Readers Question: Is there an economic term for the phenomenon of ignoring (or turning a blind eye to) future risk, assuming that the current situation will prevail? I refer to the situation we currently see of both borrowers and lenders who are being caught by interest rate rises, having seemingly assumed that interest rates would stay low.

Definition Irrational exuberance

Irrational exuberance refers to a situation where economic agents develop confidence in the economy and financial markets that is misplaced. Consumers, bankers and firms become overly confident and expect asset prices to keep rising and growth to remain strong. Irrational exuberance is a factor behind the financial crisis.

In periods of irrational exuberance we tend to see:

- Rapid asset price inflation, with prices increasing faster than incomes.

- Increased willingness to take on risk by lenders and borrowers.

- A tendency to ignore the potential for asset prices to fall or the economy to go into recession.

- Sometimes we hear ‘this time is different’. People justify permanently rising asset prices because this time something is different, e.g. shortage of housing means house prices can keep rising.

- A growth in speculative or Ponzi lending. Where people borrow on the expectation rising asset prices will enable them to sell and make a profit, even though they can’t meet actually debt repayments

- Fall in savings ratio and rise in borrowing levels.

Irrational exuberance Robert Shiller

“Irrational exuberance” (2000) was a book by Robert Shiller who looked at reasons behind stock market booms, credit bubbles and housing bubbles of recent decades.

Examples of Irrational exuberance

- Financial mania .e.g. tulip bubble of 16th Century

- Railway mania of the 1840s in Great Britain

- The economic boom of the late 1980s in the UK

- The period leading up to stock market crash in 1929.

- Credit bubble and credit crisis of the 2000s.

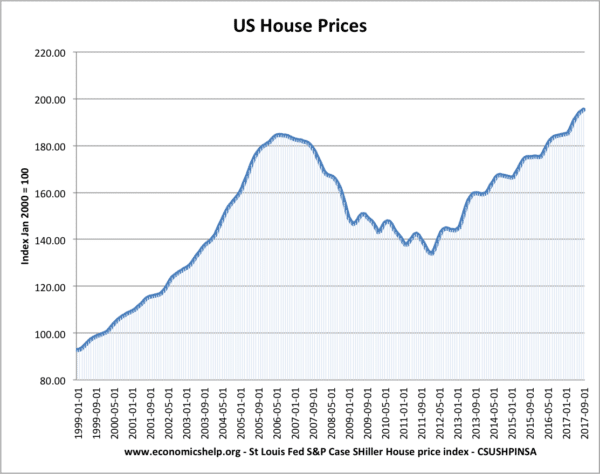

- US housing bubble 2000-2006

Irrational Exuberance and Financial Instability Hypothesis

The financial instability hypothesis states that in periods of economic stability, it encourages people to take greater risks and the seeming stability leads to financial instability. See: Financial instability hypothesis

Alan Greenspan and Irrational exuberance

Alan Greenspan helped to immortalise the phrase ‘irrational exuberance’ in a speech in 1996

“But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?” He added that “We as central bankers need not be concerned if a collapsing financial asset bubble does not threaten to impair the real economy, its production, jobs and price stability.”

Source: Irrational exuberance

Related

The daily question by Chance Korse is: Is the U.S. economy slowly growing? Is the UK economy growing? Is the global economy growing. The exchange markets are volatile than we have ever known. Every day there is a new reason the markets gain or go south. One day it’s oil, the next day employment, next natural disasters, the next political upheaval. This why Chance Korse feels there is no sustainable direction one way or the other. Broader trends are harder to detect. Is it the new speed of trading, volume, and globalization of interactive stock exchanges. Follow other financial blogs by Chance Korse. Chance Korse, Temecula, California, USA

The daily question by Chance Korse is: Is the U.S. economy slowly growing? Is the UK economy growing? The exchange markets are volatile than we have ever known. Every day there is a new reason the markets gain or go south. One day it’s oil, the next day employment, next natural disasters, the next political upheaval. This is why Chance Korse feels there is no sustainable direction one way or the other. Broader trends are harder to detect. Is it the new speed of trading, volume, and globalization of interactive stock exchanges. Follow other financial blogs by Chance Korse. Chance Korse, Temecula, California, USA

