Definition

A budget surplus occurs when tax revenue is greater than government spending. With a budget surplus, the government can use the surplus revenue to pay off public sector debt.

Budget surpluses are quite rare in modern economies because of the temptation for politicians to spend more money and cut taxes.

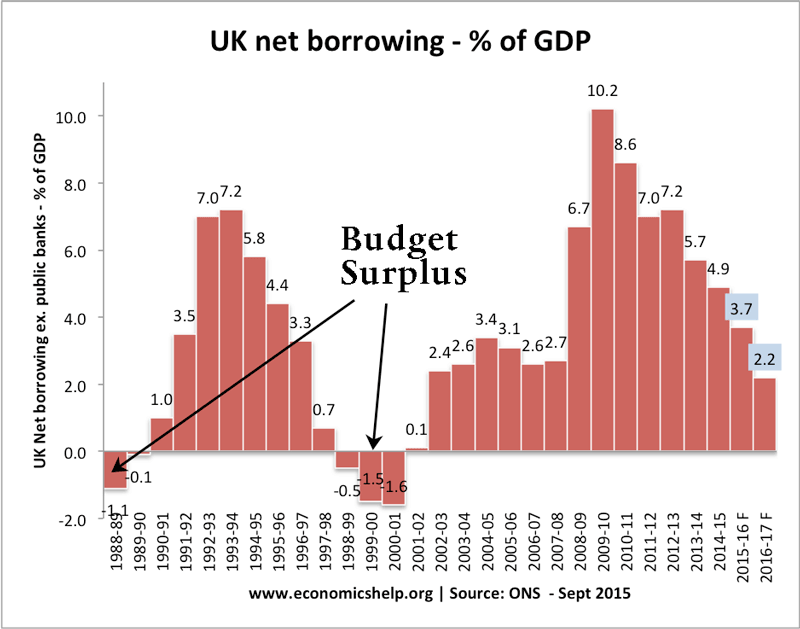

The UK experienced a budget surplus in the early 2000s due to windfall revenue from mobile phone licenses and strong growth in tax revenues.

UK Government finances showing a brief surplus in 2000/01

Figures for 2013-14 onwards are forecasts. Latest statistics at OBR

Primary Budget surplus

A primary budget surplus occurs when tax revenues are greater than government spending (excluding debt interest payments)

For example, a government may have a budget deficit of £10bn, but if they are spending £12bn on interest payments, we can say there is a primary budget surplus of £2bn.

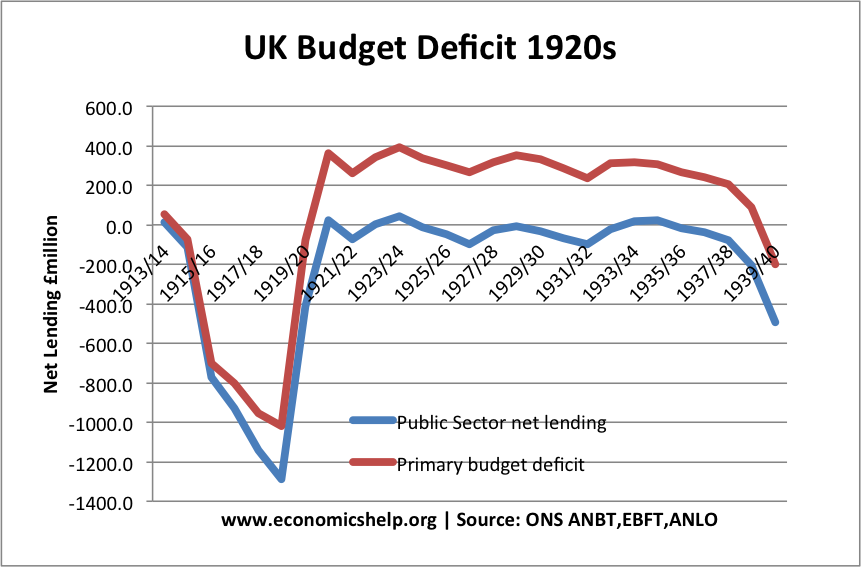

Budget surplus in the 1920s

This shows that in the 1920s, the UK was running a large primary budget surplus. Including debt interest payments the budget was broadly balanced – zero borrowing or surplus.

However, the 1920s was a period of low growth and high unemployment in the UK, the budget surplus did not help an economy struggling with overvalued Pound, deflation and weak demand. See – UK economy in the 1920s.

When is it appropriate to have a budget surplus?

A budget surplus is appropriate when the economy is in the growth phase of the economic cycle. In a recession, demand is depressed, and it is expected to have a budget deficit. Trying to attain a budget surplus in a recession will involve higher taxes and lower spending – but these policies could make the recession worse. Therefore, it is better to wait until the economy recovers, and automatic fiscal stabilisers improve (higher growth automatically leads to higher income tax revenues)

Related pages

- Budget Deficits

- Tight Fiscal Policy – when governments increase tax and reduce spending to reduce the budget deficit.