The UK has one of the highest tax rates on petrol / diesel in Europe – roughly 60% of the final price of petrol goes to the government in excise duty or VAT.

- UK fuel duty is currently 58p per litre for petrol and diesel

- VAT accounts for 20-25p per litre

- The product cost is around 50p per litre

- firms profit margins is often as low as 5p per litre – even lower for supermarkets, who use petrol as a type of ‘loss leader’ to entice shoppers into the supermarket to spend on groceries.

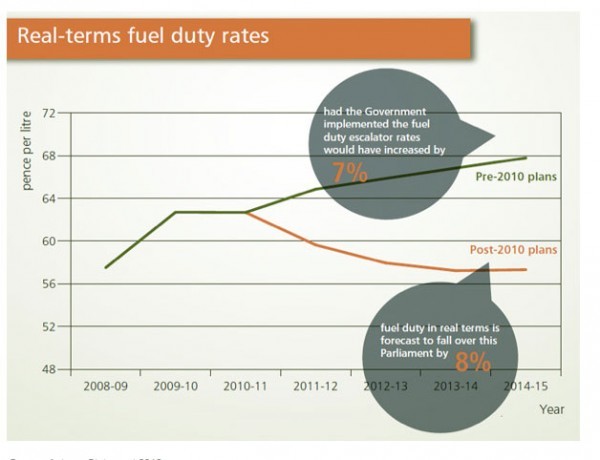

Between 1993 and 1999, fuel duty rose at 3% above inflation, causing an increase in the price of petrol. However, in 2011, the chancellor introduced a fuel duty stabiliser with a pledge to pledge to keep rates down.

Source: Fuel duty UK

However, there are economic arguments to suggest that breaking the fuel duty escalator is a mistake. With falling inflation, falling oil prices and rising congestion levels – higher petrol tax could help improve struggling government tax revenues and also contribute to a better environment and lower congestion levels.

Arguments for higher tax on petrol

Environmental costs of petrol. Using petrol causes carbon dioxide (CO2 emissions which contribute to global warming. But, also burning petrol / diesel creates other compounds toxic to life. For example carbon monoxide and methanol. Also, fine particulates of soot cause from car exhausts cause lung problems and are carcinogenic. Air quality standards in cities would be improved by reducing petrol and diesel consumption. Higher tax would act as an incentive to reduce the pollution caused by driving petrol/ diesel cars (See: tax on negative externality for more on the economics of taxing these negative externalities)

Costs of congestion. Cheaper petrol will cause increased congestion levels. Time wasted in traffic jams is a major individual cost and also cost for business. Without increasing the price of petrol, there will be a rise in the social cost of traffic congestion. The CBI estimate that congestion costs the UK economy £8bn a year. Given the limited scope for increasing the road network in many areas, pricing will have to pay a role – otherwise, we will pay for cheap petrol in other ways.

Improved fuel efficiency and falling tax revenue. One of the benefits of increasing petrol duty in the past has been to increase the incentive for manufacturers and consumers to choose more fuel efficient cars. The consequence is that although petrol tax has risen, the total amount of fuel duty we actually pay is falling – because we are using less fuel. This means government tax revenue from petrol tax is falling. In 2012, the government could expect £38bn from fuel duty and VED. (Link) But, by 2029, this tax revenue could be £13bn lower.

A study by the Institute for Fiscal Studies (IFS) has stated the government face a significant fall in tax revenue from fuel duty and vehicle excise duty (VED). They state that revenue will fall from the current levels of 1.7pc and 0.4pc of GDP respectively, to 1.1pc and 0.1pc by 2029 – in its report Fuel for Thought, commissioned by the RAC Foundation.

Given the poor performance of UK tax revenues in recent years, increasing petrol tax would help meet this deficit. Also, higher petrol tax would further increase the incentive for greater fuel efficiency.

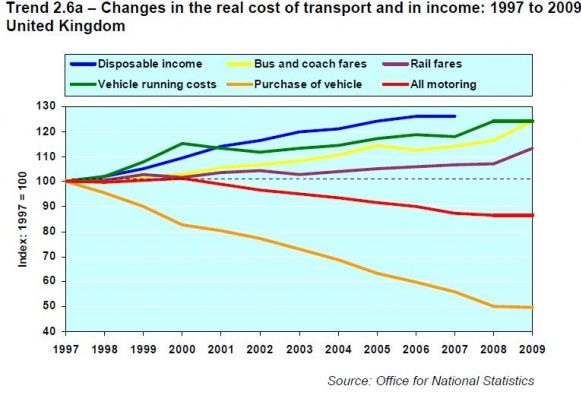

Falling real cost of driving

If we take into account other driving costs, such as cost of vehicle purchase, cost of repairs, the real cost of motoring has fallen significantly compared to public transport. For many people, motoring is much cheaper than taking public transport, such as buses and trains. Higher petrol tax could be used to subsidise alternative forms of transport.

Encouraging alternative modes of transport. 50% of car journey are less than a couple of miles. Higher petrol tax would encourage people to take alternative modes of transport – cycling, walking, public transport. This would have many positive benefits – it would encourage greater physical activity, helping deal with health issues such as heart disease and obesity. Less reliance on cars could encourage more liveable cities where there is greater pedestrianisation and less traffic accidents.

Conclusion

The decision to freeze fuel duty was politically popular. But, it has many unwarranted side effects. It will aggravate the problem of congestion, which has very high personal and social costs for drivers. It is leading to a significant loss in tax revenue at a time when the government needs to try and increase its tax base.

There are also very strong environmental and health benefits from reducing the reliance on the car. Petrol tax could play a role in this.

In the long-term, there may need to be a re-evaluation of how we tax cars. From an environmental perspective, it is a good development to see increased use of electric / hybrid cars which have significantly lower emissions. But, if the price of electric cars continues to fall, we may need some form of road pricing to prevent excess levels of congestion.

Utter rubbish. Lower taxes as it is the bloody highest in the world for fuel. This will cascade on to lower costs of most goods as transport / fuel costs impact on everything. More disposable income, better economic growth from consumer spending, banking, service utilisation etc. Not difficult to see but that’s what happens when you have idiots as ‘ministers’ who change from one role to other confirming their complete lack of expertise in any field. What a toilet of a country.

indeed, using tax as the preferred method to ‘control behaviour’ is does not give much confidence that Gov ministers have a brain to find real solutions.

It is much fairer to cancel VED (road tax) and put this on petrol/diesel if the revenue is to be the same. Less efficient cars will pay more but it would discourage use and therefore congestion and pollution. The system of CO2 analysis is based on average miles and so encourages more use as the fuel costs are relatively small overall. Also people who use their vehicle sparingly are presently subsidising heavy users and thus road wear, pollution and congestion. At least the French have thought this through even though their road fuel tax now only matches the UK whereas we still have the additional VED charges.