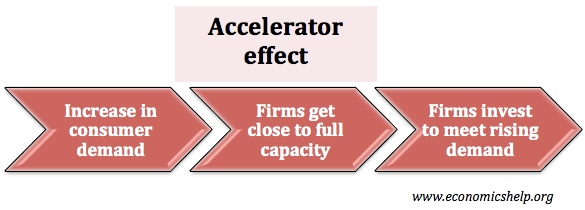

Definition of the Accelerator Effect

The accelerator effect states that investment levels are related the rate of change of GDP. Thus an increase in the rate of economic growth will cause a correspondingly larger increase in the level of investment. But, a fall in the rate of economic growth will cause a fall in investment levels.

Why the accelerator effect occurs

- If firms see a rise in demand and expect this demand to be maintained, then they will soon start to reach full capacity.

- Therefore, to meet the future demand, they will respond by investing now. To meet a growth in demand may require considerable investment outlay.

- Because of economies of scale in investment, it is more efficient to make a significant investment (e.g. increase capacity 20%) – rather than small annual increases in investment of 2%.

- Therefore, firms will wait for promising economic conditions, before embarking on investment decisions.

Implications of the accelerator effect

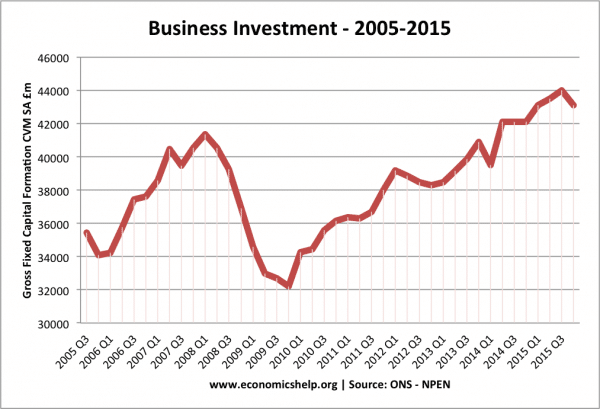

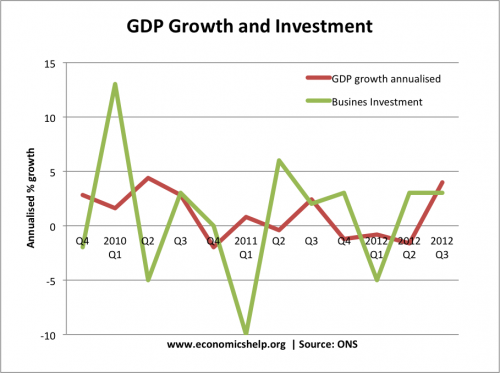

UK economic growth and business investment 2009-2012

- Investment tends to be more volatile than economic growth

- The rate of economic growth stays the same. Investment levels will also stay the same

- Investment spending can fall even when GDP is rising. This is because if there is a fall in the rate of economic growth firms may invest less.

- If GDP falls, investment spending can fall very significantly.

- Accelerator Coefficient. This is the level of induced investment as a proportion of a rise in National income accelerator coefficient = Investment/change in income.

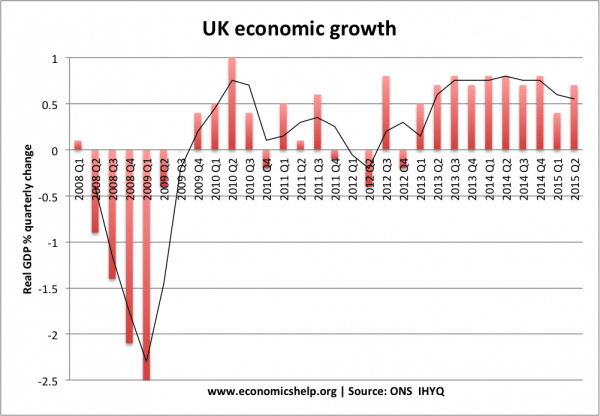

Example from the UK economy

UK economy 2008-15

Limitations of the accelerator effect

- Time lags in investment. Once a project is started, a firm will tend to want to complete it – even if demand slows down.

- Firms won’t respond to every minor change in demand and output. Investment requires planning and once started, can’t be easily stopped.

- Investment is affected by many other factors, such as investor confidence and the “animal spirits” of firms.

- It depends whether firms are optimistic about their industry. For example, a bookshop may be more nervous about investing in increasing capacity because they fear changing conditions. Whereas an online store may be more optimistic about the long-term future of their industry.

Simple Accelerator Model

This model assumes that the stock of capital goods (k) is relative to Y

- K = k×Y

- If we assume that the capital output ratio (k) is constant. An increase in Y requires an increase in K.

Net investment, In therefore equals:

- In = k×ΔY

- Suppose that k = 2

- This equation implies that if Y rises by 20, then net investment will equal 20×2 = 40, as suggested by the accelerator effect.

- If Y then rises by only 10, the equation implies that the level of investment will be 10×2 = 20.

This implies that a slowdown in the growth of Y can lead to lower fixed investment.

- However, in the next year, if Y rises by 15, then the level of investment will be 15*2 = 30.

Therefore, with an increase in the growth of Y, we get a big increase in investment.

Related