Definition of Rational expectations – an economic theory that states – when making decisions, individual agents will base their decisions on the best information available and learn from past trends.

Rational expectations are the best guess for the future.

Rational expectations suggest that although people may be wrong some of the time, on average they will be correct. In particular, rational expectations assumes that people learn from past mistakes.

Rational expectations have implications for economic policy. The impact of expansionary fiscal policy will be different if people change their behaviour because they expect the policy to have a certain outcome.

Efficient market theory

The efficient market theory states that the best guide to future asset values is present asset values. This is because investors have a profit incentive to look at all possible data and information. If a stock is undervalued or overvalued, there is a profit incentive to buy/sell – to move the asset closer to its real value.

The only factors that change asset values are random factors, that cannot be known in advance.

Weak and strong versions of Rational expectations

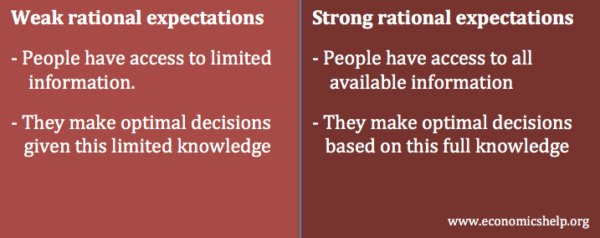

There are weak and strong versions of rational expectations.

“Strong” versions assume actors have access to all available information and make rational decisions based on this. Any mistake is due to unforeseen events.

“Weak” versions assume actors may not have time to access all information, but they make rational choices given this limited knowledge. For example, sometimes, it may be more rational to make decisions based on rules of thumb – rather than try to gain perfect information about every decision. If you buy cornflakes every week, it is ‘rational’ to keep buying the same brand – and not worry about getting perfect information about the relative prices of other cornflake brands.

Adaptive expectations vs rational expectations

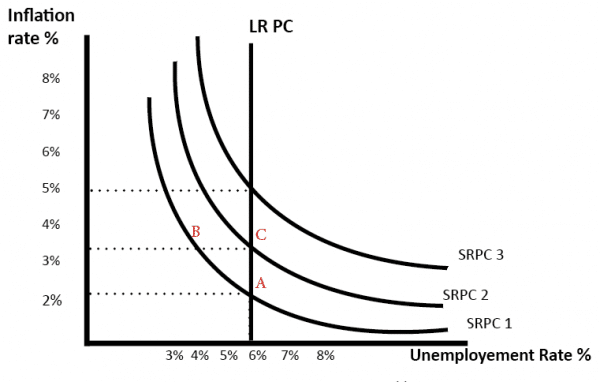

In versions of the Phillips Curve, developed by Milton Friedman, the trade-off between inflation and unemployment assumes adaptive expectations.

In summary.

- Let us assume inflation is 2% and people expect future inflation of 2%

- But, then the government increase aggregate demand.

- The increase in demand causes a rise in money wages. Wages increase more than expectations of inflation. This causes a ‘money illusion’.

- Workers think real wages have risen and this causes workers to supply more labour causing a fall in unemployment.

- However, the rise in demand also leads to inflation. When workers realise inflation has increased, they adapt their expectations and now expect inflation of 3.5%.

- With expectations catching up with reality, workers realise real wages have stayed the same.

- Unemployment returns to the natural rate.

- If, in the next year, the government increase demand, adaptive expectations states that again there will be a temporary fall in unemployment due to inflation expectations being less than actual inflation.

- Adaptive expectations assume people base forecasts of inflation purely on last years inflation.

- It assumes people can be wrong every year.

Rational expectations

Some economists, such as John F. Muth “Rational Expectations and the Theory of Price Movements” (1961) and Robert Lucas, e.g. “Expectations and the Neutrality of Money (1972) pdf challenge this view of adaptive expectations. They argue that people can learn from past mistakes. As Lucas states in 1972 paper.

“The relationship, essentially a variant of the well-known Phillips curve, is derived within a framework from which all forms of “money illusion” are rigorously excluded: all prices are market clearing, all agents behave optimally in light of their objectives and expectations, and expectations are formed optimally.” (link)

For example, if expansionary fiscal policy causes inflation last year, they will factor this into future expectations.

