Adaptive expectations is an economic theory which gives importance to past events in predicting future outcomes. A common example is for predicting inflation. Adaptive expectations state that if inflation increased in the past year, people will expect a higher rate of inflation in the next year.

A simple formula for adaptive expectations is Pe = Pt. -1 This states people expect inflation will be the same as last year.

The adaptive expectations hypothesis. The theory that people base their expectations of inflation on past inflation rates.

In more complicated adaptive expectation models, different weightings can be given to past years and how much inflation was different to predicted inflation.

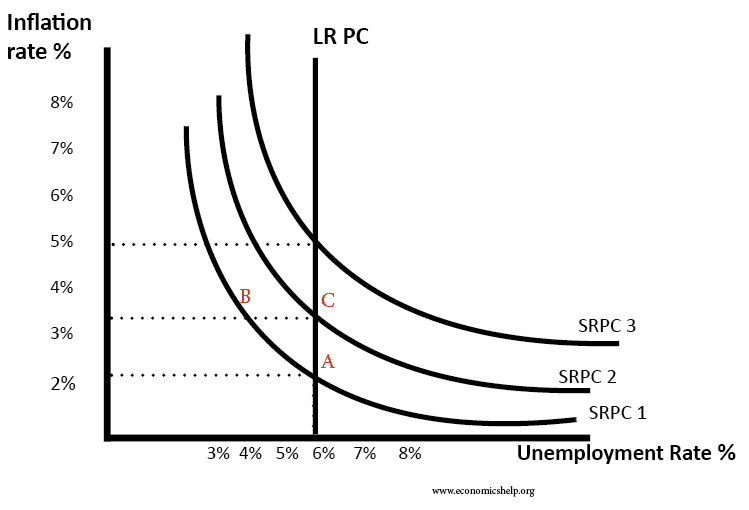

Adaptive expectations and Monetarist view of Phillips curve

- Initially, at short-run Phillips Curve I (SRPC), inflation expectations are 2%

- However, if there is an increase in demand, then inflation increases to 3.5%

- Because inflation has increased to 3.5%, consumers adapt their inflation expectations and now expect inflation of 3.5%.

- Therefore, with higher inflation expectations we now get a worse trade-off between inflation and unemployment – shown by SRPC 2

- In the third year, if demand increases again, then initially people expect inflation of 3.5% – but when they realise demand has pushed up inflation to 5% – then they revise their inflationary expectations upwards.

In predicting inflation, often stating the previous year’s inflation rate is a better guide than using inflation forecasts.

Limitations of adaptive expectations

The model is rather simplistic, assuming people base future predictions on what happened in the past. In the real world, past data is one of many factors that influence future behaviour. In particular adaptive expectations is limited if inflation is on an upward or downward trend. These limitations led to the development of rational expectations which incorporated many factors into the decision making process.

Rational expectations

Rational expectation is a model which suggests that people are more forward-looking and do not get caught out. For example, if the government offer inflationary tax cut or interest cut, then people expect inflation to occur, rather than wait for it to occur.

However, rational expectations rely on the average consumer having remarkably strong economic insight and knowledge.

Related concepts

Published 12 April 2016, Tejvan Pettinger. www.economicshelp.org