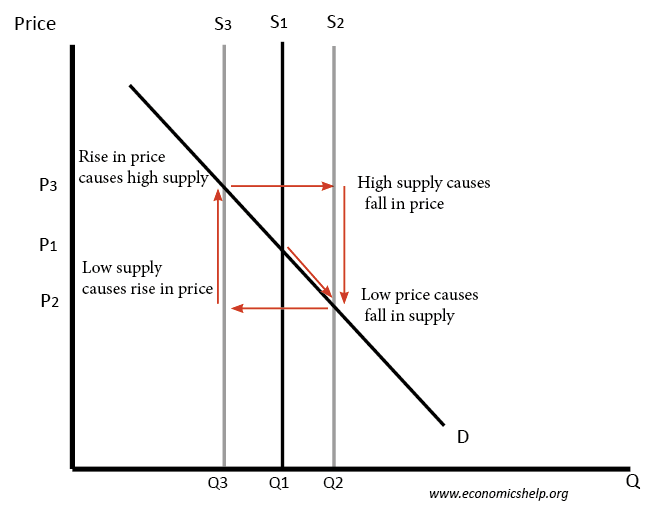

Cobweb theory is the idea that price fluctuations can lead to fluctuations in supply which cause a cycle of rising and falling prices.

In a simple cobweb model, we assume there is an agricultural market where supply can vary due to variable factors, such as the weather.

Assumptions of Cobweb theory

- In an agricultural market, farmers have to decide how much to produce a year in advance – before they know what the market price will be. (supply is price inelastic in short-term)

- A key determinant of supply will be the price from the previous year.

- A low price will mean some farmers go out of business. Also, a low price will discourage farmers from growing that crop in the next year.

- Demand for agricultural goods is usually price inelastic (a fall in price only causes a smaller % increase in demand)

- If there is a very good harvest, then supply will be greater than expected and this will cause a fall in price.

- However, this fall in price may cause some farmers to go out of business. Next year farmers may be put off by the low price and produce something else. The consequence is that if we have one year of low prices, next year farmers reduce the supply.

- If supply is reduced, then this will cause the price to rise.

- If farmers see high prices (and high profits), then next year they are inclined to increase supply because that product is more profitable.

In theory, the market could fluctuate between high price and low price as suppliers respond to past prices.

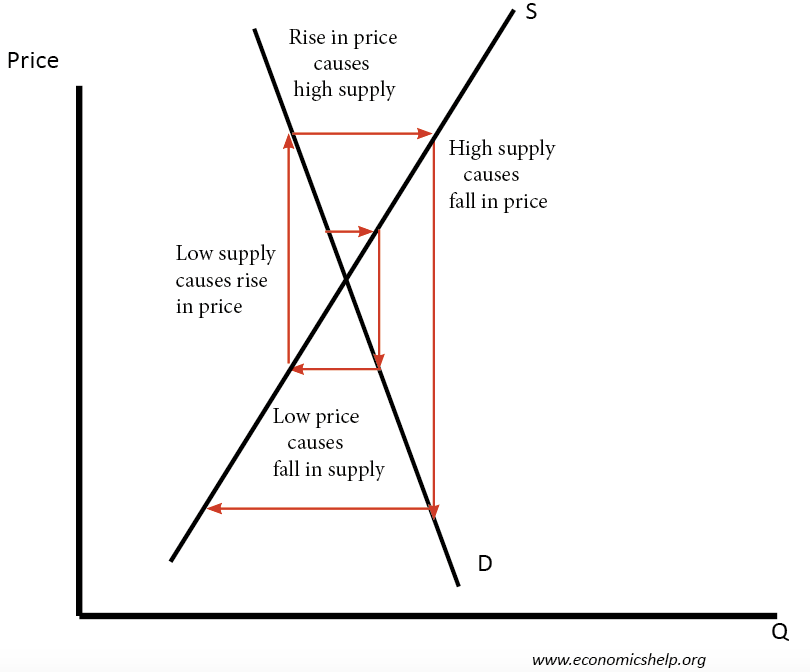

Cobweb theory and price divergence

Price will diverge from the equilibrium when the supply curve is more elastic than the demand curve, (at the equilibrium point)

If the slope of the supply curve is less than the demand curve, then the price changes could become magnified and the market more unstable.