Therefore, in the second year, if the government pursue more fiscal stimulus, unemployment may not fall at all, because people immediately adjust their inflation expectations in response to government policy.

Under rational expectations, the Phillips curve is inelastic in the short-term because people can correctly predict the inflationary impact of public policy. According to rational expectations, there is no trade-off – even in the short turn.

Abraham Lincoln famously asserted:

“You can fool some of the people all of the time, and all of the people some of the time, but you cannot fool all of the people all of the time.”

According to the theory of rational expectations, this same idea can be applied to inflation forecasts. If the government increase money supply when expectations of inflation are low, they may be able to reduce the real value of government debt. This is because inflation turns out to be higher than the nominal bond yield they promise to pay. (This happened in the 1970s when inflation was higher than expected)

But, in future, people will be more wary of buying government bonds – because of the risk of future inflation.

Robert Lucas was awarded the Nobel Prize in economics in 1995 for his work on rational expectations. In his Nobel lectures, he wrote:

“The main finding that emerged from the research of the 1970s is that anticipated changes in money growth have very different effects from unanticipated changes.”

- anticipated changes cause higher nominal interest rates and no stimulus

- unanticipated changes, on the other hand, can stimulate production.

Examples of rational expectations

- Cobweb theory not always valid. (Prices become more and more volatile)

- Permanent income hypothesis – People smooth consumption over time.

- Efficient market hypothesis

- Impact of quantitative easing

- Ricardian equivalence

The Cobweb theory suggests that prices are volatile:

- High supply leads to low price. Therefore, farmers cut back on supply and next year prices rise.

- Then the high prices lead to increased supply.

- Then high supply leads to low price.

- Cobweb theory

In other words, farmers always base their decision on how much to supply based on last years price. This causes fluctuating prices and an unstable equilibrium.

However, rational expectations suggest farmers may use more information than just last years price. Farmers may realise price volatility is a feature of farming and maintain more stable supply – rather than reacting to every annual change in price.

Permanent income hypothesis

The permanent income hypothesis developed by Milton Friedman (and similar models) placed emphasis on individuals smoothing consumption over time.

Previous Keynesian consumption functions suggested a drop in income, would lead to falling in consumption and vice-versa. But, theories of permanent income state that people will consider more than just present income. In particular, they will try to judge whether the drop in income is temporary or permanent. If they feel it is temporary, they will try to maintain average lifetime spending levels.

This implies the use of rational expectations – looking beyond one variable to a best guess estimate for optimal income and consumption.

Impact of quantitative easing

Some economists have suggested quantitative easing has little impact on the economy – partly because of how it influences people’s expectations.

One idea is that if the government announces quantitative easing to boost demand, people may take the view that resorting to Q.E. is a sign the economy is depressed. Banks sell bonds to the government, but they hold onto the cash rather than lend. Unconventional monetary policy loses some of its impacts because people react in a negative way to it.

Similarly, in a liquidity trap, plans to raise interest rates may be sufficient to depress demand and so interest rate rises kept getting delayed.

Criticisms of rational expectations

- Behavioural economics looks at psychological influences that influence consumer decisions. This branch of economics suggests people are often irrational – but subject to biases and prejudices. These include:

- irrational exuberance, and the wisdom of the crowd, People get carried away by the past performance of a stock and so keep buying – even if it becomes divorced from its fundamental value. People don’t necessarily learn from past mistakes but tell themselves ‘this time is different’ e.g. asset bubbles and busts.

- Present value bias – people can place greater value on income in short-term to income in long-term.

- Many ordinary people are unaware of the impact of economic policies, e.g. inflationary impact of fiscal policy.

- The impact of economic policy is also uncertain. For example, the significant increase in money supply post 2009 didn’t cause any inflation. Expansionary fiscal policy is not necessarily inflationary in a liquidity trap.

- The findings of Lucas in the 1970s are not necessarily applicable to the 2000s because of the different low inflationary environment.

Related

- Adaptive expectations

- Rational expectations at Econ Library

Thank you so much, I’m studying economics in college and your explanations here were so helpful! Especially the quotes and the summary of adaptive expectations