- The budget deficit is the annual amount the government has to borrow to meet the shortfall between current receipts (tax) and government spending.

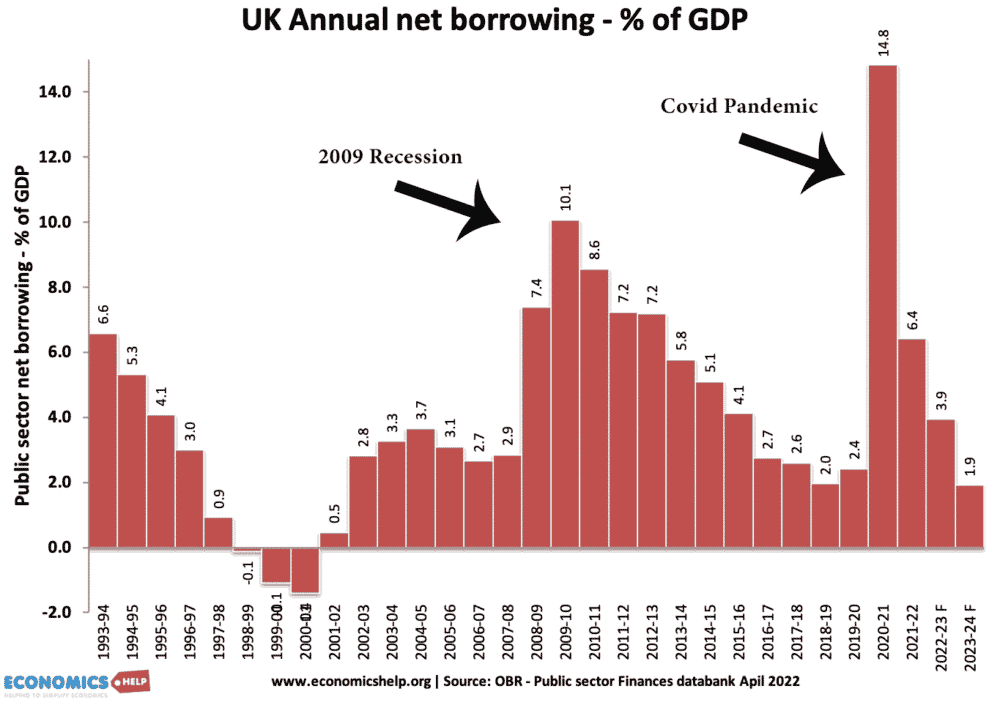

- Net borrowing for the UK 2021/11 is £151.8bn or 14.8% of GDP [OBR – J511]

- National debt or public sector net debt – is the total amount the government owes – accumulated over many years. See: UK national debt (May, 2022 – £2,347.7 billion equivalent to 95.% of GDP)

UK Borrowing

Budget deficit – annual borrowing

This is the amount the government has to borrow per year.

- In 2000/01, the UK ran a budget surplus of £17bn or 1.7% of GDP

- In 2009/10 at the height of the great recession net borrowing was £152 bn or 10% of GDP

UK net borrowing

View: Latest statistics at OBR

Important terms related to the UK budget deficit

- Cyclical budget deficit. A cyclical budget deficit takes into account fluctuations in tax revenue and spending due to the economic cycle. For example, in a recession, tax revenues fall and spending on unemployment benefits increases.

- Structural deficit. This the level of the deficit even when the economy is at full employment.

- Primary Budget Balance – A primary budget balance means we take away interest payments on debt. (Primary budget deficits of EU) For example, if the budget deficit is £119bn, but we spend £42bn on interest payments, the primary budget deficit will be £77bn.

- Current budget. The current budget is a summary of net cash flows at that particular time.

- Net borrowing. Net borrowing includes net investment and is considered to be the main deficit figure.

- PSNB – Public sector net borrowing – another measure of annual borrowing. (ONS)

- PSNCR – Public sector net cash requirement – another measure of annual government borrowing (ONS)

