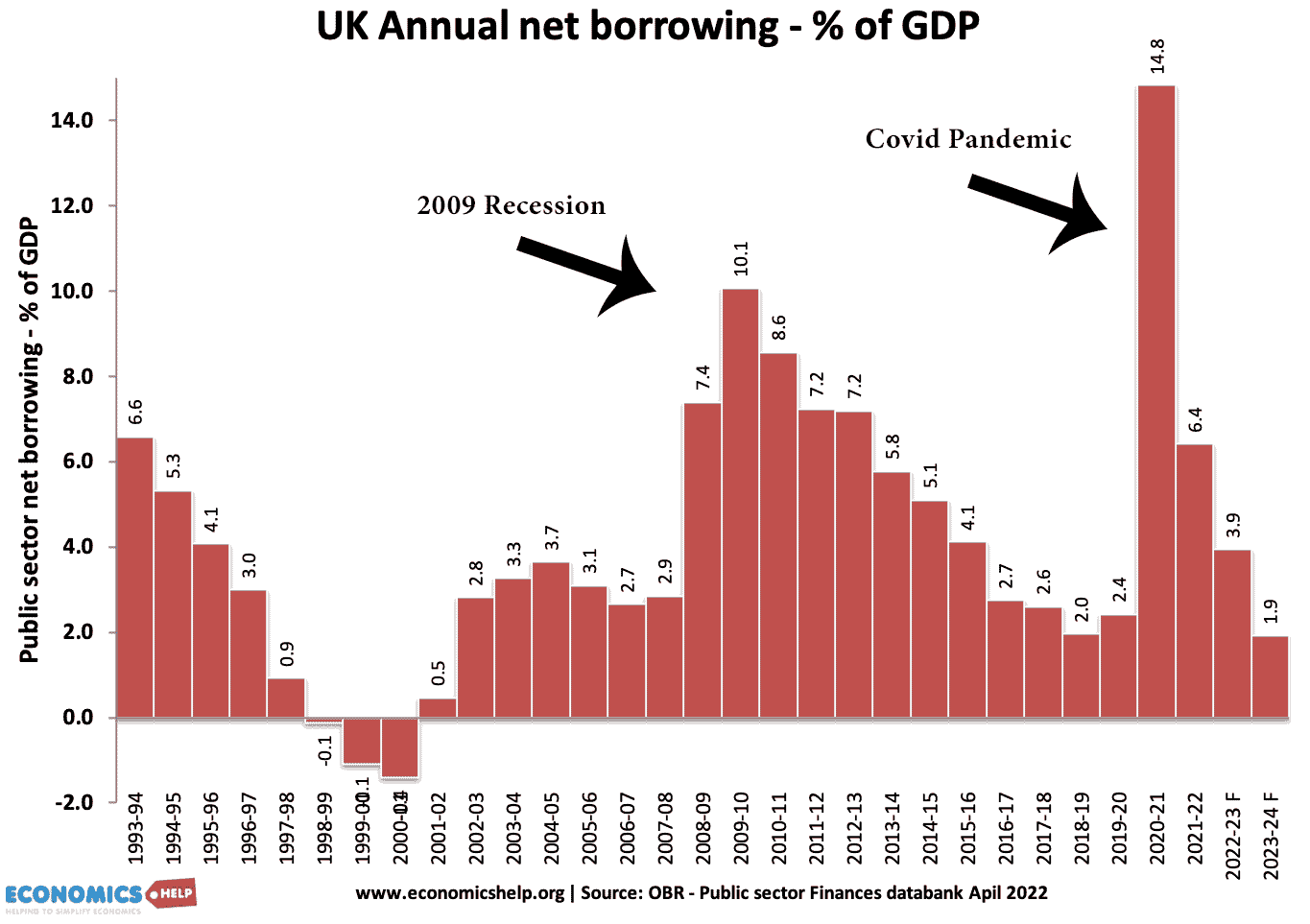

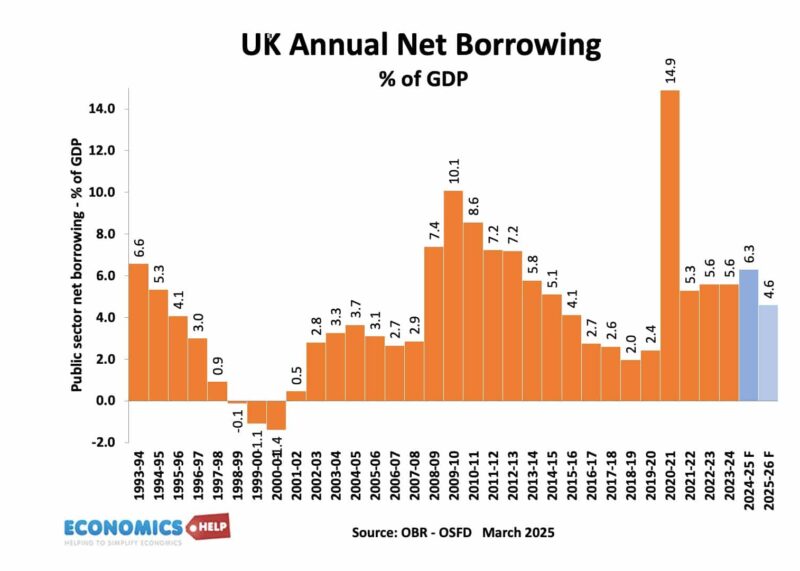

- The budget deficit is the annual amount the government has to borrow to meet the shortfall between current receipts (tax) and government spending.

- Net borrowing for the UK 2021/11 is £151.8bn or 14.8% of GDP [OBR – J511]

- National debt or public sector net debt – is the total amount the government owes – accumulated over many years. See: UK national debt (May, 2022 – £2,347.7 billion equivalent to 95.% of GDP)

UK Borrowing

Budget deficit – annual borrowing

This is the amount the government has to borrow per year.

- In 2000/01, the UK ran a budget surplus of £17bn or 1.7% of GDP

- In 2009/10 at the height of the great recession net borrowing was £152 bn or 10% of GDP

UK net borrowing

View: Latest statistics at OBR