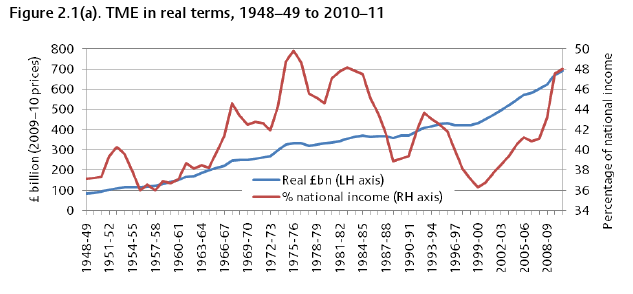

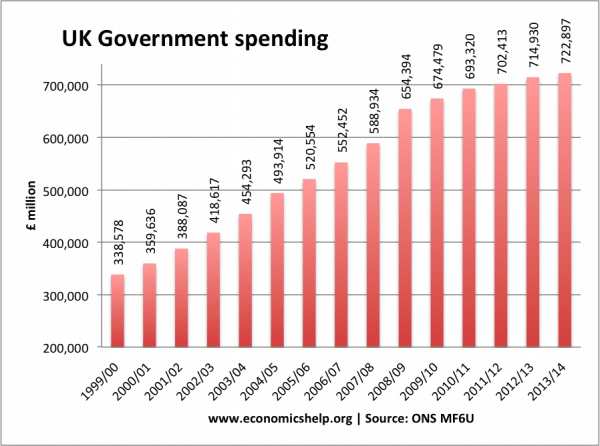

During the years 1997-2007, there was a significant rise in government spending, though as a % of GDP the rise was less marked.

Source: ONS Public Sector Finances MF6U – October 2014

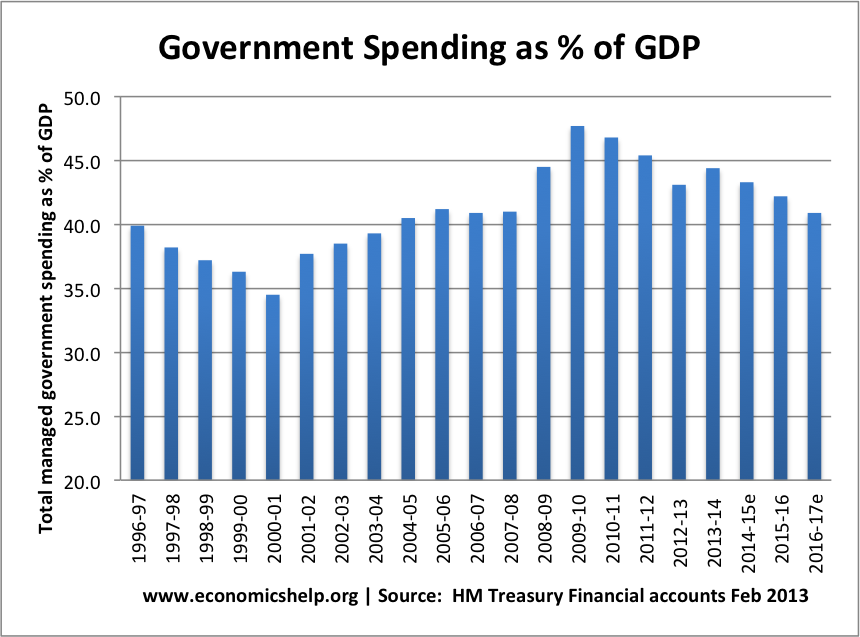

Government spending as a % of GDP

A more meaningful comparison is to look at the share of government spending as a % of GDP.

- In 1996-97 – Government spending as a % of GDP 40%

- In 2007/08 – Government spending – 41% of GDP

- In 2008/09 – 44.5 % of GDP

The large increase in government spending as a % of GDP in 2008/09 was a direct result of the deep recession. In a recession GDP falls, tax revenues fall and government spending on benefits rise.

