The shut down price are the conditions and price where a firm will decide to stop producing. It occurs where AR <AVC

- The shut down price is said to occur, where price (average revenue AR) is less than average variable costs (AVC).

- At this price (AR<AVC), the firm is making an operating loss. The total revenue is less than operating (variable) costs.

- A firm can keep producing, even if AR < ATC (average total costs) because they are making a contribution towards fixed costs which have been paid anyway.

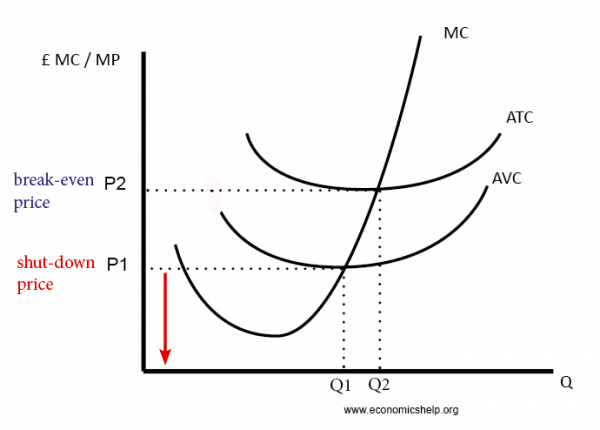

Diagram of shut down price

- The shutdown price is P1 or less.

- Between P1 and P2, the firm is making an economic loss but will continue in the short term.

Evaluation of shut-down price

In the real world, there are circumstances where firms will continue to produce – even if AR < AVC.

- For example, if there is a temporary fall in demand, due to a recession, a firm may prefer to keep producing – so they don’t lose long-term customers.

- If a firm can gain access to credit (loan) or if it has high savings, it can afford to run an operating loss for a short time.

- If a firm sees AR<AVC, they may respond – not by shutting down, but trying to cut costs and/or increase the prices.

- It is possible, a firm will shut down, even if the price is greater than average variable costs. For example, the firm may be pessimistic about the growth of this particular market and feel there is a high opportunity cost to staying in a declining industry.

- In the real world, it may take time for a firm to realise they are making an operating loss.

Related