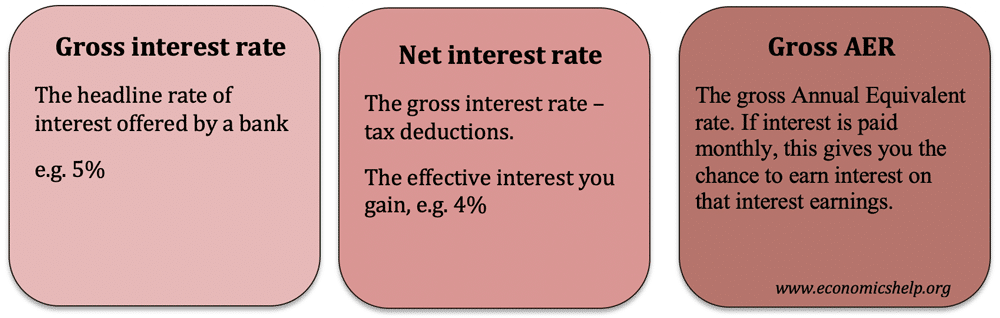

Gross interest rate. This is the total interest payable before any deductions such as tax and charges. For example, the gross interest rate on a savings account maybe 4.4%

Net Interest Rate. This is the total interest payable after any deductions. For example in the UK, the net interest rate will be the gross interest rate – the basic rate of income tax.

- If the gross rate is 4.40%

- and the basic rate of income tax is 25%

- That means a quarter of your interest income will be subject to tax.

- Therefore net rate will be 3.30%

Gross AER. This is the Gross Annual Equivalent rate. This applies to all accounts where interest rates are paid more frequently than once a year. The significance of this is that if you are paid interest every month, you have a chance to earn interest on the interest payments you gain in the first month. If interest is calculated daily the cumulative benefit will be greatest. Therefore, the Gross AER, will be higher than the gross interest rate. Typically interest is credited monthly, quarterly or in rare cases daily.

APR – Annual Percentage Rate. This is the effective interest rate for the whole year. The APR can be

- The nominal APR – the simple interest rate for the whole year (e.g. 5%)

- The effective APR – the fee plus the compound interest rate. This is what the customer effectively pays per year.

Related concepts

- Real interest rate – interest rate – inflation

Related

very helpful, thank you.

🙂

Clear and concise, thanks. B

Thanks for the help ^ __ ^

The best information i have found exactly here. Keep going Thank you

Thanking you for your help .