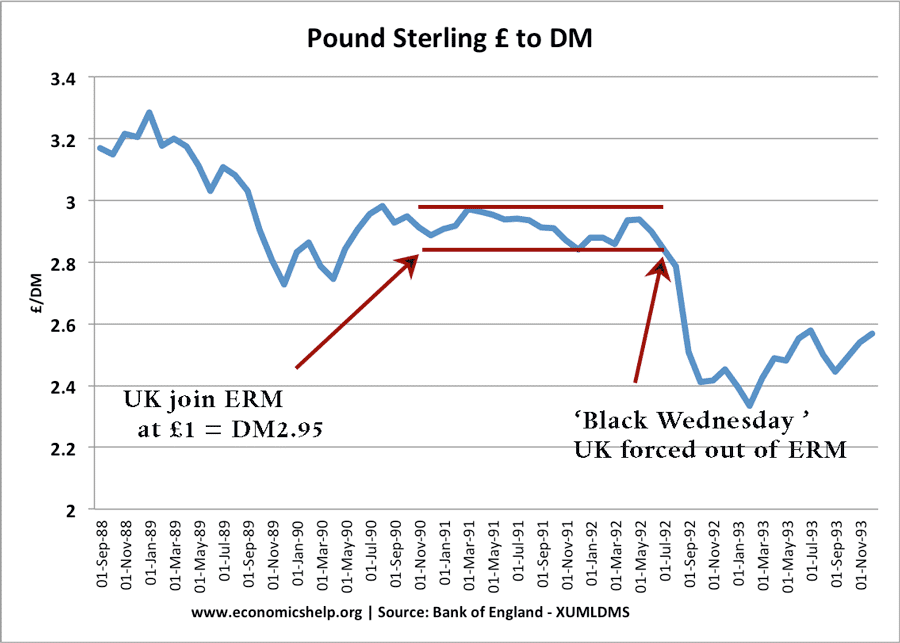

Black Wednesday refers to the date 16 September 1992, when the UK was forced out of the ERM.

The Exchange rate mechanism was a key policy tool for the Conservative government. The logic of joining the ERM was that the chancellor Nigel Lawson believed that being in a fixed exchange rate

- Would help to reduce inflation

- Provide more stability for exporters as they knew what the exchange rate would be.

However, after joining the ERM, the UK boom began to falter and inflation rose. Market pressure pushed the Pound lower (Investors wanted to sell Pounds as they thought it was overvalued.

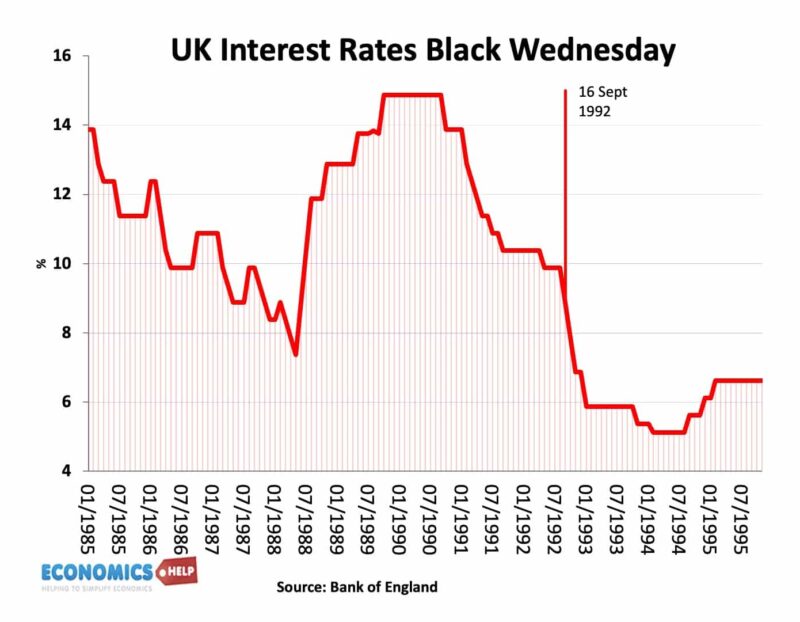

To maintain the value of the £ in the exchange rate mechanism, the government had to intervene with higher interest rates, but higher interest rates increased the cost of borrowing and reduced consumer spending.

