Readers Questions: Could you not also argue not that the Euro is a failure but that it’s members/ECB are pursuing the wrong policy? Predictions of the death of the Euro seem to have been much exaggerated & surely Europe has the potential to be a world economic superpower to rival the US or China?

It is an interesting question, and to some extent inappropriate policy is a considerable factor in the ongoing European difficulties. However, there are still structural problems surrounding the Euro, which make economic stagnation more likely than in a floating exchange rate with independent monetary policy.

Poor Policy decisions in the Eurozone

1. Failure of ECB to intervene in bond market. One example of poor policy decisions is the failure of the ECB to stop rising bond yields earlier.

In 2011 and 2012, we saw a sharp spike in bond yields – because the ECB was, at the time, unwilling to act as lender of last resort and purchase any bonds or supply liquidity. This lack of intervention by a Central Bank meant that investors became nervous and bond yields rose to very high level. This rise in bond yields caused higher debt interest payments, but most damagingly were the motivation for deep austerity which caused a deeper recession in the affected Eurozone countries.

In 2012, the ECB changed its policy and became willing to intervene in the bond market. Bond yields fell – showing that decisive Central Bank intervention was needed. Therefore, despite higher government borrowing, bond yields are now much lower than in 2011 and 2012.

Before 2012, the ECB were partly blaming the constitution of the Eurozone where it seemed the Central Bank did not have a clear mandate to intervene and provide necessary liquidity in the bond market. However, the fact that bond yields have fallen in recent months suggests that the Euro can be more successful, if the Central Bank is given the authority and mandate to provide the necessary liquidity. Some Germany bankers are still unhappy at the ECB’s intervention – fearful it may encourage fiscal profligacy.

However, it is still more difficult in the Single Currency to intervene in bond markets. It is more complicated for a European wide Central Bank – how much should it intervene? which countries should be supported ?e.t.c.

But, if the ECB had understood the necessity of intervening earlier, then we could have avoided that period of high interest rates, and partly avoided the lurch towards austerity and lower aggregate demand.

Exchange rate imbalances

A structural problem of the Eurozone is that without exchange rate fluctuations the south became uncompetitive. This led to large current account deficits in Portugal, Spain and Greece, and large current account surplus in Netherlands and Germany.

A better policy for the Eurozone would be for Germany to increase domestic demand – boost consumer spending and allow a moderately higher inflation. This would help the Eurozone to rebalance. It would lead to higher demand for southern exports and help deal with the trade imbalance in the Eurozone. It would help southern Europe restore competitiveness without just relying on deflationary policies.

Instead, Germany is keen to keep inflation low and persist with a large current account surplus. The consequence is that the south is facing a long period of deflationary pressure to try and restore competitiveness through internal devaluation.

The problem is that Germany is (unsurprisingly) pursuing the economic policy which it thinks it is most appropriate for Germany. There is little enthusiasm for risking inflation, just to help southern Europe restore competitiveness.

To me, this problem reflects a structural weakness of the Euro, rather than poor policy. I don’t think a single currency will work, when it relies on countries pursuing policy which is targeted to help other countries. (though to complicate matters, I still think it is in German interests to increase German aggregate demand)

But, if southern European countries weren’t in the Euro, they could devalue without any political difficulty or relying on other countries to pursue reflationary policy.

Austerity

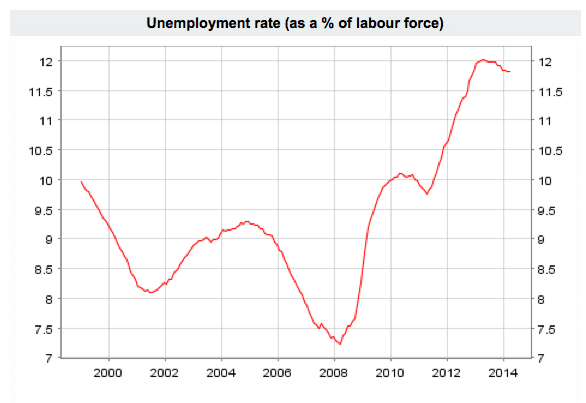

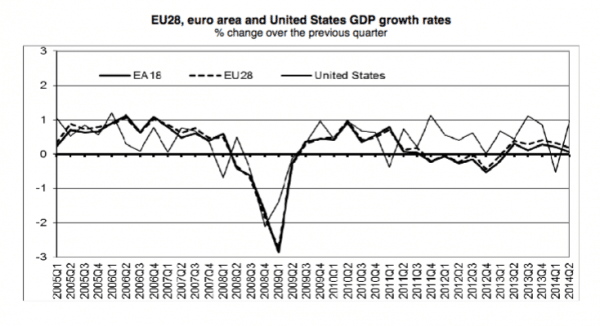

A big criticism of European economic policy in the past few years has been the tendency to favour austerity policies – cutting government spending to reduce budget deficits. However, given the relatively tight monetary policy, a deep recession and fixed exchange rates – the policy of austerity has contributed to a period of exceptionally low economic growth and high unemployment.

Source: ECB

Arguably, austerity has been self-defeating, with countries struggling to reduce debt as a % of GDP because of the falling demand.

However, outside the Euro, countries would have had more flexibility. For example, the UK pursued (relatively mild) austerity. But, the UK was able to rely on a significant devaluation and very loose monetary policy (Q.E. by Bank of England). This has offset any fiscal tightening. Countries in the Eurozone who have been forced to pursue austerity, haven’t had that release mechanism. They have tight fiscal policy, but also overvalued exchange rates and relatively tight monetary policy.

But, the Euro has survived

There is a strong political desire to keep the Euro together. But, from an economic perspective, the past few years have been very damaging in terms of low economic growth and high unemployment. Yes, politically the Euro has survived. But, there are very high economic and social costs. In a sense the Euro has encouraged worrying about relatively unimportant economic issues – bond yields, size of budget deficits e.t.c. But, faced with the highest rates of unemployment since the Great Depression, the EU has been unfortunately quite impotent.

Conclusion

To some extent, better policy could expedite the Eurozones recovery. Better policy could have avoided some of the worst economic downturn. However, there are structural features of the Single Currency which make it more difficult. It is always a mistake to design an economic system where you rely on politicians and Central Bankers always choosing the best policy, even if requires a degree of foresight and altruism.

Related