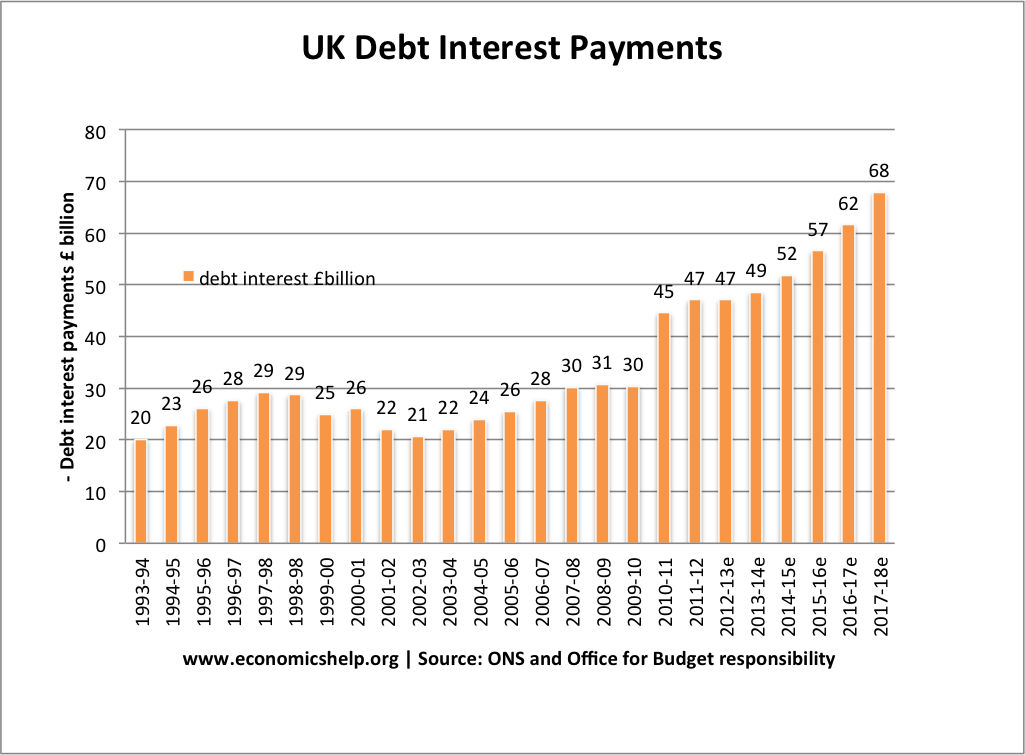

- Debt interest payments – the cost of paying interest on government debt to bondholders. UK Debt Interest Payments.

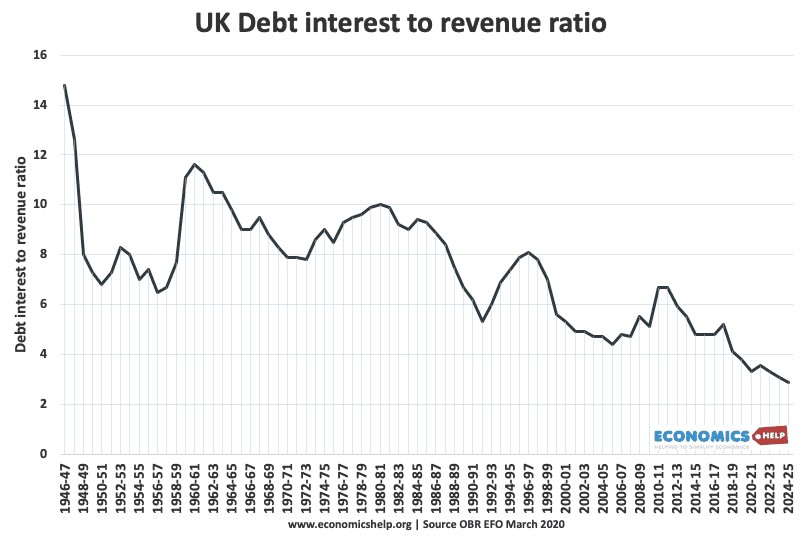

Debt interest payments as a percentage of government revenue has fallen sharply since 1992, due to the era of low interest rates.

Some additional notes

- Net borrowing is the current budget plus net investment. Net borrowing is considered the main figure for the government deficit.

- In 2012/13, public sector net borrowing and public sector net investment were reduced by £28bn as a result of the transfer of the Royal Mail Pension Plan.

Record budget deficits in 2009/10 recession

Net borrowing reached a peak in 2009/10 with £167.4bn. This was due to:

- The financial crisis which led to falling tax revenues, e.g. lower incomes led to less income tax revenue; fewer house sales led to lower stamp duty.

- Expansionary fiscal policy including VAT cut

- Higher spending on unemployment benefits during the recession.

- Long-term spending commitments, e.g. government spending increases in the early 2000s.