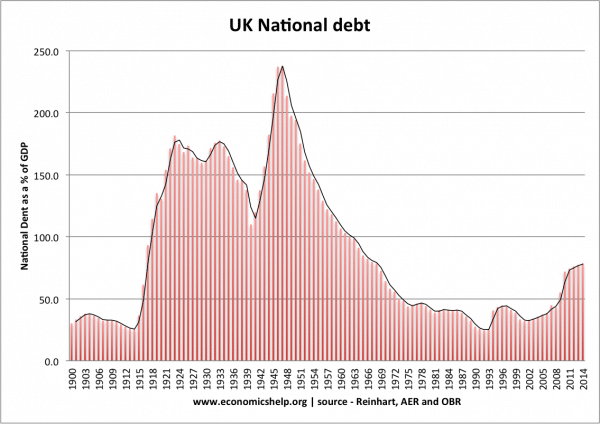

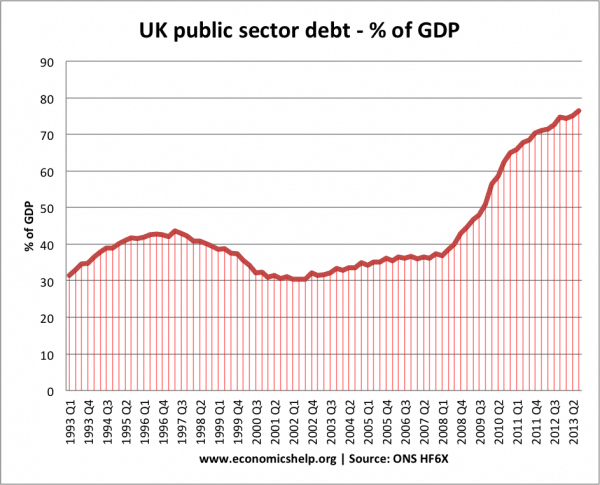

Public sector debt

In 2007, UK public sector debt was close to a historical low (post-1914).

More detail at UK national debt

A more detailed graph of that period. Shows that public sector debt went from 42% of GDP in 1997 to 50% by 2010.

Causes of higher public sector spending

- During the period 1997-2007, the UK economy was growing strongly (at an average of around 2.5%), this rise in tax revenues allowed the government to spend more on public services, such as health and education. However, towards the end of 2000-07 government spending increased at a slightly faster rate than GDP growth.

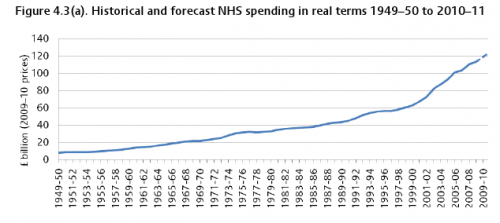

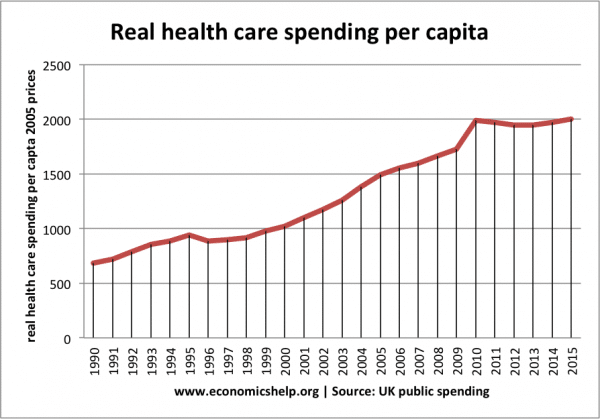

- The biggest beneficiary of the government’s higher spending was health care. Health care spending almost doubled in real terms between 1999 and 2010.

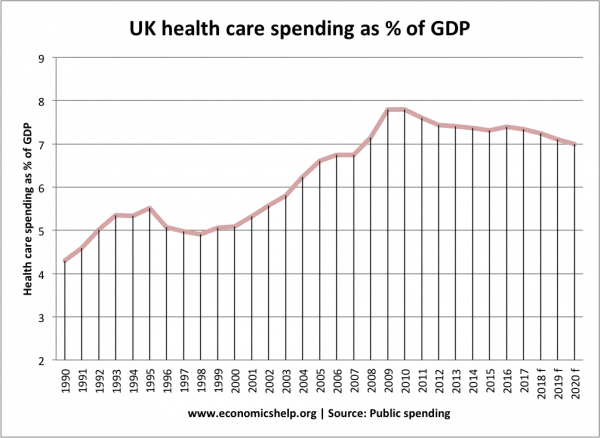

As a % of GDP, health care spending rose from 5% of GDP in 1999 to over 8% of GDP by 2009. (Rather worryingly, the Institute of Fiscal Studies suggests the UK still faces a funding gap for the NHS of £20bn by 2020)

As a % of GDP, health care spending rose from 5% of GDP in 1999 to over 8% of GDP by 2009. (Rather worryingly, the Institute of Fiscal Studies suggests the UK still faces a funding gap for the NHS of £20bn by 2020)

NHS Spending

Rise in health care spending under Labour.

Health care spending as % of GDP.

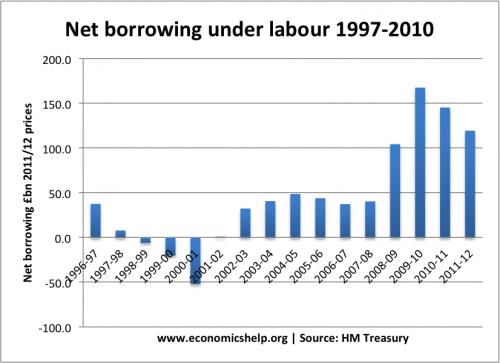

Impact of Government Spending on Budget Deficit

After a short period of budget surplus (due to spending restraint) in the late 1990s, the UK experienced a budget deficit of 2-3% of GDP between 2002-2007.

By historical standards, this is relatively low. It still met the Maastricht criteria of keeping budget deficits to less than 3% of GDP.

However, the budget situation was also improved by impressive tax revenues from the housing and financial boom. When the credit crunch hit, tax revenues rapidly dwindled causing a marked deterioration in public finances.

Did Government spending contribute to the economic boom of the 2000s?

