The market supply curve shows the combined quantity supplied of goods at different prices.

The market supply curve is the horizontal sum of all individual supply curves.

Linear Supply curve

A linear supply curve can be plotted using a simple equation P

= a + bS

a = plots the starting point of the supply curve on the Y-axis intercept.

b = slope of the supply curve.

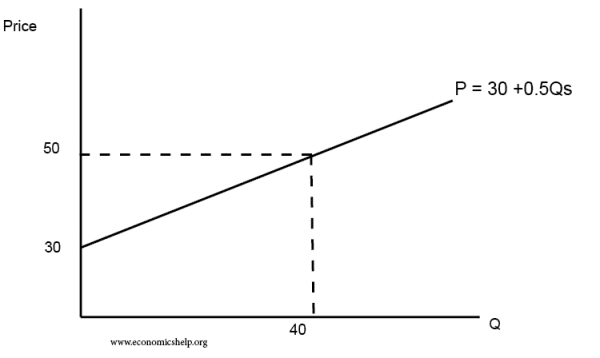

P = 30+0.5(Qs)

Inverse supply curve

This plots the same equation in terms of Qs

2(P-30)= Qs

Example of a linear supply curve

P = 30+ 0.5(QS)

| Q | P |

| 0 | 30 |

| 10 | 35 |

| 20 | 40 |

| 30 | 45 |

| 40 | 50 |

| 50 | 55 |

| 60 | 70 |

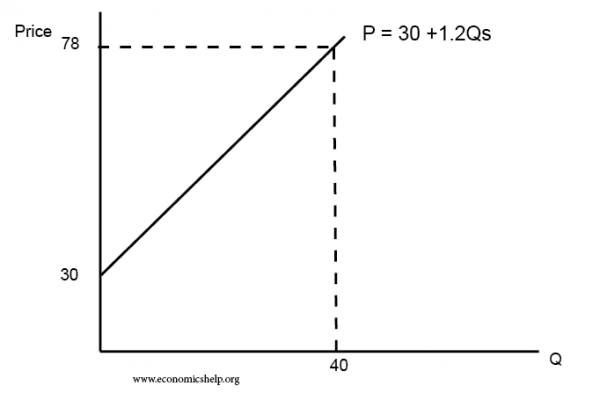

Shift in the slope of the supply curve

P = 30+ 1.2(QS)

P=30+1.2(Qs)

| Q | P |

| 0 | 30 |

| 10 | 42 |

| 20 | 54 |

| 30 | 66 |

| 40 | 78 |

| 50 | 90 |

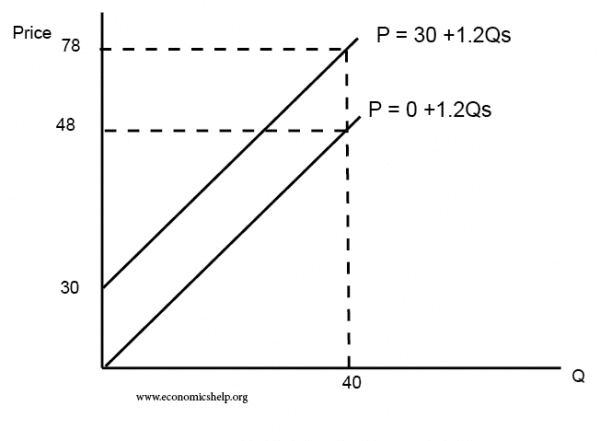

Shift in a – Shift in the supply curve

P = 0 + 1.2 (Qs) shifts the supply curve downwards so it starts at the 0,0.

Why is supply curve generally upward sloping?

Generally, a higher price encourages firms to produce more. This is for two reasons.

- A higher price makes the good more profitable to produce.

- In the short term, the cost of production (marginal cost) is affected by the law of diminishing marginal returns. Increasing output with capital fixed leads to a point where marginal costs rise rapidly, so the firm needs a higher price to compensate for the higher cost of production

Effect of tax on the supply curve

P = 0 +2Q

A specific tax will shift the supply curve upwards by £5. After tax, the supply curve will be

P = 5+2Q

An Indirect tax will shift the supply curve upwards by a certain percentage. e.g. VAT = 20%

P = 0+2Q. After VAT will be P = 0+(2Q * 1.2)

Effect of Subsidy on the supply curve

Suppose we have a supply curve

P = 30+0.5Q

After a subsidy of £10

P = 20+0.5Q

Related