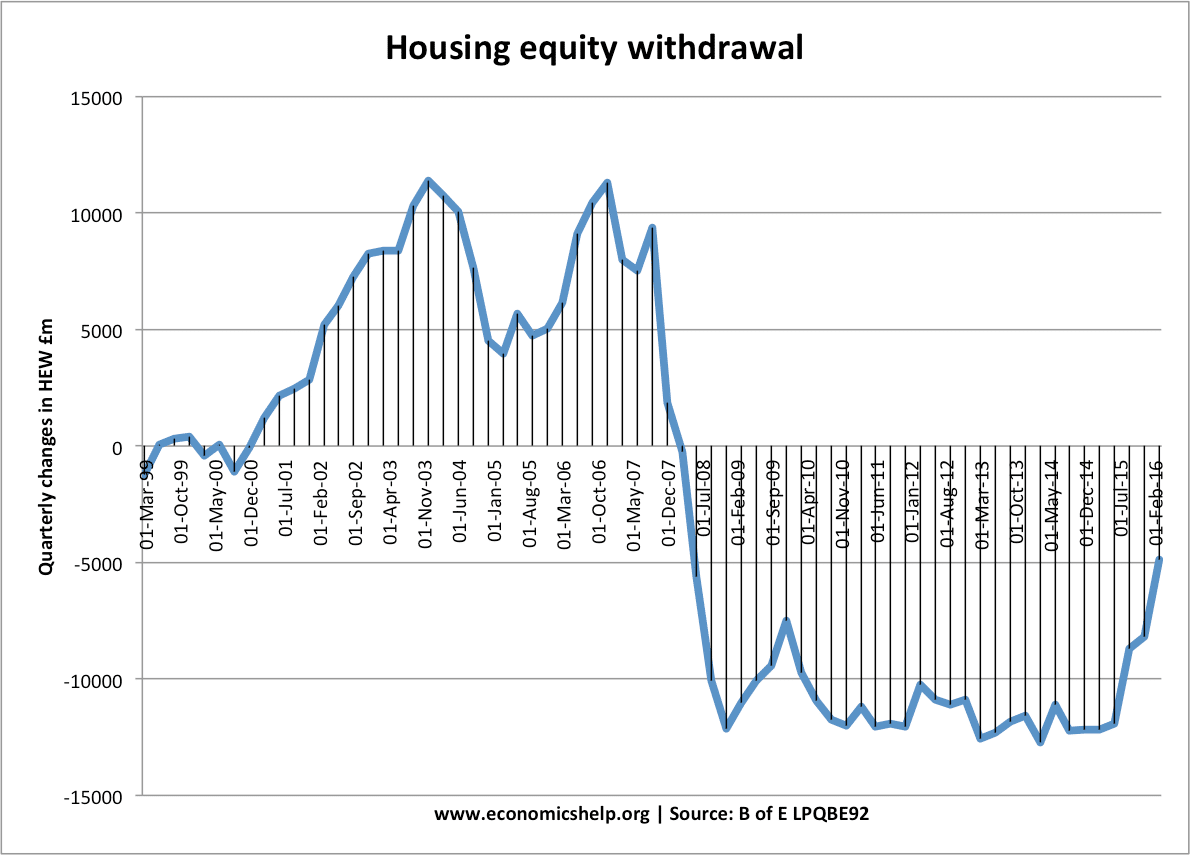

Housing equity withdrawal (HEW) is new borrowing secured on dwellings that is not invested in the housing market (e.g. not used for house purchase or home improvements). From Q1 2007 this is called Housing equity withdrawal (HEW) rather than its old name of Mortgage Equity Withdrawal. (MEW)

Source: Housing Equity Withdrawal at Bank of England.

Suppose someone buys a House for £100,000 with a 10% deposit and £90,000 mortgage. If the house price rose to £150,000, banks might be willing to lend a mortgage equal to 90% of the new value. Therefore the homeowner could take out a mortgage for £135,000. Therefore, the homeowners get a new mortgage for £135,000 giving them an extra £45,000 to spend (e.g. buy luxury items such as a new car or yacht.)

This graph shows the decline in housing Equity withdrawal since UK house prices started to fall.

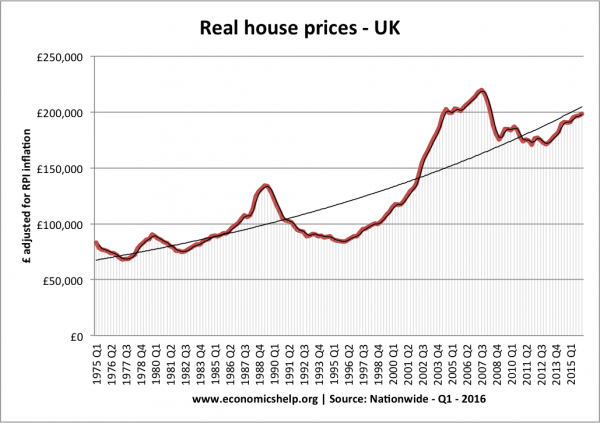

The fall in real house prices post-2008, corresponded with fall in mortgage equity withdrawal.

Factors affecting housing equity withdrawal

- House prices. Rising house prices encourage people to borrow against the increased value of their homes

- Low-interest rates. This makes it cheaper to remortgage

- Confidence in the economy. If people are optimistic then they will remortgage to spend on luxury items. If people are pessimistic, they would rather pay off debts and not take out loans.

When House prices are rising people can re-mortgage their house

When house prices are falling people can no longer borrow extra. But, people may seek to overpay their mortgage to help reduce the amount that they owe.

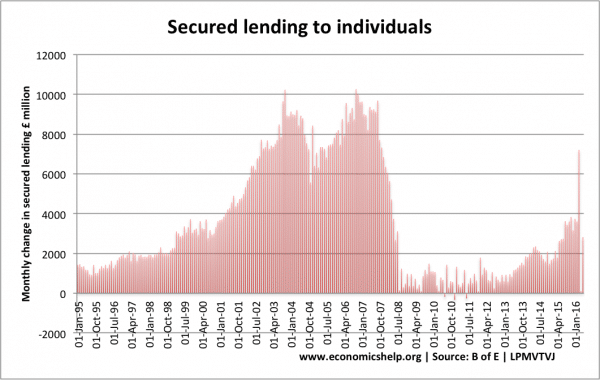

Secured lending to individual

Lending secured against value of home in UK

Related

3 thoughts on “Housing Equity Withdrawal”

Comments are closed.