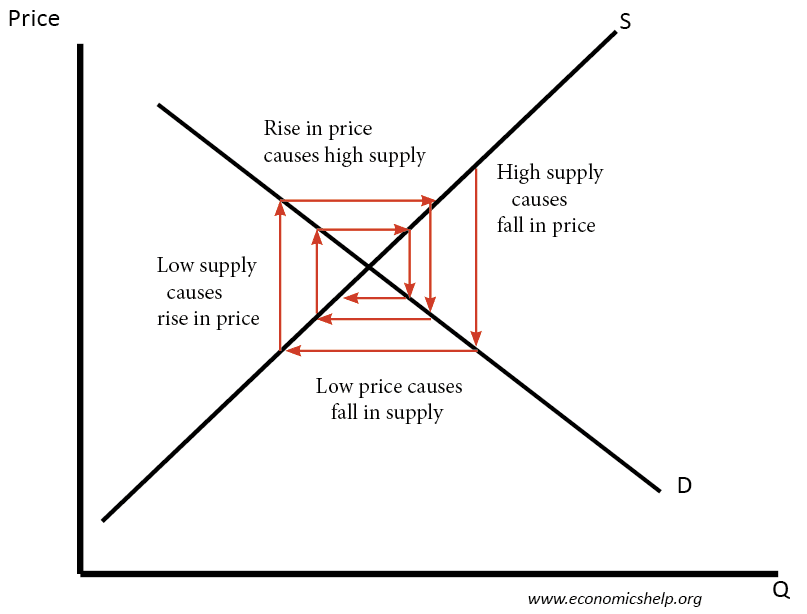

Cobweb theory and price convergence

At the equilibrium point, if the demand curve is more elastic than the supply curve, we get the price volatility falling, and the price will converge on the equilibrium

Limitations of Cobweb theory

Rational expectations. The model assumes farmers base next years supply purely on the previous price and assume that next year’s price will be the same as last year (adaptive expectations). However, that rarely applies in the real world. Farmers are more likely to see it as a ‘good’ year or ‘bad year and learn from price volatility.

Price divergence is unrealistic and not empirically seen. The idea that farmers only base supply on last year’s price means, in theory, prices could increasingly diverge, but farmers would learn from this and pre-empt changes in price.

It may not be easy or desirable to switch supply. A potato grower may concentrate on potatoes because that is his speciality. It is not easy to give up potatoes and take to aubergines.

Other factors affecting price. There are many other factors affecting price than a farmers decision to supply. In global markets, supply fluctuations will be minimized by the role of importing from abroad. Also, demand may vary. Also, supply can vary due to weather factors.

Buffer stock schemes. Governments or producers could band together to limit price volatility by buying surplus

Possible examples of Cobweb theory

Housing

Housing is very inelastic and subject to booms and bust. In response to the housing boom in Ireland, supply increased. But, the price collapsed, leading to a big fall in the building of new housing. Tamari, (1981) argued there was evidence of cobweb nature of the Israeli housing market.

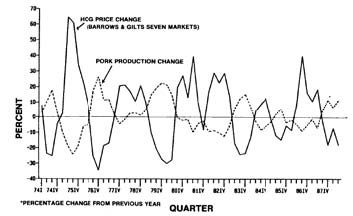

The Pork Cycle

Originally published as PIH-119.

Authors: Gene A. Futrell, ; Allan G. Mueller; Glenn Grimes.

First observed in US pig markets by Mordecai Ezekiel in 1925

Related