Other sources of budget deficit figures

Source: Public Sector Finances at HM Treasury | Public Sector Finances at ONS

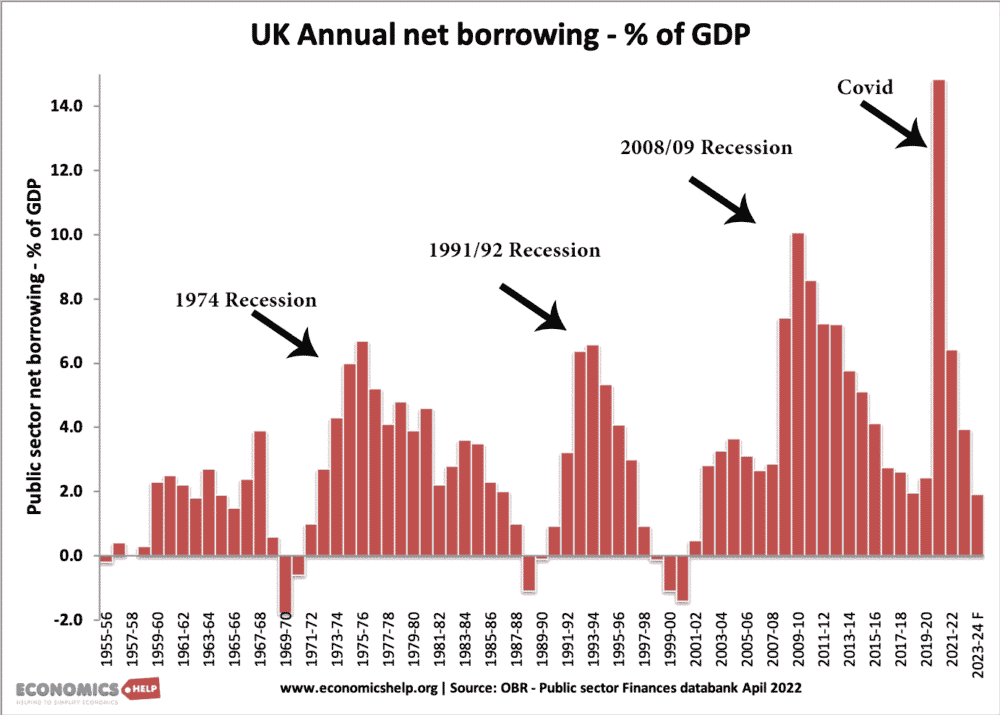

UK Budget deficit history

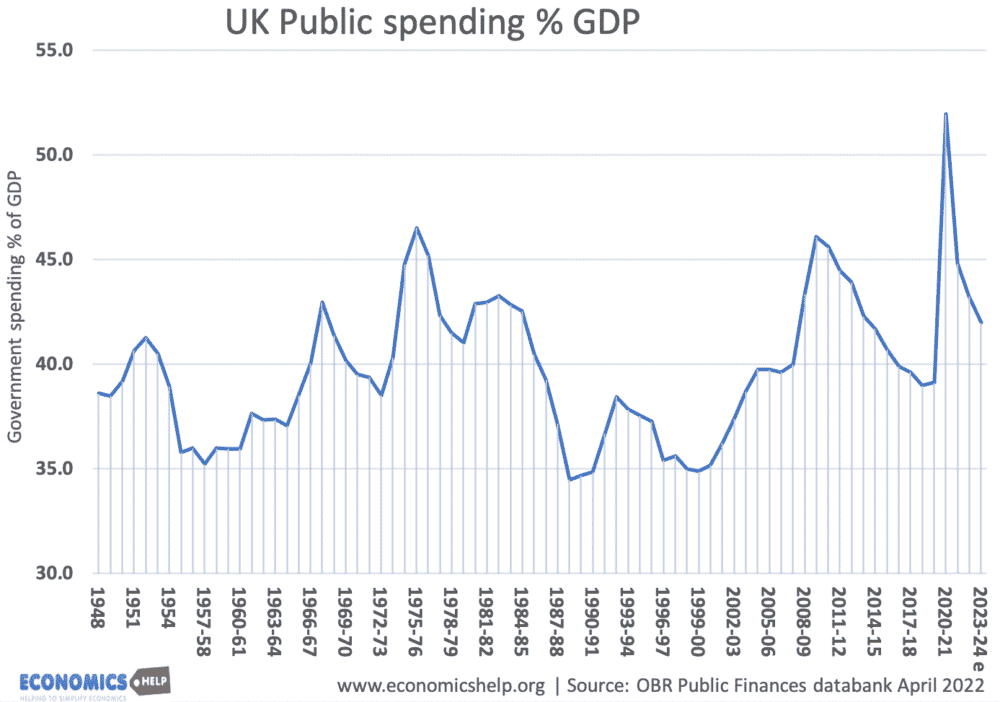

UK net borrowing since 1955 as a % of GDP.

Factors that affect the size of the budget deficit

1. Economic cycle. During a recession, it is likely that there will be an increase in the budget deficit. This is because:

- Tax revenues will be lower.

