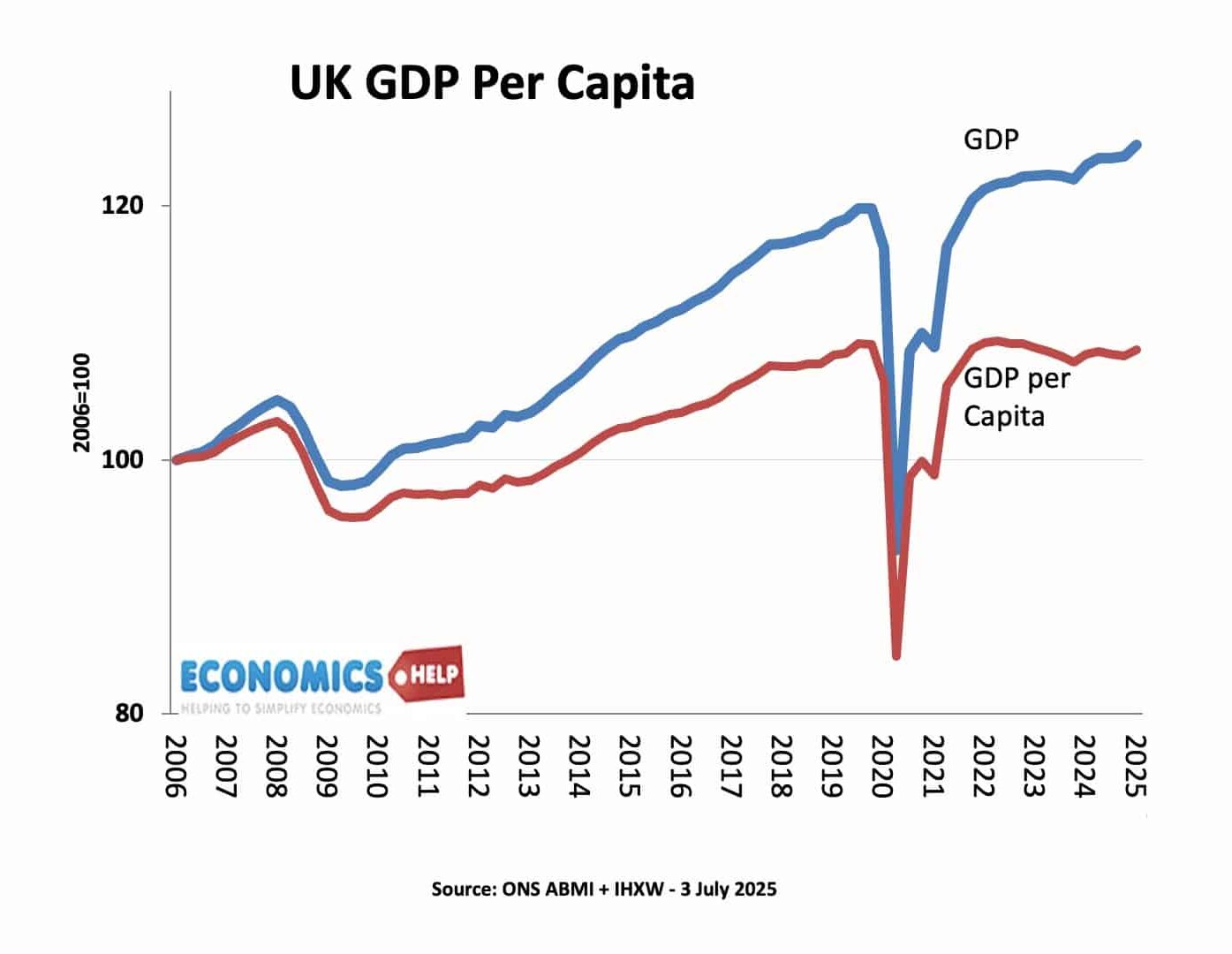

The UK Economy is in Big Trouble 2025

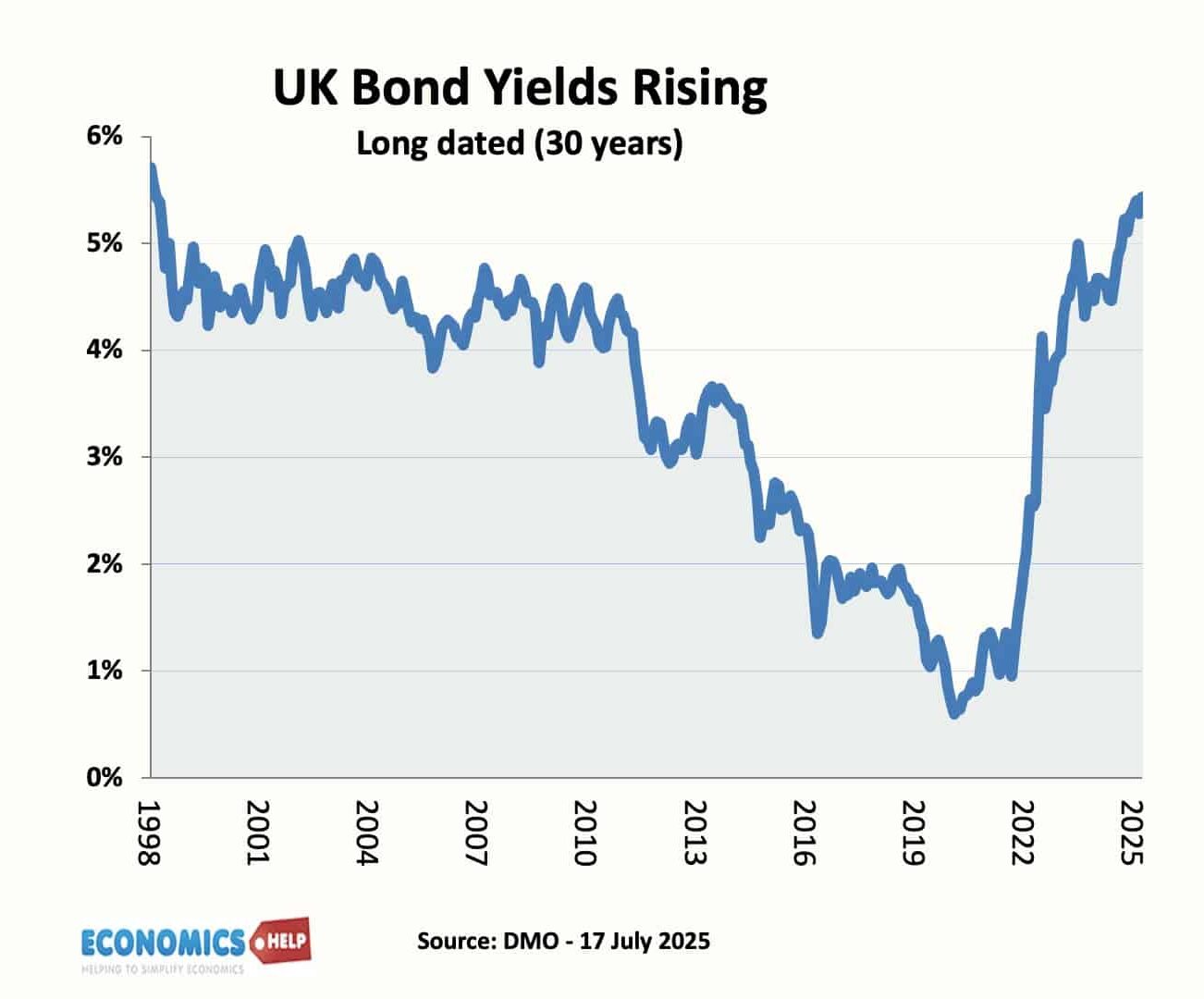

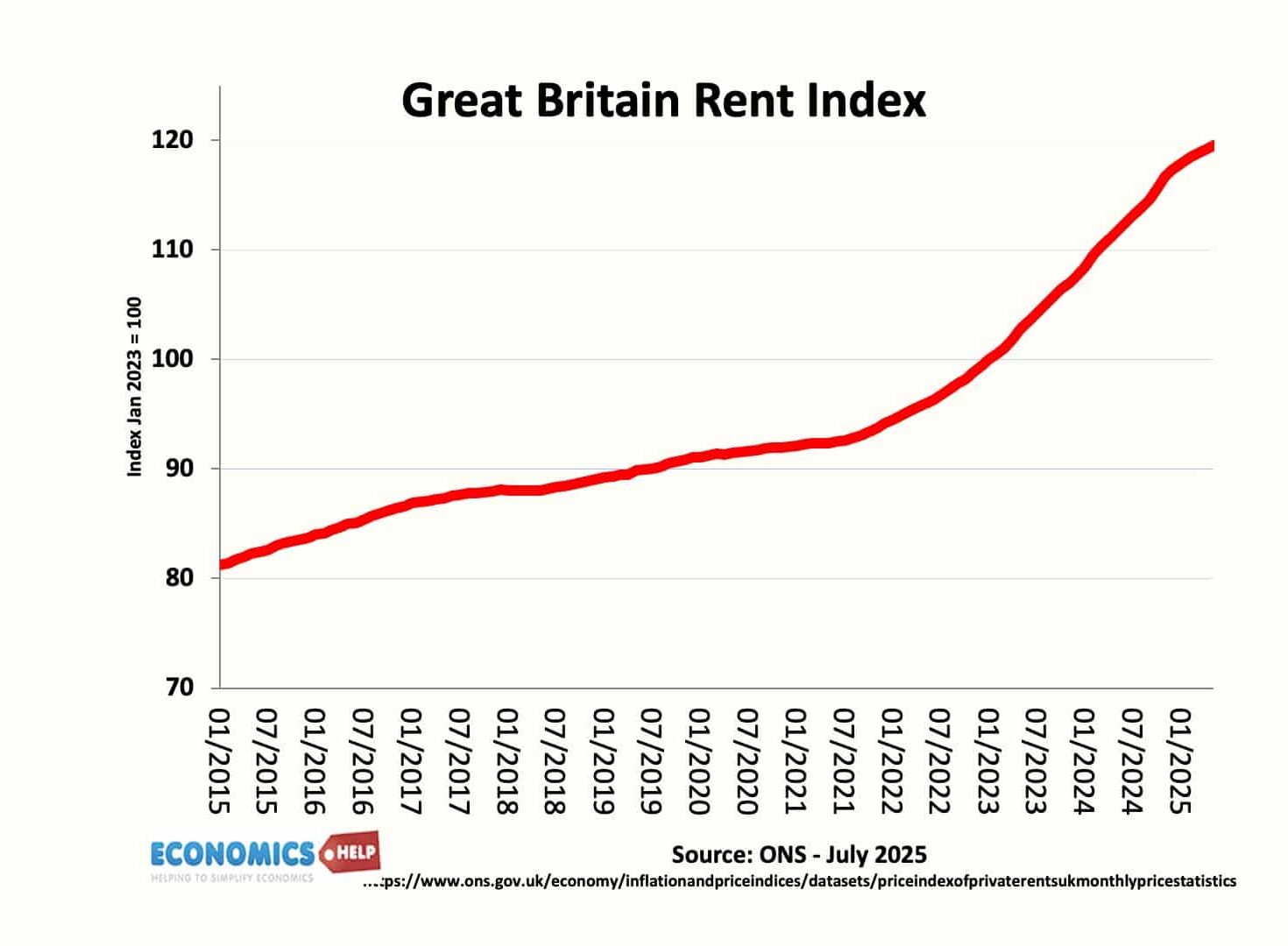

It’s been a week of unexpectedly bad news for the UK economy. Inflation was higher than expected 3.6% and core inflation 4.3%. Unemployment was also higher than expected, and that is after last weeks economic growth was lower than predicted – a 2nd month of negative growth. It is only a matter of time before …