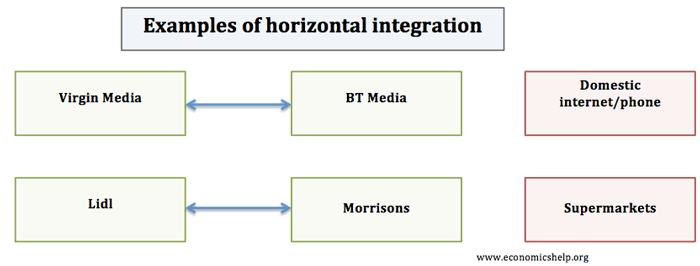

Horizontal integration occurs when there is a merger between two firms in the same industry operating at the same stage of production.

For example, if two newspapers like the Independent and the Guardian merged, this would be a horizontal integration.

Horizontal integration is different to vertical integration which occurs when firms at different stages of production merge. For example, if the Guardian merged a firm producing paper, this would be a type of vertical integration.

Benefits of Horizontal Integration

- In industries with high fixed costs, horizontal integration enables firms to benefit from greater economies of scale. With higher output, the firm can benefit from greater efficiency, lower costs and lower prices for consumers.

- As well as share fixed costs, the firm may benefit from marketing economies of scale and access to a more efficient distribution network.

- More profit and resources to invest in research and development. This is important for industries like the drug industry and commercial aeroplanes.

Potential Problems of Horizontal Integration

- Horizontal integration could lead to an increase in market share and monopoly power. (If the firm has more than 25% of Market share). This could lead to all the problems of monopoly power.

- It could also lead to diseconomies of scale – when bigger firms become more inefficient.

Related