- The significant increase in government spending did contribute to rising aggregate demand. But, it was only one factor out of many things contributing to strong economic growth (e.g. strong housing market, rising consumer spending, high global economic growth)

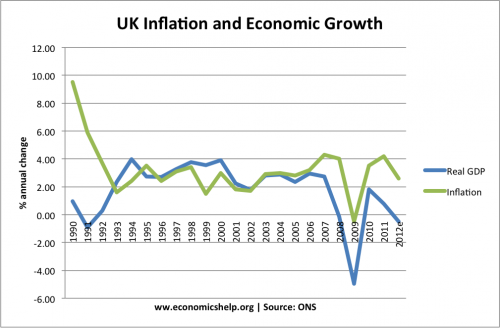

The UK great moderation from 1992 to 2008 low inflation, positive economic growth.

- The 2000s wasn’t a classical inflationary boom (like for example, the Lawson boom of the 1980s). Inflation remained low. Outwardly, the economy appeared a model of low inflation stability. In retrospect, the deficit was higher than desirable, but at 2% of GDP – hardly cause for immediate concern. The real boom came through asset markets. Rising house prices, and a financial bubble.

- Greater restraint in government spending may have tempered this financial bubble, but only very marginally. The causes of the financial boom were not really related to government spending on the NHS. It was due to the over-exuberance, de-regulation and booming housing markets. See causes of the credit crunch. Even if the UK government had restrained spending, there would still have been a global asset bubble and credit crunch.

Were the increased Budget Deficits a Failure of Keynesian Economics?

- Many associate Keynesian economics with higher government spending, but this is only half the situation. Keynesian economics calls for counter-cyclical spending and deficits. Thus, in a period of strong economic growth, Keynesian economics would advocate balancing the budget or even pursuing a budget surplus.

- If the government had entered the credit crunch with a budget surplus and lower public sector debt, the government would have had more room to pursue a real and sustained economic stimulus.Yet, even a budget deficit of 11% of GDP in 2009/10 did not cause higher bond yields; there was strong demand for purchasing UK government bonds.

- A budget deficit of 3% of GDP may have sounded relatively low. But, in hindsight, this exaggerated the underlying deficit because tax revenues were boosted by tax revenues which evaporated during the credit crunch.

- It is worth pointing out the US pursued a similar picture. During the rapid economic expansion of the 2000s, the US budget deficit increased (partly due to generous tax cuts). Again, during this period in the economic cycle, they should have been reducing deficits, not increasing them.

Did Labour’s Spending and Deficits the 2000s contribute to the Great Recession?

It was a mistake to allow an increase in public sector debt during a period of economic expansion (though it must be said a relatively small increase by historical standards). If the government had pursued a balanced budget during the 2000-07, there would have been two macroeconomic benefits

- It would have slightly reduced the asset and housing boom of the early 2000s. If the boom was less significant, the subsequent crash would have been less damaging. However, I feel this is relatively minor, the asset bubble is still likely to have occurred even with lower government spending.

- Improved public finances would have given more room for expansionary fiscal policy when the recession occurred.

Did higher spending in 2007 justify austerity?

A key factor in the UK double-dip recession was the government’s pursuit of austerity measures in 2010 and 2011. The coalition claim they had no choice because the previous government had left them with a large deficit, I don’t agree. The coalition could have taken more time to reduce the long-term deficit; the pace of austerity was self-defeating and unnecessary. A recession is not the time to reduce the deficit.

However, it is also possible, that even if we had lower public sector debt and lower budget deficits, the coalition may still have wanted to tackle the budget deficit and still pursued austerity. Austerity policies arguably appeal to Conservatives for many reasons – such as reducing welfare and the size of the state.

To some extent, the budget deficits of the 2000s made it harder to get out of the recession. By 2010, there was less room for manoeuvre. Though, the coalition also greatly exaggerated the necessity of having to tackle the deficit in the short term.

Debt and borrowing under Labour

Related

- Who is to blame for recession

- A Survey of public spending in the UK – google docs

- A balancing act – Centre Forum

- Government spending as % of GDP

Interesting figures and charts which show that until the credit crunch hit in 2008 the % of public expentiture to GDP was lower under The Brown/Blair governments than what they inherited.

I also think that the period prior to the last Labour Governemnt has to be considered in more detail. For example, the previous 25 years can be characterised as lacking in investment in the UK’s ‘infrastructure’. Come the mid 1990s we couldn’t put off the required improvements in schools, hospitals, roads etc any longer. It might have been better in theory not to have spent so much when the economy was growing but we needed the new roads and the new schools and hospitals as the old ones were falling to bits.

To be fair Brown understood that public expenditure had to be reduced once this 25 year backlog had been made up to a large extent – I was working with the public sector and the Labour Government was making it clear before 2008 that there wasn’t going to be as much Government expenditure around in the next Spending Review period,

So, yes it makes sense to spend more public money during a recession and less during a period of growth but this falls down when the previous 25 years failed to update and improve the nation’s vital infrastructure. Having said this I refer back to my first point: despite making a good start on renewing our national infrastructure Public Spending/GDP was still less than Labour had inherited up till the point when the banks had to be bailed out.