most hospitals send SMS text reminders on the day. Studies suggest that changing the words of the SMS can influence how successful these text messages are. For example, if text messages mention the direct costs to the NHS for missing an appointment (£160) – it helped reduce missed appointments from 11.1% to 8.5%. (Behavioural insights Blog)

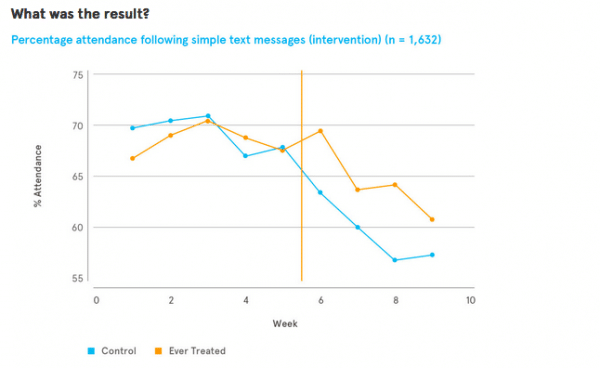

- Encouraging certain behaviours. A study found that if students are sent motivating text messages, attendance rates improved.

Source: Behavioural insights team Blog

Commercial nudges

Many firms use nudges to increase profit. For example:

- Insurance payment protection. Banks encouraged the sale of payment protection insurance for pensions and other financial services. They were sold as an essential package for the product. But, in reality, the cost and profit margin for the bank was never fully explained. The government later made banks liable for evidence of mis-selling.

- Special offers. Some firms offer a free subscription for a month. But, to get the free subscription it is necessary to give credit card details and pay for a month upfront. To gain free subscription it is necessary to ring and cancel before the end of the month. But, because of the inconvenience, many consumers may end up paying more than expected.

- Pushy salespeople. If you try to cancel certain services, e.g. internet provider. To cancel you have to ring up and a dedicated salesperson will try and discourage consumption – through offering a special discount for next three months. The strong sales pitch may nudge consumers into not changing.

- Special offer mortgage deals. In the early 2000s, many US consumers were offered special discounts on mortgages. It made mortgages very cheap for the first year or two – to encourage people to get the mortgage. But, after that introductory period, interest rates went up to normal levels – causing a big increase in the cost of mortgage payments. Many people defaulted on mortgages because they didn’t fully realise how much mortgage payments would rise after the end of an introductory period. This proved a cause of the credit crunch.

Evaluation of nudges

There is a difference between nudging a certain behaviour and compelling a certain choice. A good nudge may be considered to be one which encourages a certain choice, but is still:

- Transparent – Make the nudge clear and obvious, not hiding costs / other options.

- Choice is retained – with consumer able to make the final choice.

- Good reason to believe that the nudge is warranted, e.g. strong health costs of smoking/eating too much sugar.

- Nudges may not be enough. To reduce smoking rates, we need policies which really tackle core problems. This may require – higher taxes, restrictions on places where you can smoke.

Nudge theory

- Nudge theory by Richard Thaler and Cass Sunstein at Amazon.co.uk

Related pages

External links

- Good and bad nudges at NY Times