The economy went into recession because

- Interest rates had to rise to protect the value of the Pound

- The price of UK exports was less competitive in an overvalued exchange rate.

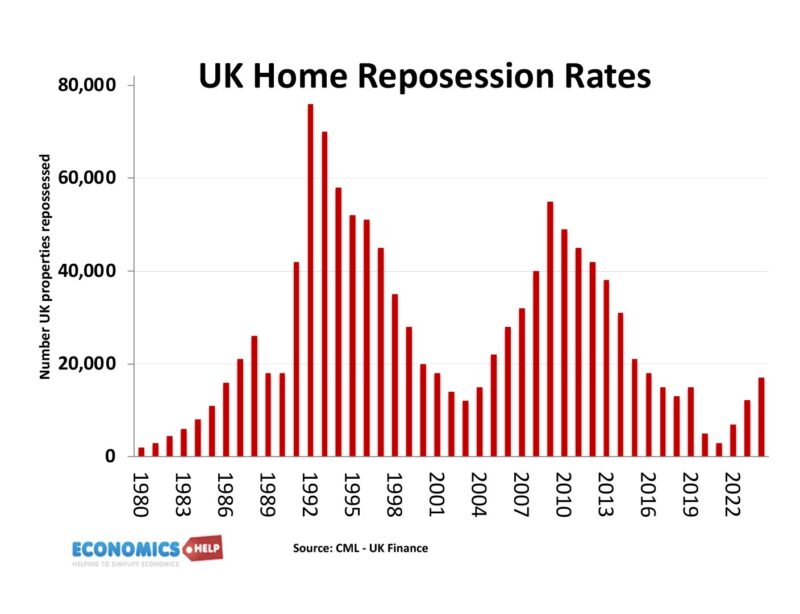

- The combination of high-interest rates and end of the Lawson boom had caused the UK to enter into a recession, with falling house prices and falling GDP. see: UK recession 1991-92

UK Interest Rates and Inflation around Black Wednesday

Interest rates of 15% caused mortgage payments to become a very high percentage of household disposable income, leading to

Role of George Soros and international speculators

Market speculators such as George Soros felt the government’s position was untenable and at some time they would have to devalue. They say this as an opportunity to make a profit selling Pounds at a high price and buy them back at a lower price. Therefore, the speculators kept selling pounds, forcing the treasury to keep buying them and the government also had to keep raising interest rates.

George Soros said his investors shorted the Pound. They borrowed UK government bonds (gilts) and then sold them. They watched the value fall and then bought them back making a profit each time. In effect, Soros was making huge profits without even owning any Sterling assets. It is estimated Soros made a £1 billion profit from Black Wednesday.

The Bank of England said they were buying £2bn of Sterling very hour. Within a short space of time, the UK Treasury spent £27bn in buying sterling on the foreign exchange markets.

It was estimated the final loss of the government’s intervention was £3.4bn. (HM Treasury)

No help from the Bundesbank

Jim Trott a former official at the Bank of England said they were hoping the German Bundesbank would help the UK by selling German D-Marks and buying Pounds. However, with problems of its own (post-re-unification), the Germans didn’t intervene meaning the UK government were heavily outgunned by speculators. Trott remembers:

“The cavalry were the Bundesbank. We kept on looking over the hill, but there was no dust and there were no hats and no sabres. And then later at the conference call they suddenly didn’t speak English, which was extraordinary. So we were kind of stretched on that day,” (Guardian)

However, whatever the government did, the markets felt the government couldn’t maintain it in the long term.

Eventually, on 16th September, the government admitted defeat. John Major and the then chancellor Norman Lamont admitted to the inevitable and left the ERM. The pound was allowed to devalue on the foreign exchange markets. It meant the government could cut interest rates and this allowed the UK economy to recover from the recession.

Although it was seen as a humiliation, the decision to leave the ERM allowed the UK economy to have a long period of low inflationary growth. It was also a major factor in the UK not joining the Euro Single Currency.

Related