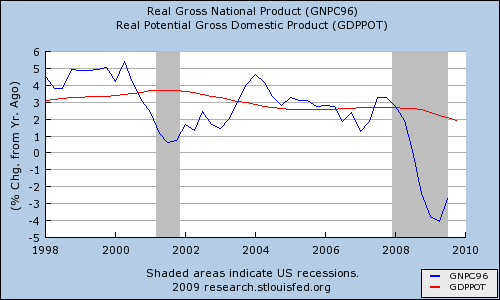

This graph illustrates the difference between actual GDP and potential GDP. It also indicates how much Real GDP growth has lagged behind potential growth. This means the US economy currently has substantial spare capacity. This is reflected by a rise in unemployment and factories operating below full capacity.

The Real potential GDP illustrates the long run trend rate of growth which is the average sustainable rate of growth over a period of time. Notice how the recession has reduced the growth of potential GDP from 3% to 2%.

What are the Implications of Growth well Below Potential Growth?

- High Spare capacity

- High rates of unemployment likely to persist

- The economy needs to grow substantially quicker than average to regain ‘full employment’

- Growth of 1-2% would not solve the spare capacity and unemployment of the US

- Growth could be temporarily above the long run trend rate fo 2.5% without causing inflation.

- This large amount of spare capacity may encourage policy makers to pursue a more expansionary fiscal and monetary policy – taking into account limitations of budget deficit.

More on the Current state of the US Economy and prospects for 2010

I will be doing a similar overview of the UK economy soon.