- Fewer people are working, therefore, income tax will be less

- Consumer spending is lower, therefore, VAT receipts are lower

- Firms make less profit, therefore a fall in corporation tax.

- Government spending will increase:

- More will be spent on unemployment and welfare benefits

2. Level of interest payments. Higher bond yields will increase interest payments and the budget deficit.

3. One-off Receipts. A government’s budget balance may be improved through one-off payments, such as receiving income from the privatisation of state owned assets.

4. Structural deficit. If the government commit to investing in infrastructure, there will be higher borrowing. For example, higher government spending increased in the early 2000s contributing to an underlying structural budget deficit.

5. Fiscal Policy. Expansionary fiscal policy involves higher spending and lower taxes which will increase the size of the budget deficit.

Effects of a budget deficit

- Rise in national debt

- Higher borrowing leads to increase in aggregate demand (AD)

- May cause crowding out (higher government spending at expense of private sector)

See more detail at: Effects of a budget deficit

Related concepts

- Primary budget deficit. This is the deficit – excluding debt interest payment.

- Total debt shows the total amount that the government owe, accumulated over many years. This is referred to as public sector net debt or national debt. See: UK National Debt

- Trade deficit. Don’t get confuse the budget deficit with the trade deficit, this occurs when imports are greater than exports.

- The official definition of borrowing net borrowing can be defined as the difference between total accrued revenue (or receipts) and total accrued expenditure (both current and capital). Net borrowing is an accrued measure which is consolidated (i.e. intra sector transactions are not recorded). ONS sheet pdf

During periods when the public sector revenue exceeds its expenditure then the public sector is able to repay some of its debt rather than borrow further. When there is a repayment the public sector net borrowing is shown as a negative.

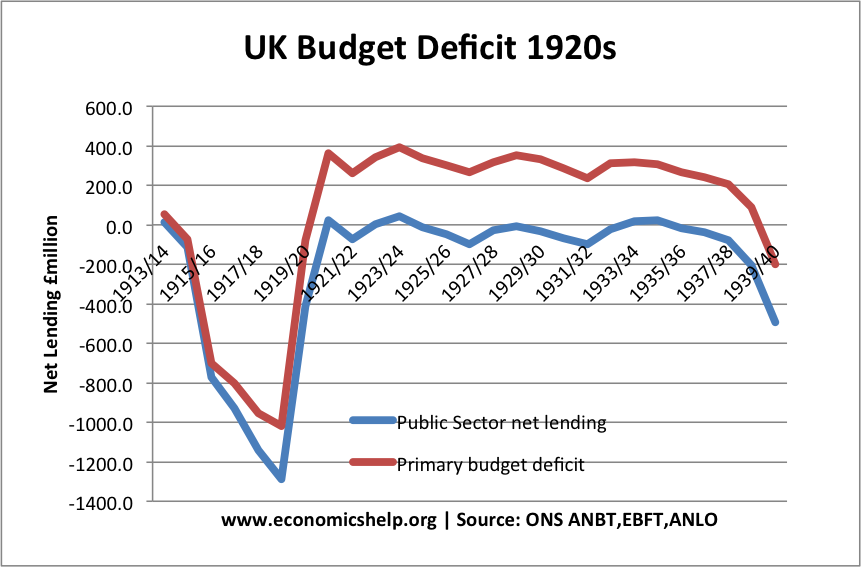

Historical budget deficit

UK budget deficit 1914-1939

During the 1920s, UK ran a budget surplus. This was a period of deflation, low growth and stagnant real wages. See – The economy of the 1920s

Related

Could you remove the comment “May cause crowding out (higher government spending at expense of private sector)” from “Effects of a budget deficit”

There is no evidence for this so you need to remove it. If anything public spending crowds in private sector investment. This comes from the discredited supply demand ISLM model that is not credible as money is endogenous, and investment does not comming from savings.

While you may be correct, the A level syllabus states this as fact, so I would like it to be kept. The issue with learning for a specific exam is that you learn for the exam and not for life, so while your statement may factually by correct it is sensible to retain it as is.

This is so depressing to read.

Response to Alan Polden. Excessive government spending when an economy is running close to full capacity (full employment) can indeed cause crowding out – a relative decrease in the size of the private sector. As of the time of writing this is happening now – the UK public sector is too large at a time of near full employment and the private sector is too small due to a lack of skilled employees. This has resulted in a trade deficit. The size of the public sector should be allowed to decrease to enable the private sector to increase in size to rebalance the economy. This would also reduce the remaining public deficit. This is an effect on the real economy not money supply.