Government Intervention in Markets

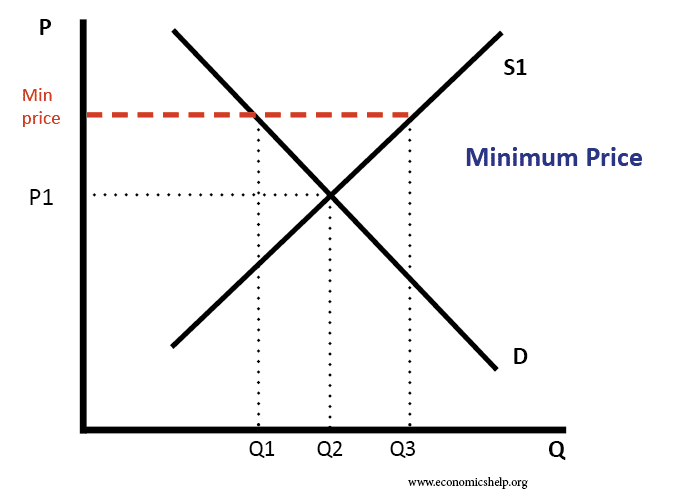

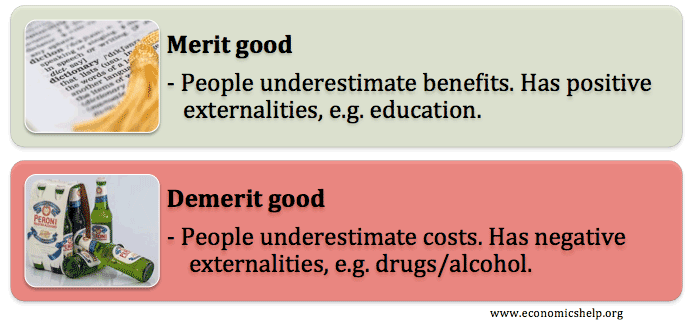

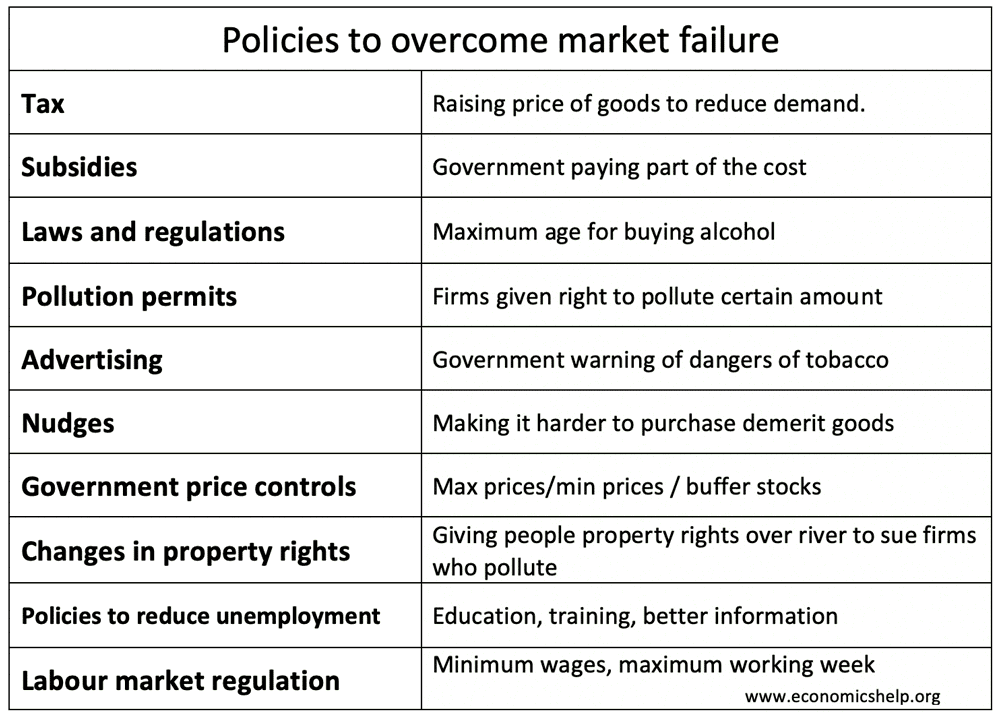

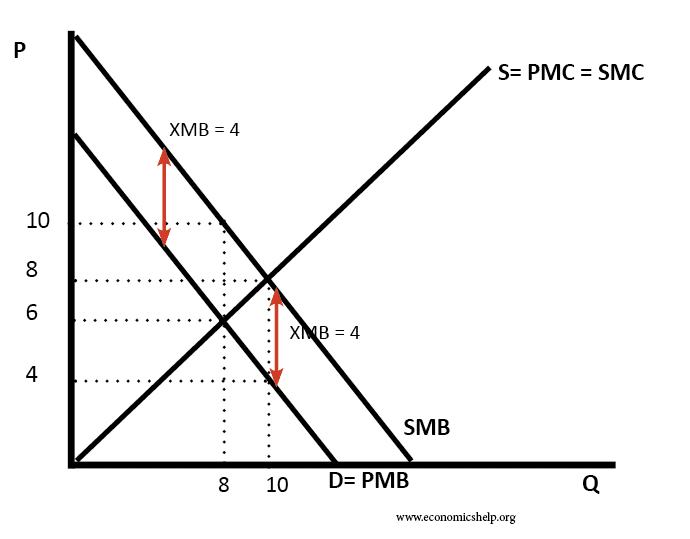

Governments intervene in markets to try and overcome market failure. The government may also seek to improve the distribution of resources (greater equality). The aims of government intervention in markets include Stabilise prices Provide producers/farmers with a minimum income To avoid excessive prices for goods with important social welfare Discourage demerit goods/encourage merit good Forms …