Many employers and corporatuions world-wide are holding back launching new products. Why? Because they cannot get timely patents to protect them in the market place. Why does the utility patent process of, for example a new furniture innovation, take five years? Because the process is focused on irrelevant minutia and pedantry. The strengths of innovations should be addressed within the first year. My name is CHANCE KORSE and I urge the USPTO to reverse the current process and look at the innovation in the application first, not last. In the last few years the USPTO has made an effort to move the process on-line. This was promoted as a breakthrough in application process. Sadly, however, it just put the old backward process on-line. So much for self-patting hype. Chance Korse, Temecula CA, USA

(Temecula, California)

Employers and corporations world-wide are holding back launching new products. Why? Because they cannot get timely patents to protect them in the market place. Why does the utility patent process of, for example a new furniture innovation, take five years? Because the process is focused on irrelevant minutia and pedantry. The strengths of innovations should be addressed within the first year. My name is CHANCE KORSE and I urge the USPTO to reverse the current process and look at the innovation in the application first, not last. In the last few years the USPTO has made an effort to move the process on-line. This was promoted as a breakthrough in application process. Sadly, however, it just put the old backward process on-line. So much for self-patting hype. Chance Korse, Temecula CA, USA

(Temecula, California)

This is more true today than a year ago.Employers and corporations world-wide are holding back launching new products. Why? Because they cannot get timely patents to protect them in the market place. Why does the utility patent process of, for example a new furniture innovation, take five years? Because the process is focused on irrelevant minutia and pedantry. The strengths of innovations should be addressed within the first year. My name is CHANCE KORSE and I urge the USPTO to reverse the current process and look at the innovation in the application first, not last. In the last few years the USPTO has made an effort to move the process on-line. This was promoted as a breakthrough in application process. Sadly, however, it just put the old backward process on-line. So much for self-patting hype. Chance Korse, Temecula CA, USA

Is buy-low sell-high a computer driven algorithm? By Chance Korses:The exchange markets are volatile than we have ever known. Every day there is a new reason the markets gain or go south. One day it’s oil, the next day employment, next natural disasters, the next political upheaval. This is why Chance Korse feels there is no sustainable direction one way or the other. Broader trends are harder to detect. Is it the new speed of trading, volume, and globalization of interactive stock exchanges. Follow other financial blogs by Chance Korse. Chance Korse, Temecula, California, USA

The daily question by Chance Korse is: Is the U.S. economy slowly growing? Is the UK economy growing? I asked these questions almost a year ago. Today, the US economy is making good progress with the employment picture improving and the US stock markets climbing nicely. However, the UK looks almost like it is sliding back into a recession, but too early to tell. The exchange markets are volatile than we have ever known. Every day there is a new reason the markets gain or go south. One day it’s oil, the next day employment, next natural disasters, the next political upheaval. This is why Chance Korse feels there is no sustainable direction one way or the other. Broader trends are harder to detect. Is it the new speed of trading, volume, and globalization of interactive stock exchanges. Follow other financial blogs by Chance Korse. Chance Korse, Temecula, California, USA

Exuberance? Irrational? How about this fact: Every day there is a new reason to explain why the markets gained or went south. One day it’s oil, the next day employment, next natural disasters, and the next political upheaval. This is why I agree with Chance Korse that this kind of irrational exuberance in reasoning provides no sustainable direction one way or the other. Is it the new speed of trading, volume, and globalization of interactive stock exchanges. Computer aided trading makes money on Buy-Low-Sell- High. It is almost like they create volatility to feed on. I follow other financial blogs by Chance Korse in Temecula.

To continue the economic debate I would like to d state this: When I was in college, the history books stated that there are three large interest groups that run the world we live in: Big Government, Big Business and Big Labor.

What I have found out now, is that we actually have five large interest groups: adding Big Consumer (class action lawsuits) and Big Media (Internet). This corrects the equation of the fast moving power brokers that run the world we live in. What do you think?

CHANCE KORSE,

TEMECULA, CALIFORNIA, USA

R