A bond is a specific type of security that is sold by firms or governments. It is a way for the firm or government to borrow money at a certain interest rate. In return for buying the bond and investor gets a certain interest rate for the duration of the bond.

As opposed to treasury bills and gilt-edged securities a bond has a maturity date of greater than one year. For this reason, a bond is seen as illiquid (not near money)

Government Bonds

Government bonds are used to finance the National Debt and the government’s public sector net borrowing requirement. They are issued by the Treasury and sold on the bond market. Bonds are typically bought by pension funds, investment trusts and private individuals. Government bonds are seen as one of the safest types of investment.

Price of Bonds and Inverse Relationship of Interest Rates

For a bond with a long maturity date, the value of a bond will fluctuate on the bond market in close relationship to any change in interest rates.

Basically a rise in interest rates makes existing bonds less attractive and their value falls.

A simple example will explain

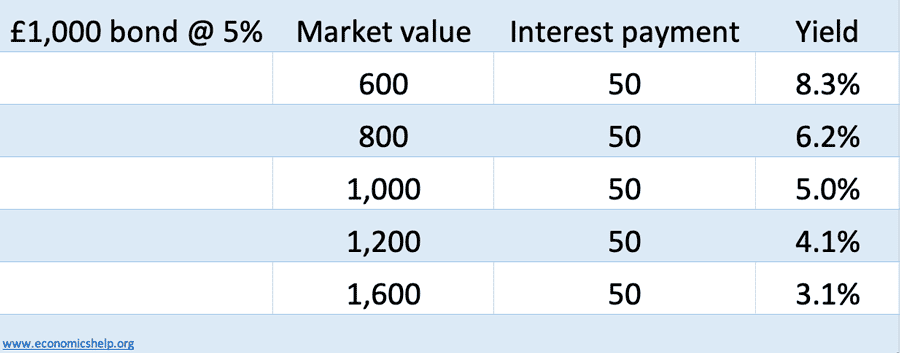

- Suppose market interest rates are 5% and the government agree to pay an interest rate of 5% on a £100 bond. The annual return is £5 a year. This is a competitive interest rate and similar to other investments.

- However, suppose the MPC increase interest rates to 10%. This means that the above bond offers bad value for money. Because it only pays £5 a year. Another investment should pay £10. a year.

- Therefore the new value of the bond is effectively reduced to £50. This is because with an annual payment of £5 a year. The price would have to be £50 to give a market-based return.

Related